Horizon Technology Stock: Get Paid Monthly From This Bullish 10.6%-Yielder

Horizon Technology Finance Corp Pays Special Dividends

Today’s focus pick is Horizon Technology stock.

We like business development companies (BDCs) like Horizon Technology Finance Corp (NASDAQ:HRZN), because they provide financing for exciting and often-overlooked small- and mid-sized companies. And for that privilege, their clients pay higher-than-average yields.

That’s a boon in this higher-interest-rate environment. But what happens when rates fall?

The Federal Reserve is expected to start cutting its key lending rate this September, but stubbornly high global inflation means that interest rates will decline a lot slower than previously expected and remain higher than they were before. In fact, because of soaring budget deficits, the days of ultra-low interest rates are probably over.

On the plus side, even moderately lower interest rates make it cheaper to borrow and stimulate economic growth. And economic growth needs a lot of capital investment from alternative banks like Horizon Technology.

Where most BDCs invest in companies in virtually every sector and industry, Farmington-Connecticut-based Horizon Technology Finance Corp provides structured debt products to life-sciences, technology, health-care information, and sustainability companies. (Source: “Investor Presentation – First Quarter 2024,” Horizon Technology Finance Corp, May 2024.)

Since 2004, Horizon has directly originated and invested more than $3.0 billion in venture loans in more than 300 growing companies.

The transaction sizes of its loans are up to $50.0 million, and generally last between three and five years with a meaningful interest-only period. The loans are secure, with term, bridge, and special purpose loans that prioritize interest over equity and unsecured debt.

Horizon’s portfolio companies use the money to grow their operations, fund acquisitions, pad their cash holdings, etc.

Solid First-Quarter Results

For the first quarter ended March 31, 2024, Horizon Technology Finance Corp reported total investment income of $26.1 million, compared to $28.0 million in the first quarter of 2023. The lower figure was primarily a result of lower interest income on investments. (Source: “Horizon Technology Finance Announces First Quarter 2024 Financial Results,” Horizon Technology Finance Corp, April 30, 2024.)

This resulted in net investment income of $12.6 million, or $0.38 per share, down from $13.0 million, or $0.46 per share, in the same period last year. Net asset value was $332.1 million, or $9.64 per share, down slightly from $9.71 per share in the first quarter of last year.

During the quarter, the company raised $12.0 million in proceeds with an “at-the-market” offering program. It also funded five loans, totaling $33.5 million.

Commenting on the results, Robert D. Pomeroy Jr., Horizon Technology’s chairman and chief executive officer said, “During the first quarter, we were selective with respect to new originations in light of the challenging venture debt environment, while our investment portfolio continued to generate net investment income that exceeds our distributions.”

“Despite the challenges in the venture market, we believe there are positive market signs, including an increase in demand from quality companies. Accordingly, we seek to grow our portfolio, while we remain cautious with respect to new originations. As always, we will continue to focus on maximizing NAV.”

The company has not announced its second-quarter results yet, but it did note that it originated a “modest” number of investments: $11.5 million in loans and $0.5 million in equity. Horizon ended the quarter with unfunded loan approvals and committed backlog of $137.5 million to 13 companies. (Source: “Horizon Technology Finance Provides Second Quarter 2024 Portfolio Update,” Horizon Technology Finance Corp, July 10, 2024.)

To help expand its borrowing capacity and offer venture debt, Horizon Technology enhanced its capital resources with a $100.0-million senior secured credit facility. That number could increase to $200.0 million. (Source: “Horizon Technology Finance Enhances Capital Resources and Increases Capacity via New $100 Million Credit Facility,” Horizon Technology Finance Corp, June 24, 2024.)

Monthly Distribution Maintained at $0.11 Per Share

The company’s first-quarter net interest income of $0.38 per share is more than enough to cover its monthly dividend payout of $0.11 per share, or $0.33 per share on a quarterly basis. (Source: “Dividend History,” Horizon Technology Finance Corp, last accessed July 17, 2024.)

This works out to an annual distribution of $1.32 per share for a current annual yield of 10.64%.

Horizon Technology stock also has a recent history of paying out special distributions. It last paid one out for $0.05 per share in April 2024. It has actually paid five consecutive years of $0.05 special distributions.

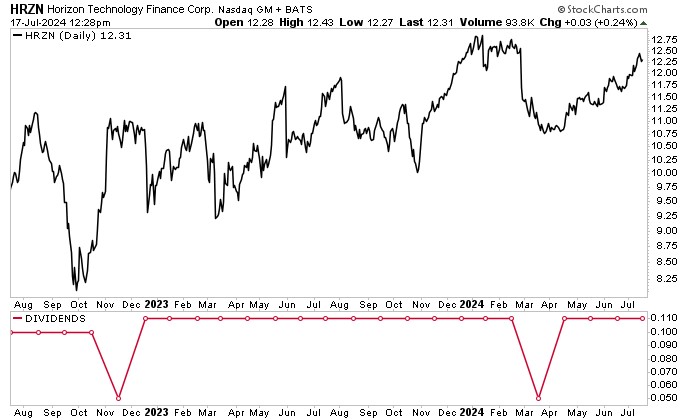

Horizon Technology Stock Up 13% Since April

A reliable monthly dividend and special dividends are great, but it’s even better when they come with a rising share price. And Horizon Technology stock has been outpacing the S&P 500 over the past three months, climbing 13%.

There’s certainly room for additional growth. Currently trading at $12.31, Horizon Technology stock needs to climb five percent to hit a new 52-week high and 17% to best its November 2021 record high of $14.40 per share.

Chart courtesy of StockCharts.com

The Lowdown on Horizon Technology Stock

Horizon Technology Finance Corp is a BDC that boasts a top-yielding portfolio with significant capacity to make robust investments in dynamic markets.

Thanks to its diversified portfolio, there is a lower concentration of risk. This has allowed it to generate total returns above the industry. It’s also why Horizon Technology stock is able to provide investors with a reliable high-yield monthly payout and special dividends: $18.48 in cumulative distributions since HRZN stock’s 2010 initial public offering.