Hess Midstream Stock: Shares of High-Yielder Hit Record Levels

Hess Midstream Increases Quarterly Distribution…Again

Hess Midstream stock is looking pretty good right now.

Weak U.S. jobs data have fueled recession fears, but talk of that kind of economic slowdown might be a little premature. The fact is, anyone can cherry-pick data to create a negative story or positive narrative.

Yes, there are signs of weakness in the U.S. economy, from hiring, retail sales, and Purchasing Managers’ Index (PMI) reports, but economic data like gross domestic product (GDP) and trade numbers remain solid and the likelihood of a September interest-rate cut is a lock. Second-quarter earnings have also been decent.

Despite the recent stock market meltdown and concerns about a recession, investors aren’t that spooked. The S&P 500 has erased all of its gains since the start of May, but it’s still up 9.5% year-to-date. The Nasdaq, meanwhile, is still up 8.5% year to date.

As a result, concerns of a U.S. recession are a little overblown. This means that the recent sell-off in oil prices is, too. West Texas Intermediate (WTI) is down more than 10% since early July at around $72.95 per barrel, but there are signs that oil prices are near a bottom.

Saudi Aramco foresees oil demand increasing by 1.6 million barrels per day in the second half of 2024. Goldman Sachs, meanwhile, expects Brent Crude prices to find support at $75.00 per barrel; that’s pretty much where it’s sitting right now. (Source: “Goldman Sachs Sees a $75 Floor for Brent Oil Prices,” OilPrice, August 6, 2024.)

That optimism bodes well for the energy sector as a whole, including Hess Midstream LP (NYSE:HESM).

Whether it’s a near-term or long-term outlook, Hess Midstream is able take advantage of market strengths, weaknesses, and inherent volatility.

Why?

Unlike other midstream companies, the limited partnership is on the receiving end of an 85% fixed-fee, revenue-based contract to gather, process, move, store, and export crude oil and natural gas.

As a result, Hess Midstream’s bottom line isn’t susceptible to fluctuations in oil and gas prices. Instead, the company is like a tollkeeper that collects money whether its clients use its pipelines or not.

The partnership owns, operates, develops, and acquires oil and gas and water midstream assets in the prolific North Dakota Bakken shale region. Hess Midstream provides its strategic infrastructure assets services primarily to it parent company, Hess Corp (NYSE:HES), and a number of global third parties. (Source: “About Us,” Hess Midstream LP, last accessed August 6, 2024.)

Minimum volume commitments (MVCs) provide the partnership with downside protection. Hess Midstream’s contracts, which are set on a rolling three-year forward basis (send or pay), cannot be adjusted downward once set, and any shortfall payments are made quarterly.

Hess Midstream LP locks its customers in to long-term contracts; its commercial contracts are locked in through 2033. On top of that, the partnership’s fees escalate each year based on the Consumer Price Index (CPI).

This provides Hess Midstream with reliable cash flow and opportunities to expand its business. This strategy also provides HESM stockholders with both a reliable dividend and long-term share price gains.

Strong Operational Results

For the second quarter ended June 30, 2024, Hess Midstream announced that net income increased 8.5% year over year to $160.3 million. After deductions from non-controlling interest, net income was $49.5 million, or $0.59 per share, versus $0.50 per share in the second quarter of 2023. (Source: “HESS MIDSTREAM LP REPORTS ESTIMATED RESULTS FOR THE SECOND QUARTER OF 2024,” Hess Midstream LP, July 31, 2024.)

Adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) for the second quarter of 2024 climbed 12% to $276.5 million. Adjusted free cash flow increased to $156.4 million from $153.0 million.

Throughput volumes increased by 17% for gas gathering, 17% for oil terminaling, and 43% for water gathering.

Commenting on the results, John Gatling, the company’s president and chief operating officer, said, “We delivered strong operational and financial results in the second quarter, driven by Hess Corporation’s Bakken performance, our continued focus on gas capture and solid project execution.”

“We are increasing our 2024 gas throughput guidance and reiterating our expectation for substantial volume growth across our oil and gas systems through 2026, which is expected to result in sustained excess free cash flow generation and continued return of capital to our shareholders.”

2024 Guidance

Thanks to a strong year-to-date performance, Hess Midstream increased its full-year 2024 guidance for gas gathering and gas processing throughput volumes.

It also updated its full-year 2024 net income guidance to $650.0 million to $700.0 million and reiterated its full-year adjusted EBITDA guidance of $1.12 billion to $1.17 billion.

Targets at Least 5% Annual Distribution Growth Through 2026

Hess Midstream is a cash cow that has a history of reporting strong FCF, which it uses to pay dividends and debt. Since 2020, its FCF has grown from $340.6 million to $642.9 million in 2023. (Source: “Hess Midstream LP CI A,” MarketWatch, last accessed August 6, 2024.)

The company has raised its dividend for the last seven consecutive years, but that only tells part of the story. Hess Midstream company has also raised its dividend every quarter since its initial public offering in April 2017. (Source: “Distributions,” Hess Midstream LP, last accessed August 6, 2024.)

Most recently, in late July, the company declared a quarterly cash distribution of $0.6677 per share, or $2.67 on an annual basis, for a current yield of 7.56%. This represents an 11% increase over the $0.6011 declared in the same period last year, which is significantly above Hess Midstream’s targeted five-percent growth in annual distributions per share through 2026. (Source: “Hess Midstream LP Announces Distribution Per Share Level Increase,” Hess Midstream LP, July 29, 2024.)

Commenting on the increase, Jonathan Stein, Hess Midstream’s chief financial officer, said, “Through a combination of our 5% targeted growth in annual distributions per Class A share and incremental increases in our quarterly distributions following unit repurchases, we have increased our distribution per Class A share by approximately 48% since the first quarter of 2021 and by over 10% in 2024 year to date on an annualized basis.”

“We expect to continue to have more than $1.25 billion of financial flexibility through 2026 that can be used to support our return of capital framework, including potential additional and ongoing unit repurchases that could support further distribution per share level increases.”

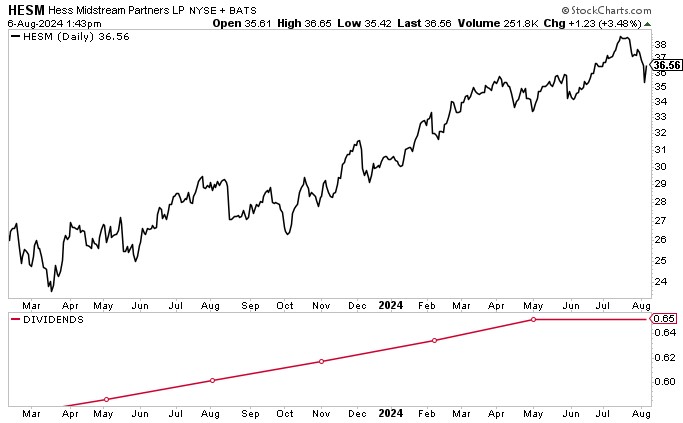

Hess Midstream Stock Hits Record High

What’s better than an ultra-high-yield distribution?

One that’s accompanied by a stock trading at record levels.

On July 17, Hess Midstream stock hit a record intraday high of $39.08. It is trading a little lower than that today, at $36.56 per share, but Wall Street thinks it will hit fresh highs over the coming quarters, with a 12-month share price target of $40.00 to $41.00 per share. This points to potential gains in the range of 9.5% to 15%.

Chart courtesy of StockCharts.com

The Lowdown on Hess Midstream Stock

Hess Midstream stock continues to be a great energy play reporting strong financial results, including FCF This helps explain how Hess Midstream been able to grow its EBITDA every year since it formed in 2015 and has been able to increase its dividend every quarter since 2017.

The outlook remains just as robust. Hess Midstream is reaffirming its full-year 2024 adjusted EBITDA guidance. The company also reiterates its guidance of at least 10% per year expected growth in net income, adjusted EBITDA, and adjusted FCF in both 2025 and 2026.