Hercules Capital Stock: 9.7%-Yield Alternative Bank Trading at Record Levels

Why HTGC Stock Is Worth Watching

While cash-strapped American individuals and businesses are waiting for the Federal Reserve to start lowering its decades-high interest rates, lenders—including business development companies (BDCs) like Hercules Capital Inc (NYSE:HTGC)—have been quietly celebrating record-best financial results.

And even when interest rates do start to fall, according to Janet Yellen, U.S. Treasury Secretary and former Fed chair, it’s “unlikely” that market interest rates will return to the levels seen before the COVID-19 pandemic. (Source: “Yellen Says US Rates ‘Unlikely’ to Return to Pre-COVID Levels,” Bloomberg, March 13, 2024.)

That bodes well for Hercules Capital Inc for the near term and long term as it capitalizes on improving market conditions.

If a company is going to put “Hercules” in its name, it better live up to the name’s enormous expectations. Fortunately for Hercules Capital stockholders, this company has been. HTGC stock, which has been trading at record-high levels, has been crushing the broader market lately. Moreover, Hercules Capital Inc reported record-best first-quarter results and recently paid another special dividend.

Hercules Capital is the leading and largest BDC that focuses on providing financing to high-growth venture capital-backed companies in a broad variety of sectors: technology, software as a service (SaaS) financing, sustainable and renewable, life sciences, and special situations. (Source: “Q1 2024 Investor Presentation,” Hercules Capital Inc, May 2, 2024.)

Since its inception in December 2003, Hercules Capital has made debt commitments to more than 650 companies.

Its current debt portfolio stands at $3.38 billion, with investments in 127 companies with investment sizes of $5.0 to $200.0 million. The BDC’s highly asset-sensitive debt investment portfolio is made up of 97.3% floating-rate loans with interest-rate floors.

Special situation companies use Hercules Capital’s senior secured loans to grow and develop their businesses during times of change or inflection points that aren’t readily served by typical financing. Special situation companies tend to be later-stage companies, often public, that operate in many of the same sectors as the other companies in Hercules Capital’s portfolio.

Some of the companies that Hercules Capital has invested in over the years are 23andMe Holding Co. (NASDAQ: ME), Ancestry.com, DocuSign Inc (NASDAQ:DOCU), Fastly Inc (NYSE:FSLY), Impossible Foods Inc., and Zoom Media Group Inc. (Source: “Portfolio,” Hercules Capital Inc, last accessed May 8, 2024.)

What it doesn’t invest in is equally important. The BDC doesn’t have any direct exposure to oil and gas, metals, minerals, cryptocurrencies, or cannabis.

Record 1st-Quarter Financial Results

For the first quarter ended March 31, Hercules Capital announced that its total investment income increased by 15.7% year-over-year to a record-high $121.6 million. Its net investment income went up in the quarter by 20.9% year-over-year to a record-high $79.2 million, or $0.50 per share. (Source: “Hercules Capital Reports First Quarter 2024 Financial Results,” Hercules Capital Inc, May 2, 2024.)

The company also reported gross debt and equity commitments of $956.0 million and total gross fundings of $605.2.

Commenting on the results, Scott Bluestein, Hercules Capital’s CEO and chief investment officer, said, “2024 is off to a tremendous start with record Q1 commitments of $956.0 million and record fundings of $605.2 million, each growing year-over-year by 81% and 27%, respectively.” (Source: Ibid.)

He continued, “Our record setting performance in Q1 drove net debt portfolio growth by $325.3 million, our largest quarter-to-quarter increase in history.”

Hercules Capital Inc Paid Out Another Special Dividend

Hercules Capital has a variable distribution policy that aims to distribute four quarterly distributions that account for 90% to 100% of the company’s taxable quarterly earnings or potential annual income. On top of that, the company pays supplemental distributions (aka special dividends) pretty regularly. (Source: “Distributions,” Hercules Capital Inc, last accessed May 8, 2024.)

In the first quarter, the company’s net investment income of $0.50 per share provided 125% coverage of its base distribution, which contributed to an increase in its undistributed earnings spillover to $142.7 million. (Source: “Hercules Capital Reports First Quarter 2024 Financial Results,” Hercules Capital Inc, May 2, 2024, op. cit.)

As a result, Hercules declared a quarterly base dividend of $0.40 per share and a supplemental distribution of $0.08 per share, to be paid on May 21. (Source: “Hercules Capital Declares a Total Cash Distribution of $0.48 per Share for the First Quarter 2024,” Hercules Capital Inc, April 30, 2024.)

As of this writing, the total quarterly payout of $0.48 per share works out to a forward yield of 9.72%.

Hercules Capital Stock Up in 2024

Reliable quarterly dividends and regular special distributions are great, and they’re even better when they’re tied to a share price that rips higher. HTGC stock has been doing just that.

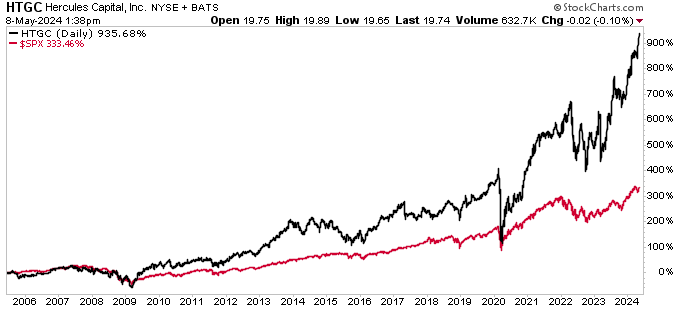

Save for the 2008 financial crisis and the 2020 COVID-19 pandemic, Hercules Capital stock has been blistering higher since it went public in June 2005. Since then, with dividends reinvested, HTGC stock has provided total returns of 935%. Over the same period, the S&P 500 has provided returns of just 333%.

Hercules Capital stock has been performing well over the near term, too, hitting a new record high of $19.89 on May 8. As of this writing, the stock is up by:

- Seven percent month-over-month

- 18% over the last three months

- 21% year-to-date

- 64% year-over-year

- 21% since I wrote about HTGC stock in September 2023

Chart courtesy of StockCharts.com

The Lowdown on Hercules Capital Inc

Hercules Capital has been an outstanding BDC since it went public in 2005. This is due in large part to its underwriting skills and the kinds of companies it invests in. Since 2013, the company’s total investment income has expanded at a compound annual growth rate (CAGR) of 12.7%, its net investment income has grown at a CAGR of 15.3%, and its total assets have increased at a CAGR of 11.7%.

Hercules Capital Inc reported record-best results in 2023, with that momentum carrying into the first quarter of 2024. Subsequent to the first quarter, the BDC reached “another remarkable milestone” of more than $20.0 billion in cumulative debt commitments. (Source: “Hercules Capital Reports First Quarter 2024 Financial Results,” Hercules Capital Inc, May 2, 2024, op. cit.)

This should help Hercules Capital stock continue providing one of the most reliable, high-yield variable dividends in its industry. HTGC stock’s distributions are supported by high interest rates and a strong floating-rate loan portfolio.