Hercules Capital Stock: 10.15%-Yielder Up 13.4% in 2024

Becoming a Venture Capital Investor

Today, I’m taking a look at Hercules Capital stock…and why my readers might want to consider becoming venture capital investors.

Investing in high-quality venture capital opportunities has long been the realm of high-net-worth individuals and institutional money.

But there are now ways to become a venture capital investor while also collecting a nice dividend along the way. With this approach, you can benefit from the success of the ventures and collect dividend income at the same time.

That’s what someone gets when they invest in Hercules Capital Inc (NYSE:HTGC). The company operates as a specialty finance company that provides senior secured venture growth loans.

Clients comprise growth-oriented, venture-capital-backed companies focused on the technology and life sciences segments.

According to Hercules Capital, it has so far lent out in excess of $20.0 billion to over 660 companies since December 2003. (Source: “Investor Relations,” Hercules Capital Inc, last accessed September 5, 2024.)

The business of venture loans is higher-risk but could pay handsomely if an investment pans out. Look at some of today’s top technology companies that were once venture investments.

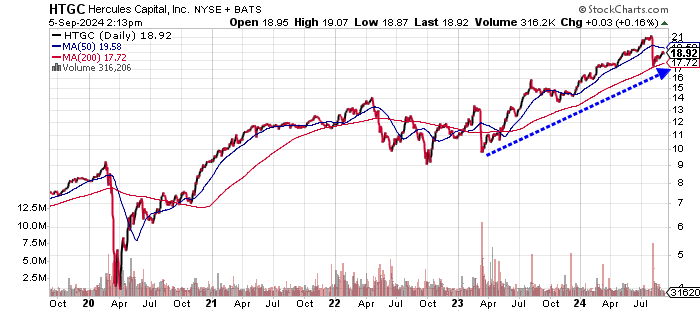

Hercules Capital stock currently pays a high dividend and is on 20-year dividend payment streak. Moreover, HTGC stock is also up 13.4% this year and 19.1% over the past year to September 5. If you add the dividend, the total return is above that of the S&P 500.

On the chart, Hercules Capital stock has reclaimed its 200-day moving average (MA) of $18.41; it could take a run at the 50-day MA sitting at $19.88.

An upward move is possible given that HTGC stock is currently flashing a golden cross. This is a bullish technical crossover when the 50-day MA is above the 200-day MA.

Chart courtesy of StockCharts.com

Profits & Free Cash Flow Surge

Hercules Capital Inc has grown its revenues by 65.1% from 2019 to the record $469.1 million in 2023. This included three consecutive years of growth, such as the stellar 44.6% in 2023.

| Fiscal Year | Revenues (Millions) | Growth |

| 2019 | $284.4 | N/A |

| 2020 | $231.2 | -18.7% |

| 2021 | $306.3 | 32.5% |

| 2022 | $324.5 | 5.9% |

| 2023 | $469.1 | 44.6% |

(Source: “Hercules Capital, Inc.,” MarketWatch, last accessed September 5, 2024.)

The revenue outlook is positive albeit the growth rate is expected to fall to the high single digits. This is not unusual given the nature of the business, which typically witnesses swings.

Analysts estimate that Hercules Capital will grow revenues by 9.3% to $503.3 million in 2024 and 7.9% to $542.8 million in 2025. (Source: “Hercules Capital, Inc. (HTGC),” Yahoo! Finance, last accessed September 5, 2024.)

The bottom line points to a consistently profitable company, including impressive 192.7% growth in record generally accepted accounting principles (GAAP) profits in 2023.

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2019 | $1.71 | N/A |

| 2020 | $2.01 | 17.6% |

| 2021 | $1.49 | -25.4% |

| 2022 | $0.79 | -46.9% |

| 2023 | $2.31 | 192.7% |

(Source: MarketWatch, op. cit.)

Adjusting for the non-recurring expenses, Hercules Capital Inc earned $2.09 per diluted share in 2023.

Analysts predict that adjusted earnings will come in at $2.04 per diluted share in 2024 and $2.03 per diluted share in 2025. While the estimates are flat, the consistent profitability is positive and supports continued dividend payments. (Source: Yahoo! Finance, op. cit.)

Hercules Capital is also a free cash flow (FCF) machine, pumping out a record $269.7 million in 2023. This was after paying out $273.7 million in common dividends.

| Fiscal Year | FCF (Millions) | Growth |

| 2019 | $144.7 | N/A |

| 2020 | $154.9 | 7.0% |

| 2021 | $175.5 | 13.3% |

| 2022 | $164.3 | -6.3% |

| 2023 | $269.7 | 64.1% |

(Source: MarketWatch, op. cit.)

The company’s balance sheet held $1.77 billion in total debt. This shouldn’t be a surprise given that Hercules’ business is lending out money. (Source: Yahoo! Finance, op. cit.)

Based on what we have seen over the last few years, I don’t see any immediate financial concerns.

Hercules Capital Stock’s Dividends Up 54.8% Since 2018

Hercules Capital currently has an attractive forward dividend yield of 10.15% and has returned strong dividend growth since 2018.

Income investors will like the fact that the company has paid dividends in 20 consecutive years.

Hercules Capital stock’s current quarterly dividend is $0.48 per share with $1.92 per share in dividends to be paid out in 2024. The dividend coverage ratio was a manageable 1.2 times in 2023.

Dividends with Hercules Capital stock over the last five years were as follows:

| Fiscal Year | Dividend Per Share |

| 2019 | $1.28 |

| 2020 | $1.38 |

| 2021 | $1.58 |

| 2022 | $2.04 |

| 2023 | $1.92 |

(Source: Yahoo! Finance, op. cit.)

The Lowdown on Hercules Capital Stock

Income investors have seen nice dividend growth since 2018 that was well above the inflation rate. The 10.15% yield is attractive, especially as interest rates will soon begin to decline.

Of course, as Hercules Capital stock rallies, the forward dividend yield will likely normalize, but then shareholders also get price appreciation.