Hercules Capital Stock: 10.05%-Yielder Up 19.6% Over Past Year

Steady Dividend Flow for Income Investors

Today, I’m putting the spotlight on Hercules Capital stock.

Generating income above the real rate of return will become critical as interest rates decline and inflation settles down moving into 2025.

To gauge the outlook for interest rates, I refer to the CME FedWatch Tool. This provides an expected timeline for the direction of the fed funds rate based on the highest probability. The probabilities are fluid and constantly changing depending on the data.

According to the current view, the CME FedWatch Tool predicts that the fed funds target range will decline by another 125 basis points by the December 2025 Federal Open Market Committee (FOMC) meeting. This downward pressure on interest rates means that investors need to look for alternatives to government treasuries. (Source: “CME FedWatch Tool,” CME Group, last accessed November 4, 2024.)

A high-potential area to generate income consists of companies that focus on investing in high-quality venture capital opportunities. One could reap the success of the invested venture companies while also collecting regular dividend income at the same time.

This is where a company like Hercules Capital Inc (NYSE:HTGC) comes in. It’s a specialty finance company that provides senior secured venture growth loans.

Hercules’ clients are growth-oriented, venture-capital-backed companies focused on the technology and life sciences segments.

Hercules Capital has lent out over $21.0 billion to over 660 companies since December 2023. (Source: “Investor Relations,” Hercules Capital Inc, last accessed November 4, 2024.)

While it’s high-risk, the business of venture loans pays out if the investment pans out.

What impresses me about Hercules Capital stock is that it has paid a dividend in 20 straight years, with higher dividends in three straight years. HTGC stock offers a forward dividend yield of 10.05% based on the annual dividend of $1.92 per share and stock price of $19.10 on November 4.

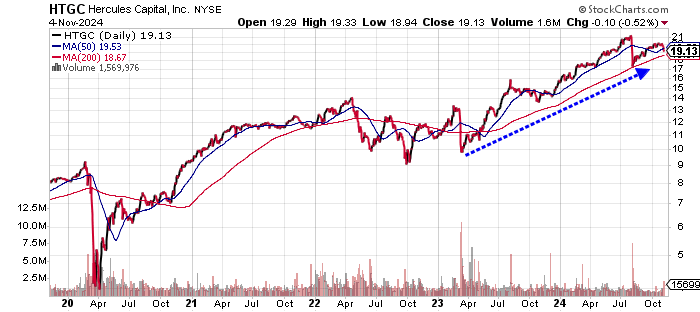

Hercules Capital stock has also advanced 19.6% over the past year to November 4.

On the chart, HTGC is currently flashing a golden cross. This is a bullish technical crossover when the 50-day moving average (MA) moves above the 200-day MA.

Chart courtesy of StockCharts.com

Record Third-Quarter Investment Income

Hercules Capital Inc has grown its revenues by 65.1% from 2019 to the record $469.1 million in 2023. There were three consecutive years of growth, including the stellar 44.6% in 2023.

| Fiscal Year | Revenues (Millions) | Growth |

| 2019 | $284.4 | N/A |

| 2020 | $231.2 | -18.7% |

| 2021 | $306.3 | 32.5% |

| 2022 | $324.5 | 5.9% |

| 2023 | $469.1 | 44.6% |

(Source: “Hercules Capital, Inc,” MarketWatch, last accessed November 4, 2024.)

The company’s third quarter saw record revenues (investment income) of $125.2 million, up 7.3% compared to the same period in 2023. Hercules Capital had around $4.6 billion in assets under management, representing growth of 10.9% year over year. (Source: “Hercules Capital Reports Third Quarter 2024 Financial Results, ” Hercules Capital Inc, October 30, 2024.)

Looking ahead, analysts estimate that Hercules will increase its revenues to $501.6 million in 2024 and $530.2 million in 2025. (Source: “Hercules Capital, Inc (HTGC),” Yahoo! Finance, last accessed November 4, 2024.)

Shifting to the bottom line shows Hercules to be a consistently profitable company. This includes stellar 192.7% growth in generally accepted accounting principles (GAAP) profits to a record $2.31 per diluted share in 2023.

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2019 | $1.71 | N/A |

| 2020 | $2.01 | 17.6% |

| 2021 | $1.49 | -25.4% |

| 2022 | $0.79 | -46.9% |

| 2023 | $2.31 | 192.7% |

(Source: MarketWatch, op. cit.)

Adjusting for the non-recurring expenses, Hercules Capital earned $2.09 per diluted share in 2023. The third quarter saw an inline adjusted $0.51 per diluted share.

Analysts estimate that the company will report adjusted earnings of $2.04 per diluted share in 2024 and $2.00 per diluted share in 2025. (Source: Yahoo! Finance, op. cit.)

While the estimates are flat, I’m encouraged by the relatively stable profitability and free cash flow, which support dividend payments.

Hercules Capital Stock’s Dividends Up 50% Since 2019

Hercules Capital stock’s dividend of $1.92 per share in 2023 was lower than its 2022 payout, but the current dividend is 50% higher than in 2019. The current $0.48 per share dividend has been in place for five straight quarters. Prior to this, Hercules Capital stock paid $0.47 per share in May 2023.

| Fiscal Year | Dividend Per Share |

| 2019 | $1.28 |

| 2020 | $1.38 |

| 2021 | $1.58 |

| 2022 | $2.04 |

| 2023 | $1.92 |

(Source: Yahoo! Finance, op. cit.)

HTGC stock currently has an attractive forward dividend yield of 10.05%. The next scheduled dividend of $0.48 per share has an ex-dividend date of November 13.

The Lowdown on Hercules Capital Stock

With Hercules Capital stock, you get regular dividend income that has grown since 2019. The forward yield is also well above comparative bond yields; plus, you get the opportunity to generate capital appreciation.