HD Stock: Why Home Depot Inc is a Top Dividend Stock

Patience doesn’t always pay off. Earlier this month, I wrote that Home Depot Inc (NYSE:HD) was an investment that I’d own in a heartbeat if the price was just a little bit lower. Well, since that article just a few weeks ago, Home Depot stock has gone up about seven percent, easily outpacing the broader market. Ah, the pains of being a value investor.

Now, I usually wouldn’t even think about “chasing” a dividend stock once it’s already floated away from me, but there are times when a company’s fundamentals are improving so much that it might make sense. As I always tell our Income Investors readers, investing is all about finding a company with a widening competitive advantage, improving cash flows, and a management team that is sharing the spoils with shareholders.

Judging from its quarterly results last week, Home Depot easily checks off all those boxes. Let’s take a closer look, shall we?

Big Quarter for Big Orange

The home improvement gorilla has been on an operational tear of late, and Q4 certainly was no exception. Earnings per share bounced 23% to $1.44, easily topping the consensus by $0.11. Meanwhile, revenue grew a solid 5.8% to $22.2 billion, $410.0 million higher than the average analyst estimate.

More importantly, U.S. comparable-store sales, a key measure of a retailer’s health and performance, increased 6.3%. And internationally, both the Mexican and Canadian segments posted positive comps, representing the 53rd and 21st quarters of consecutive same-store sales growth.

See, retailers are able to rapidly grow revenues simply by opening up new stores, but that doesn’t necessarily mean that established locations are doing well. That’s why it’s so important to look at same-store sales, which can generally only increase through higher prices and higher volume. Luckily for investors, Home Depot is using its muscle to score well on both factors.

The company is currently displaying something that we always love to see in our retail investments: balanced growth between transactions and average ticket price. During the quarter, comparable transactions increased 2.8%, while the comparable average ticket price increased 2.9%.

In other words, not only is Home Depot selling more stuff, but it’s also selling more expensive stuff! In fact, transactions totaling more than $900.00, which now represent roughly 20% of U.S. sales, increased 11.6%, driven largely by flooring and appliances.

“Our focus on providing localized and innovative product selection, improving the interconnected customer experience, and driving productivity resulted in record sales and net earnings for 2016,” said Chairman and Chief Executive Officer Craig Menear. “Our associates responded to a healthy housing market and strong customer demand.” (Source: “The Home Depot Announces Fourth Quarter And Fiscal 2016 Results,” Home Depot Inc, February 21, 2017.)

Bright Orange Outlook

Given the sluggish sales of many brick-and-mortar retailers of late, Home Depot’s strong performance really illustrates the power of its highly differentiated offering and massive scale.

Longtime readers know that I am obsessed with highlighting companies that have real competitive advantages, because they are usually the only ones that can maintain margins and cash flow through prolonged downturns. In Home Depot’s case, management even believes that it is differentiated enough to grow over the next few years.

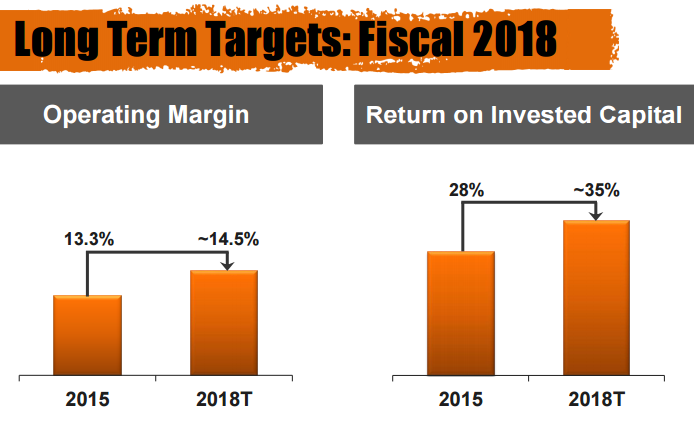

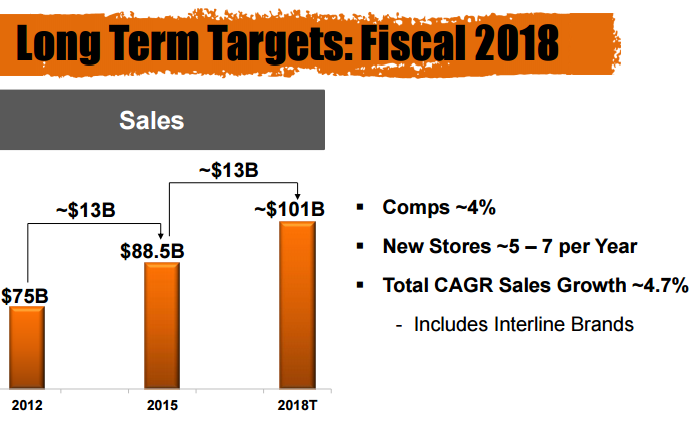

For 2017, the company expects earnings per share (EPS) to jump 10.5% to $7.13, while it sees both revenue and comparable store-sales increasing 4.6%. Moreover, Home Depot believes that full-year operating margin will grow roughly 30 basis points to 14.5%. That’s more than a 100 basis point improvement from 2015, and also means that management should reach its fiscal 2018 margin target one year in advance.

Also, with Home Depot’s 2016 return on invested capital (ROIC) increasing 330 basis points to 31.4%, I’d fully expect management to meet its long-range ROIC goal, as well.

(Source: “Australia/Asia October 2016,” Home Depot Inc, last accessed February 26, 2017.)

Dynamic Dividend Depot

Of course, what really makes Home Depot special is that management hasn’t hesitated to share its success with shareholders.

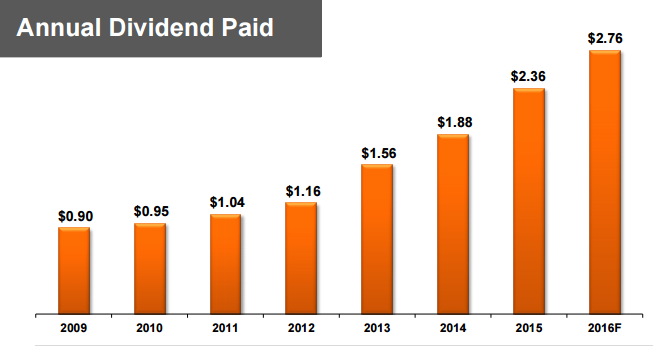

The company has grown its annual dividend for seven consecutive years, with one of the larger jumps coming in late 2011, when management decided to increase its target payout ratio from 40% to 50%. Aside from fatter income for investors, the policy tied Home Depot’s dividend increases much more closely to its earnings growth.

(Source: Ibid.)

Well, shareholders can expect even bigger dividends going forward because, in Q4, Home Depot said that it is increasing its target payout ratio yet again, this time to 55%.

That healthy five-percentage-point bump, combined with strong earnings growth expected in 2017, prompted management to raise its quarterly dividend a whopping 29%. The payment represents the company’s 120th consecutive quarterly payout and translates to a 2017 annual dividend of $3.56.

And if the dividend wasn’t delicious enough, Home Depot also announced a $15.0-billion share repurchase program, with about $5.0-billion worth of buybacks expected to take place in 2017. Since 2002, the company has returned more than $67.0 billion of cash to shareholders through stock repurchases, buying back roughly 1.3 billion shares. Talk about shareholder-friendly.

Given Home Depot’s increased payout ratio, hefty new repurchase program, and long-range sales growth of about five percent per year, I’d only expect the company’s capital returns to increase at a healthy rate for several years.

(Source: Ibid.)

“Our disciplined approach to capital allocation continues to be evidenced by the investments we are making in our business and the cash return to shareholders,” said CFO Carol Tome in a conference call with analysts. (Source: “The Home Depot (HD) Q4 2016 Results – Earnings Call Transcript,” Seeking Alpha, February 21, 2017.)

Priced for Imperfection?

But, while everything is clicking on the operational front, there’s still the little issue of HD’s white-hot stock momentum. After all, even a great company can turn out to be horrible investment if you pay too high of a price for its shares.

Well, when you consider how quickly Home Depot’s dividend is growing, as well as how well-covered it is, HD stock’s forward yield of 2.4% still looks very attractive to me. That’s well above the dividend yield of main rival Lowe’s Companies, Inc. (NYSE:LOW) (1.8%), and just edges out the S&P 500 (2.2%).

Now, of course, I’d love to see Home Depot’s price-to-earnings ratio of 24 come down a bit (or a lot). But I also understand that there are times when paying up for high quality is completely reasonable. With Home Depot’s financials only gaining steam and the housing recovery still very much in the middle innings, now seems like one of those times.

The Bottom Line On Home Depot

Don’t let HD stock’s recent run prevent you from investigating the income opportunity. Home Depot’s massive scale advantages within home improvement continue to drive robust cash flows and, more importantly, solidly growing dividends and share repurchases.

I wouldn’t call it a bargain at these elevated levels but, if the housing market can remain relatively healthy, Home Depot stock’s above-average dividend yield is certainly stable enough for the long haul.