Hafnia Stock: Projected Forward Yield of 20.9%

Nice Dividend, Plus One Year Gain of 23.8%

What’s to love about Hafnia stock?

It’s always exciting when dividend stocks deliver dividend growth and capital appreciation. This is the ultimate goal of income investors—and it can be found in Hafnia Ltd (NYSE:HAFN).

The company currently operates the largest fleet of product and chemical tankers in the world that has grown to over 250 vessels. (Source: “Corporate Overview,” Hafnia Ltd, last accessed September 19, 2024.)

Income investors will love Hafnia stock’s high dividend yield along with the stock’s 23.8% advance over the past year to September 19. Hafnia pursues an aggressive dividend payment structure that saw the payout ratio raised from 64% in 2023 to the current revised 80%. I will talk more about this below.

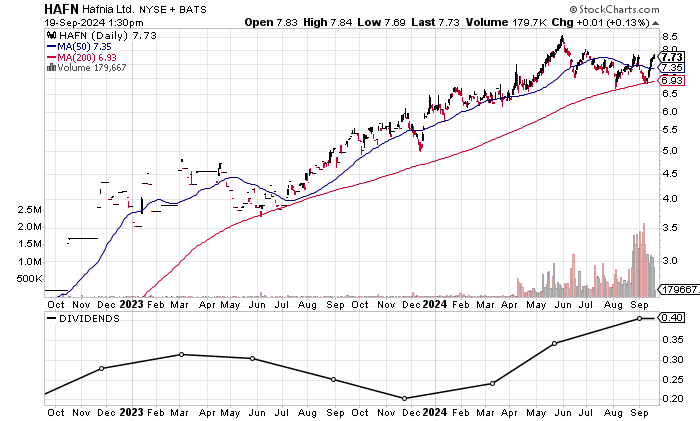

HAFN stock is currently down after trading at a record $8.99 in May. The dip has helped to drive the dividend yield higher.

Hafnia stock is currently looking for direction after breaking just below its 200-day moving average (MA) of $7.87, but is holding its 50-day MA of $7.64.

Chart courtesy of StockCharts

Strong Second Quarter Drives Optimism

Hafnia Ltd generates significant revenues, including a 38.7% increase to a record $2.67 billion in 2023.

Revenues grew 223% between 2019 and 2023. The compound annual growth rate (CAGR) during this period was an impressive 34%.

| Fiscal Year | Revenues | Growth |

| 2019 | $827.9 million | 124.7% |

| 2020 | $874.1 million | 5.6% |

| 2021 | $811.2 million | -7.2% |

| 2022 | $1.93 billion | 137.5% |

| 2023 | $2.67 billion | 38.7% |

(Source: “Hafnia Limited (HAFN),” Yahoo! Finance, last accessed September 19, 2024.)

In the second quarter, Hafnia delivered revenues of $831.2 million, which equates to a run rate of around $3.3 billion, well above revenues in 2023. The trailing 12-month revenues to the end of June were $2.97 billion. This is extremely positive and supports higher dividends.

The company’s bottom line shows the highest generally accepted accounting principles (GAAP) profitability on record in 2022 and 2023.

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2019 | $0.21 | 228.0% |

| 2020 | $0.41 | 97.5% |

| 2021 | -$0.15 | -137.4% |

| 2022 | $1.54 | 1,107.7% |

| 2023 | $1.56 | 1.3% |

(Source: Yahoo! Finance, op. cit.)

In the second quarter, Hafnia Ltd posted $259.2 million, or $0.51 per diluted share, year over year. GAAP profits, up significantly from $213.3 million, or $0.42 per diluted share, year over year. The first half saw profits of $478.8 million, or $0.94 per diluted share, versus the comparative $469.9 million, or $0.93 per diluted share, in the same period in 2023. (Source: “Condensed Consolidated Interim Financial Information Q2 and HS 2024,” Hafnia Ltd, last accessed September 19, 2024.)

The company’s strong profit results were aided by an increase in the adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) income to $317.1 million in the second quarter, compared to $261.6 million in the year ago second quarter. For the first half, the adjusted EBITDA came in at $604.1 million versus $557.6 million in the first half of 2023.

Its financial situation is healthy despite Hafnia carrying $1.13 billion in total debt and $166.7 million in cash at the end of June. The company has been active in paying down more than $1.5 billion in debt over the last four years.

| Fiscal Year | Debt Repayment (Millions) |

| 2020 | $230.9 |

| 2021 | $622.5 |

| 2022 | $438.9 |

| 2023 | $314.5 |

(Source: Yahoo! Finance, op. cit.)

The strong profitability and free cash flow suggest there are no concerns. This is further supported by a strong interest coverage ratio of 11.3 times in 2023.

Hafnia Ltd has also easily covered its interest payments via much higher earnings before interest and taxes (EBIT) with the exception of 2021.

| Fiscal Year | EBIT (Millions) | Interest Expense (Millions) | Interest Coverage Ratio |

| 2020 | $198.4 | $46.9 | 4.23X |

| 2021 | -$12.1 | $39.0 | NA |

| 2022 | $849.4 | $91.1 | 9.32X |

| 2023 | $876.9 | $77.4 | 11.33X |

(Source: Yahoo! Finance, op. cit.)

A look at the Piotroski score, an indicator of a company’s balance sheet, profitability, and operational efficiency, shows a reasonable reading of 5.0, which is just above the midpoint of the 1.0 to 9.0 range.

Hafnia Stock Payout Ratio Raised to 80%

Hafnia stock’s quarterly dividend of $0.405 paid in September was raised from $0.344 per share in May. The new dividend implies an annual payout of $1.62 per share, equating to a forward dividend yield of 20.9%. The previous annual dividends were $1.38 per share in 2023 and $1.04 per share in 2022.

While the forward yield looks high, it will decline when the stock rallies. At HAFN stock’s record $8.99, the forward dividend yield would fall to 18%.

| Metric | Value |

| Dividend Growth Streak | 2 years |

| Dividend Streak | 3 years |

| Dividend Coverage Ratio | 2.0X |

The Lowdown on Hafnia Stock

Institutional ownership in the stock has been rising, now sitting at 30.0% versus 19.7% in early July. This is positive. Hafnia stock has extremely high insider ownership of 54%. The high insider interest entices the company to deliver strong results. (Source: Yahoo! Finance, op. cit.)

HAFN stock could rally if the company can continue with its strong results from the second quarter. There is a lot of price appreciation potential here and you can collect a high dividend yield,