16.6%-Yield Hafnia Stock Hit Record High

Why Investors Should Take a Look at HAFN Stock

Crude oil prices might be down from their October 2023 high of roughly $95.00 per barrel to about $80.00 per barrel now, but their outlook is robust.

Goldman Sachs Group Inc (NYSE:GS) forecasts that Brent crude oil prices will hit $86.00 per barrel this summer, fueled by healthy consumer demand. (Source: “Goldman Sachs Sees Oil Prices Rising to $86 This Summer,” OilPrice.com, June 19, 2024.)

The outlook for the marine shipping industry is also buoyant, with the petroleum product tanker market being significantly affected by events in the Red Sea that have been forcing vessels to take longer routes.

This tailwind will eventually fade away, but the outlook for the rest of 2024 is solid, mainly due to refinery dislocation and oil production ramp-ups in the Middle East, coupled with minimal growth in the number of operational tanker vessels. Solid oil demand from China and India is also contributing to the positive outlook.

That’s good news for Hafnia Ltd (NYSE:HAFN), the biggest operator of product and chemical tankers in the world. The Singapore-headquartered company’s fleet consists of more than 200 vessels and continues to grow. (Source: “About,” Hafnia Ltd, last accessed June 11, 2024.)

If you’re not familiar with Hafnia, you’re not alone. While the company has been trading on the Oslo Stock Exchange (OSE) since November 2020, its shares only began trading on the New York Stock Exchange (NYSE) on April 9, 2024.

The company transports “dirty” and “clean” petroleum products, refined oil products, vegetable oil, and “easy” chemicals to oil, chemical, trading, and utility companies. (Source: “Hafnia Limited (HAFN)” Yahoo! Finance, May 14, 2024.)

The majority of its vessels operate in the spot market, primarily through pools of similarly sized vessels. This allows Hafnia to maximize its fleet utilization, fleet revenues, and cyclical freight rate recovery.

Strong 1st-Quarter Results

For the first quarter ended March 31, Hafnia reported net profits of $219.6 million, or $0.43 per share. Meanwhile, the company’s commercially managed pool business generated income of $9.8 million. (Source: “Quarterly Financial Information Q1 2024,” Hafnia Ltd, May 15, 2024.)

The company’s time charter equivalent (TCE) earnings inched up in the first quarter to $378.0 million, compared to $377.2 million in the same period last year. This resulted in an average daily TCE rate of $36,230.

Hafnia’s adjusted first-quarter earnings before interest, taxes, depreciation, and amortization (EBITDA) were down slightly at $287.1 million, from $296.0 million in the first quarter of 2023.

As of May 10, for the second quarter, 68% of the total earning days for the company’s fleet were covered at $37,896 per day. For the entire year, 32% of the total earning days of the fleet were covered at $33,901 per day.

Commenting on the first-quarter results, Mikael Skov, Hafnia Ltd’s CEO, said, “I am proud to share that Hafnia achieved a net profit of USD 219.6 million in our first quarter, demonstrated by our active management approach, modern fleet, and strong presence in the spot market.” (Source: Ibid.)

Management Announced Highest Quarterly Dividend

A lot of great things have been happening at Hafnia Ltd that support its growing quarterly dividends.

On April 9, its shares began trading on the NYSE. Why was that a big deal? The dual listing expanded its investor base, providing it exposure to the lucrative U.S. stock market.

That same day, the company announced it was raising its dividend payout ratio (the percentage of earnings paid to shareholders as dividends) from 70% to 80% when its net loan-to-value is between 20% and 30%. When the company’s net loan-to-value falls to 20% or lower, the company will raise its dividend payout ratio to 90%. (Source “Hafnia Limited – Increase in Quarterly Dividend Payout Ratio,” Hafnia Ltd, April 9, 2024.)

At the end of the first quarter, Hafnia’s net loan-to-value stood at 24.2%, resulting in a dividend payout ratio of 80%. (Source: Hafnia Ltd, May 15, 2024, op. cit.)

That led the company to pay a quarterly dividend of $175.7 million, or $0.3443 per share, on June 3. (Source: “Dividend History,” Hafnia Ltd, last accessed June 12, 2024.)

As of this writing, that translates to a forward yield of 16.6%.

That marked the highest dividend Hafnia has ever paid, and it shows there’s potential for further dividend growth as the company continues to strengthen its balance sheet.

Hafnia Stock’s Price Hit Record High

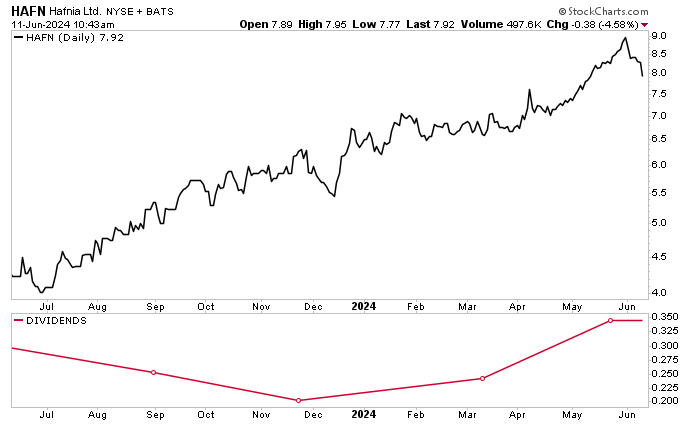

Hafnia Ltd’s share price has been doing well since the company’s dual listing on the NYSE. HAFN stock entered 2024 trading at record highs, but the trading volume was pretty low. The stock traded in a tight range from January until early April, when it was listed on the NYSE.

From April 9 through May 31, Hafnia stock rallied by an impressive 17.6%, hitting a record high of $8.99 per share on the last day of May. HAFN stock has given up some ground since then to well-earned profit-taking.

As of this writing, Hafnia stock is trading up by about:

- 20% over the last three months

- 44% over the last six months

- 83.5% year-over-year

Chart courtesy of StockCharts.com

Note that oil prices have taken a temporary hit after nine members of the Organization of the Petroleum Exporting Countries (OPEC) increased their oil output by 100,000 barrels per day in May, despite quotas. That lifted their production above their collective target by 320,000 barrels per day. (Source: “OPEC Output Surges 120,000 B/D in May Despite Quotas; Russia-Led Allies Cut: Platts Survey,” S&P Global Inc., June 10, 2024.)

The solid outlook for crude oil demand should help oil prices rebound over the coming months, though.

The outlook for HAFN stock also looks good. The lone (so far) Wall Street analyst that tracks Hafnia stock has provided a 12-month share-price target of $10.00. This points to potential gains of 26%.

The Lowdown on Hafnia Ltd

Hafnia Ltd is a great marine shipping company with the largest fleet of oil product and chemical tankers. Its shipping pool also covers every petroleum product segment and chemical segment.

The company reported excellent first-quarter financial results, including TCE earnings of $378.8 million and net profits of $219.6 million.

HAFN stock recently paid quarterly dividends of $0.3443 per share, its highest quarterly distribution to date. Moreover, Hafnia’s share price has significant upside potential as the company strengthens its balance sheet.