H & R Block Inc and Its 3.8% Dividend Yield Just Soared 15%

H & R Block Inc (NYSE:HRB) investors finally have something to smile about. After falling sharply over the past couple of years, shares of the tax preparation specialist soared 15% last Wednesday on a much-needed market-topping earnings report.

Management has been trying to restructure the business over the past several years to varying degrees of success, but this big bounce might suggest that its best days are ahead. Regular readers know that I’m always on the hunt for cheap dividend stocks, but I usually only buy into turnaround stories when the fundamentals are actually turning around.

Trying to catch a falling knife can be one of the most dangerous things you can do as an investor, so it’s far safer to make sure the knife is stuck in the ground before grabbing it.

Judging from the latest quarter, I think H&R Block has reached a point where its solid dividend is worth picking up. Let’s take a closer look.

H&R Block Party

In the company’s fiscal year Q3, H&R Block generated a loss of $0.49 per share, topping the consensus by $0.01, while revenue slipped 4.8% to $452.0 million, besting estimates by $5.6 million.

Now, of course, tax preparation is a highly seasonal business, so don’t be too alarmed with those depressed results. H&R Block, along with other tax prep plays like Liberty Tax Inc (NASDAQ:TAX) and digital disrupter Intuit Inc. (NASDAQ:INTU), typically report earnings of slim to none over their first fiscal three quarters, with a big surge in both profits and revenue pouring in during the height of tax season in the fourth quarter.

Well, the encouraging news coming out of Wednesday is that H&R Block’s Q4 surge will likely be bigger than expected. Why? Because even amid an overall decline in the tax return industry, H&R Block is managing to gain market share in two key areas.

In the Assisted category, the company’s volume declined eight percent, easily outperforming the IRS’ reported decrease of 13%. And in the Do-It-Yourself (DIY) category, H&R Block’s volume slipped five percent, also besting the industry’s drop of eight percent. In total, H&R Block outperformed the industry with a seven-percent decline in return volume versus the IRS’ e-file falloff of 10%.

“Through aggressive Assisted and DIY offers, we are achieving our goal of new client growth and I’m pleased that we gained market share in both the Assisted and DIY tax preparation categories in the first half of the tax season,” said President and CEO Bill Cobb. “I’m proud of what we have accomplished so far.” (Source: “H&R Block Reports Market Share Gains in First Half of Tax Season; Announces Fiscal 2017 Third Quarter Results,” H & R Block Inc, March 7, 2017.)

Taxing Turnaround

H&R Block’s market share recovery is a big deal, and gauging from Wednesday’s pop, Wall Street is correctly seeing it as such.

After all, this is company that has experienced steady market share and client declines over the past several years amid the rise of online tax-prep software like “TurboTax.” Furthermore, a relatively complicated offering of diverse financial services led to a prolonged period of subpar margins and returns on capital.

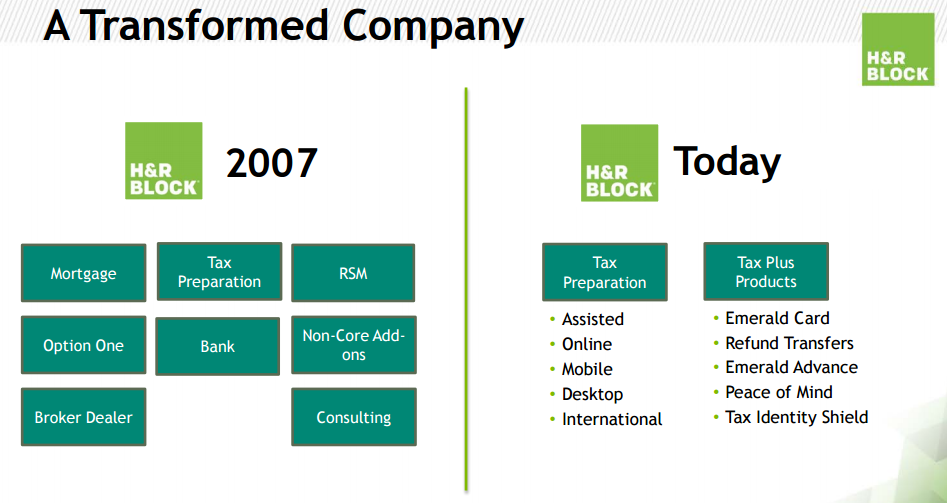

Well, management’s efforts in recent years to streamline the business and introduce new promotional offerings are now paying off. H&R Block’s decision to focus only on its core tax business—tax preparation and “tax-plus” products—is finally giving the company a synergistic leg up.

Source: “Investor Conference 2016,” H & R Block Inc, December 8, 2015

In fact, new client growth at H&R Block is the highest it has been since 2011, thanks to aggressive promotions and new products.

In the Assisted segment, for example, new clients are coming through the door for the company’s new “Refund Advance” product, which is simply a no-interest, no-fee loan that helps clients bridge the gap from the time they file to the time they receive the refund. H&R Block has also introduced a new client experience that uses “IBM Watson” and its massive computing chops to gain a better feel for each person’s unique situation.

In the company’s DIY business, client growth is being fueled by the expansion of its free filing option, “H&R Block More Zero,” as well as a ton of new product enhancements, such as a drag-and-drop feature that makes importing W2s, 1099s, and prior year returns all the more easy.

In other words, management is making good on its promise to stem the client decline.

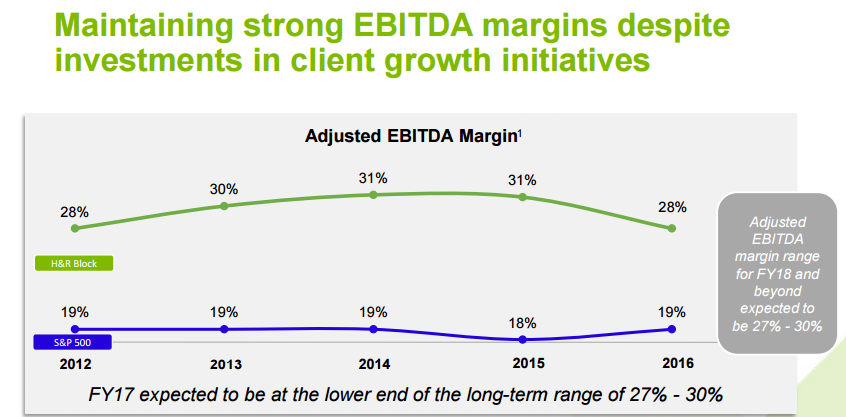

More importantly, with the company continuing to cut costs at a healthy rate—operating expenses declined $18.0 million in the quarter—H&R Block’s margins aren’t being compromised in the process.

Source: “2nd Quarter Fiscal 2017 Earnings Call,” H & R Block Inc, December 7, 2016

Tax Returns = Capital Returns

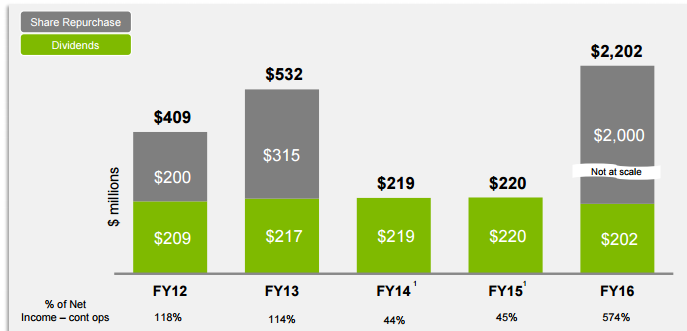

But what’s really exciting about H&R Block’s market share and cost improvement? Well, it’s all happening while management continues to return boatloads of capital to shareholders. And as income investors, there’s really nothing more we can ask for from our turnaround plays.

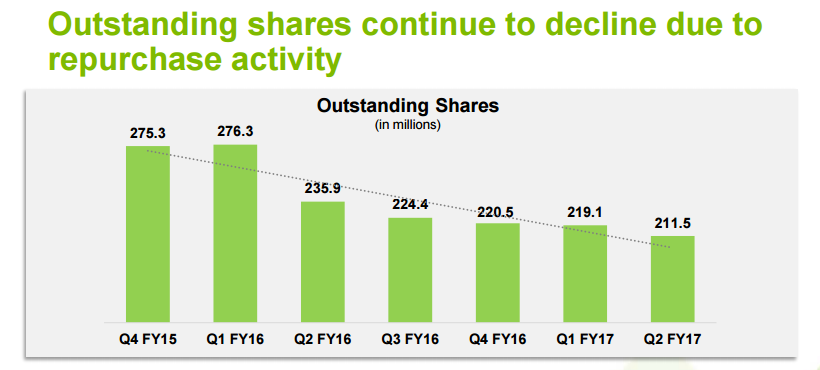

During the quarter, the company repurchased about 4.4 million shares for $100.0 million, bringing the total amount of buybacks for fiscal 2017 to $317.0 million. H&R Block has now repurchased about 105-million shares since mid-2011 (when new management took over), roughly representing a whopping 35% of its shares outstanding.

Source: “2nd Quarter Fiscal 2017 Earnings Call,” H & R Block Inc, December 7, 2016

Furthermore, H&R Block has continued to pay a pretty solid dividend along the way. In fact, the recently declared dividend of $0.22 per share extends the company’s impressive streak of paying quarterly dividends since 1962. Moreover, the dividend has grown nicely in recent years, with the annual payout up more than 45% since 2011.

In total, H&R Block has returned about $4.0 billion to shareholders since mid-2011. To put that into context, that represents more than 70% of the company’s market value of $5.5 billion!

Source: “2nd Quarter Fiscal 2017 Earnings Call,” H & R Block Inc, December 7, 2016

With the company expecting even further market share traction and cost reductions, I wouldn’t expect the capital returns to significantly slow anytime soon.

“While expenses are down slightly this quarter, the majority of our planned reductions will occur after the first quarter,” said CFO Tony Bowen. “These planned savings will enable us to continue to ensure strong free cash flow while also allowing us to make the appropriate investments to achieve our operational objectives for the upcoming tax season.” (Source: “H&R Block Announces Fiscal 2017 First Quarter Results,” H & R Block Inc, August 30, 2016.)

Bargain Block

But does H&R Block still have room to run after Wednesday’s big bounce? Well, considering how well the company is executing, and that the stock is still off about 20% from its 52-week highs, I’d definitely say so.

Of course, the biggest reason is H&R Block’s still-juicy dividend yield of 3.8%. That is well above the average of consumer cyclical companies (1.8%), as well as the S&P 500 (2.1%). H&R Block’s forward price-to-earnings multiple of 13 also represents a clear discount to the broader market, further reinforcing its relative cheapness.

Given the company’s improving competitive position and cost-structure, I’d expect that pricing to correct over time.

The Bottom Line On HRB Stock

Don’t let H&R Block’s recent rally prevent you from looking into the stock. Although the tax industry is facing a wider decline, H&R Block’s capital-light business model and strengthening market share continue to fund a well-covered dividend and healthy repurchases.

With an above-average dividend yield and strong operating momentum, H&R Block is an income opportunity worth pouncing on.