Grindrod Stock: 18.5%-Yielder Up by 236% Year-Over-Year

Grindrod Shipping Holdings Ltd Initiates Ultra-High-Yield Dividend

When it comes to eyewatering share-price appreciation and ultra-high-yield dividends, few can compete right now with marine shipping stocks. For instance, Grindrod Shipping Holdings Ltd (NASDAQ:GRIN) has been on fire lately, and the company recently initiated an ultra-high-yield dividend. Moreover, the outlook for the marine shipping industry is robust.

Grindrod is a Singapore-based international shipping company that owns, charters in, and operates a fleet of dry bulk carriers and medium-range tankers. The company primarily operates in the dry bulk carrier business. (Source: “About Us,” Grindrod Shipping Holdings Ltd, last accessed February 4, 2022.)

The company’s fleet of Handysize, Supramax, and Ultramax vessels consists of approximately 24 owned dry bulk carriers and seven long-term chartered-in dry bulk carriers. (Source: “Fleet,” Grindrod Shipping Holdings Ltd, last accessed February 4, 2022.)

Its dry bulk carriers transport commodities such as ore, coal, grain, forestry products, steel products, and fertilizer. The company’s tankers carry petroleum products such as diesel, jet fuel, and heavy fuel oil.

With an average vessel age of six years, Grindrod Shipping Holdings Ltd believes it has one of the youngest and most efficient fleets in the shipping industry. (Source: “Grindrod Shipping Holdings Ltd. Unaudited Financial Results for the Three Months & Nine Months Ended September 30, 2021,” Grindrod Shipping Holdings Ltd, November 17, 2021.)

In November 2021, the company’s board of directors declared an interim quarterly dividend of $0.72 per ordinary share, for a yield of 18.5%. The dividend is the first payment under Grindrod’s recently announced capital return policy, and it represents approximately 30% of the company’s third-quarter 2021 net income.

Q3 Revenues Soar 150%; Company Swings to Profitability

For the third quarter ended September 30, Grindrod Shipping Holdings Ltd announced that its revenue jumped by 150% year-over-year to $135.1 million. (Source: Ibid.)

The company’s time charter equivalent (a measurement used to calculate average revenue per vessel) per day for its Handysize vessels was $25,919, compared to $6,713 in the third quarter of 2020. Its Supramax and Ultramax time charter equivalent per day was $29,934, compared to $10,831 in the third quarter of 2020.

Grindrod Shipping Holdings Ltd’s gross profit in the third quarter of 2021 was $62.0 million, compared to $1.6 million in the same prior-year period.

The company reported third-quarter 2021 net income of $49.1 million, or $2.19 per share, compared to a third-quarter 2020 net loss of $14.6 million, or $0.75 per share. Its adjusted net income in the third quarter of 2021 was $45.8 million, or $2.38 per share, compared to an adjusted net loss of $7.8 million, or $0.41 per share, in the third quarter of 2020.

During the third quarter of 2021, Grindrod Shipping Holdings Ltd repurchased $1.4 million worth of its own shares. Furthermore, it ended the quarter with cash and cash equivalents of $76.1 million and restricted cash of $9.0 million.

In the first nine months of 2021, the company’s revenue surged by 65% year-over-year to $366.3 million. Its gross profit was $110.1 million, compared to $10.5 million in the same prior-year period.

Grindrod Shipping Holdings Ltd’s net income in the first nine months of 2021 was $74.2 million, or $3.29 per share, versus a net loss of $26.9 million, or $1.31 per share, in the first nine months of 2020. Its adjusted net income in the first nine months of 2021 was $67.3 million, or $3.35 per share, compared to an adjusted net loss of $13.1 million, or $0.69, in the first nine months of 2020.

During the first nine months of 2021, the company repurchased $165.0 million worth of its own shares.

Grindrod Stock Trouncing Market & Peers

On the back of significant industry tailwinds and ongoing business growth, GRIN stock has been on fire. As of this writing, Grindrod stock is up by:

- 30% over the last three months

- 58% over the last six months

- 237% year-over-year

Strong gains indeed.

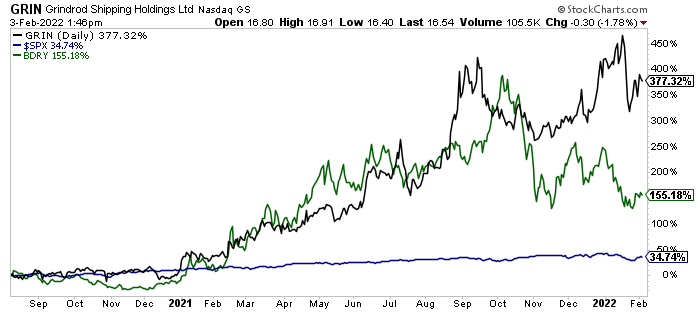

Chart courtesy of StockCharts.com

GRIN stock has been trumping the broader market and its peers. Over the last 18 months, with dividends reinvested, Grindrod stock has soared by 377.3%, compared to the S&P 500, which has gone up by 34.7%, and Breakwave Dry Bulk Shipping ETF (NYSEARCA:BDRY), which has advanced 155.1%.

Chart courtesy of StockCharts.com

GRIN stock’s outlook is bullish, with Wall Street analysts providing an average 12-month target of $31.00, which points to potential gains of 87%.

The Lowdown on Grindrod Shipping Holdings Ltd

With the marine shipping industry running on all cylinders, it makes sense to examine the sector’s biggest players.

A leading dry bulk and liquid shipping company, Grindrod Shipping Holdings Ltd has been reporting fabulous results. During the third quarter of 2021, it achieved better-than-expected financial results, taking full advantage of the robust market conditions and its expanded fleet. The company also declared its first quarterly payout under its new dividend policy.

Income hogs hope management will be increasing Grindrod stock’s payout over the coming quarters.