13.3%-Yielding Green Plains Partners Stock’s Payout Hiked in 4 Consecutive Quarters

GPP Stock Might Be Perfect for Income & Growth

Gas prices have been declining for the last month or so, and with them, the prices of many oil and gas stocks. That doesn’t mean all energy stocks have been facing headwinds; some have been trending higher, such as Green Plains Partners LP (NASDAQ:GPP).

Green Plains Partners is a fee-based limited partnership formed by its parent company, Green Plains Inc, to provide fuel storage, terminal, and transportation services. (Source: “Our Operations,” Green Plains Partners LP, last accessed August 23, 2022.)

Green Plains Partners owns 32 ethanol storage facilities located at or near Green Plains Inc’s 13 ethanol production plants in Indiana, Illinois, Iowa, Minnesota, Nebraska, Tennessee, and Texas. They have a combined annual ethanol production capacity of approximately 1.1 billion gallons. The combined storage capacity of its ethanol assets is approximately 31.9 million gallons.

Through its fuel terminals, Green Plains Partners LP provides terminal services and logistics solutions. The company’s eight fuel terminal facilities in seven south-central U.S. states have fuel holding tanks and access to major rail lines for transporting ethanol and other fuels. The partnership’s current combined total storage capacity is approximately 6.8 million gallons.

Green Plains Partners LP’s transportation assets include a leased rail transportation fleet of approximately 2,840 railcars with an aggregate capacity of 85.2 million gallons. The railcars are dedicated to transporting ethanol and other fuels under commercial agreements with Green Plains Inc to refiners throughout the U.S. and to international export terminals.

Q2 Net Income of $0.44 Per Share

For the second quarter ended June 30, Green Plains reported net income of $10.5 million, or $0.44 per share, up from $10.3 million, or $0.44 per share, in the second quarter of 2021. (Source: “Green Plains Partners Reports Second Quarter 2022 Financial Results,” Green Plains Partners LP, August 2, 2022.)

The partnership also reported second-quarter 2022 adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) of $12.9 million and distributable cash flow of $11.3 million, compared to adjusted EBITDA of $12.7 million and distributable cash flow of $11.2 million in the same period of 2021.

“Green Plains Partners continues to achieve consistent returns,” said Todd Becker, Green Plains Partners LP’s president and CEO. “We believe Green Plains’ ability to achieve higher throughput rates, as demonstrated in the second quarter, should benefit the partnership in future periods.”

Green Plains Partners LP Hikes Dividend for 4th Straight Quarter

Thanks to consistent operations and low leverage, Green Plains Partners’ management felt confident enough to increase the company’s quarterly distribution for a fourth consecutive quarter. On July 21, the board increased Green Plains Partners stock’s quarterly cash distribution to $0.45 per unit, for a yield of 13.3%.

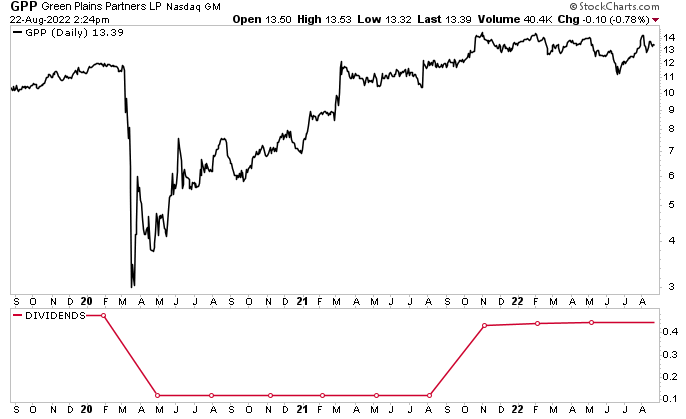

As you can see in the chart below, the company cut GPP stock’s dividend in 2020 during the COVID-19 pandemic and raised it in the last quarter of 2021.

The slashing of Green Plains Partners stock’s payout in 2020 shouldn’t be a total surprise, since the global economy was at a standstill at the time. Reducing GPP stock’s dividend by 75% to $0.12 per unit was a prudent move. It freed up approximately $33.8 million on an annual basis. Green Plains Partners LP used that freed-up cash to pay down its debt.

That was then; this is now. Since then, the company has raised its dividend in four consecutive quarters.

Moreover, GPP stock’s price has been on the move recently. As of this writing, Green Plains Partners stock is:

- Up by four percent over the last month

- Up by six percent over the last three months

- Up by five percent over the last six months

- Flat year-to-date

- Up by 14% year-over-year

Chart courtesy of StockCharts.com

The Lowdown on Green Plains Partners Stock

Energy companies like Green Plains Partners LP don’t always do well. How could they? Oil and gas prices can experience huge price swings.

Nevertheless, when things are good, like they are right now, GPP stock is great for investors who are looking for market-thumping share-price gains and inflation-crushing, ultra-high-yield dividends.