Global Net Lease Stock: Beaten-Down 20%-Yielder Presents Opportunity

GNL Stock a Work-in-Progress REIT Play for Contrarian Investors

Contrarian stock traders who are patient should take a look at Global Net Lease Inc (NYSE:GNL), a high-yield real estate investment trust (REIT) that’s focused on commercial properties.

The REIT acquires commercial properties and leases them back to the occupants. Its properties are situated in the U.S., western Europe, and northern Europe. (Source: “Corporate Overview,” Global Net Lease Inc, last accessed February 29, 2024.)

Global Net Lease owns approximately 1,304 properties comprising 66.8 million square feet. An impressive 96% of the properties are leased out, and they have a weighted average remaining lease term of 6.9 years. (Source: “Portfolio Overview,” Global Net Lease Inc, last accessed February 29, 2024.)

This represents steady cash flow for years to come.

The risk with Global Net Lease stock is the company’s financial losses and significant debt obligations, which have scared off investors.

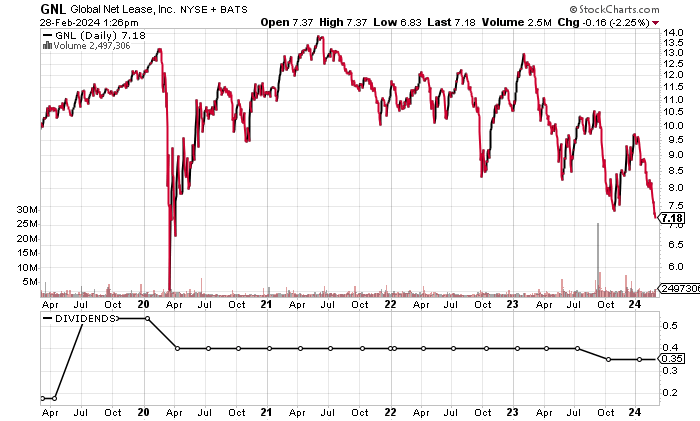

GNL stock’s high dividend yield is due to major share-price deterioration. As of February 28, the stock was down by a whopping 28.0% in 2024 and 49.1% over the past year. It fell to a 10-year low of $6.83 on February 28.

Global Net Lease stock traded at highs of $14.50 in March 2023 and $30.21 in June 2015, so its current upside potential is significant.

The company’s goal should be to improve its balance sheet. Fortunately, Global Net Lease Inc has been producing positive free cash flow (FCF), which should make its current dividend safe.

Chart courtesy of StockCharts.com

Growing Revenues & Positive FCF

Global Net Lease Inc grew its revenues from 2019 to a record-high $392.3 million in 2021, prior to having a small decline in 2022.

The outlook for the company’s revenues is extremely optimistic at this time. Analysts estimate that Global Net Lease will drive its revenues up to $795.7 million in 2024. (Source: “Global Net Lease, Inc (GNL),” Yahoo! Finance, last accessed February 29, 2024.)

| Fiscal Year | Revenues (Millions) | Growth |

| 2018 | $281.2 | N/A |

| 2019 | $305.4 | 8.6% |

| 2020 | $330.1 | 8.1% |

| 2021 | $392.3 | 18.9% |

| 2022 | $379.6 | -3.3% |

(Source: “Global Net Lease Inc.” MarketWatch, last accessed February 29, 2024.)

Global Net Lease Inc has generated strong gross margins, including ones that were higher than 80% in 2021 and 2022.

| Fiscal Year | Gross Margins |

| 2018 | 75.9% |

| 2019 | 79.5% |

| 2020 | 79.1% |

| 2021 | 81.6% |

| 2022 | 80.7% |

One of Global Net Lease Inc’s issues is its inconsistent generally accepted accounting principles (GAAP) profitability. After producing GAAP-diluted earnings-per-share (EPS) profits in 2018 and 2019, it had three straight years of losses.

The sole analyst who monitors Global Net Lease expects the company to come back with of $0.41 per diluted share in 2024. (Source: Yahoo! Finance, op. cit.)

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2018 | $0.01 | N/A |

| 2019 | $0.39 | 3,800% |

| 2020 | -$0.09 | -123.1% |

| 2021 | -$0.20 | -122.2% |

| 2022 | -$0.09 | 55.0% |

(Source: MarketWatch, op. cit.)

A big plus for Global Net Lease Inc and its ability to continue paying dividends is its positive FCF since 2019. The company uses its FCF to pay dividends and reduce its debt load.

| Fiscal Year | FCF (Millions) | Growth |

| 2018 | $143.1 | N/A |

| 2019 | $128.7 | -10.1% |

| 2020 | $170.5 | 32.5% |

| 2021 | $184.6 | 8.3% |

| 2022 | $154.3 | -16.4% |

(Source: MarketWatch, op. cit.)

As I mentioned earlier, the major risk with GNL stock is the company’s debt, which was $5.3 billion at the end of 2023. As of this writing, Global Net Lease Inc also has $162.4 million in cash and strong working capital, so liquidity shouldn’t be a problem at this time. (Source: Yahoo! Finance, op. cit.)

The company’s interest coverage ratio of 1.2 in 2022 was weak. A plus, however, is that Global Net Lease Inc has managed to cover its interest expense with its higher earnings before interest and taxes (EBIT) for three straight years.

| Fiscal Year | EBIT (Millions) | Interest Expense (Millions) |

| 2020 | $87.6 | $71.8 |

| 2021 | $118.9 | $94.3 |

| 2022 | $120.6 | $97.5 |

(Source: Yahoo! Finance, op. cit.)

Global Net Lease Inc’s Piotroski score—an indicator of a company’s balance sheet, profitability, and operational efficiency—is a weak reading of 2.0, which is near the bottom of the Piotroski score’s range of 1.0 to 9.0. Prior to 2023, the company’s Piotroski score averaged a healthy 6.0.

Global Net Lease Stock’s Dividend Streak Should Continue

Global Net Lease’s dividend history shows its quarterly distribution rising from $0.1775 per share in April 2019 to $0.5325 per share in July 2019. The company subsequently cut its quarterly dividend to $0.40 per share in April 2020 and followed that with a cut to $0.354 per share in October 2023. (Source: “GNL Dividend History,” Global Net Lease Inc, last accessed February 29, 2024.)

GNL stock’s current quarterly dividend of $0.354 per share translates to a forward yield of 19.75% (as of this writing). That’s well above the stock’s five-year average yield of 11.78%. As mentioned earlier, Global Net Lease stock’s ultra-high yield is due to its weak share price.

Considering the company’s debt level, I don’t expect it to increase its dividend anytime soon.

Management could maintain GNL stock’s current dividend level, given the company’s positive FCF and moves toward positive adjusted earnings. On the other hand, Global Net Lease Inc’s dividend coverage ratio of 0.6 is on the weak side, so the company could eventually make another dividend cut.

| Metric | Value |

| Dividend Streak | 10 Years |

| 7-Year Dividend Compound Annual Growth Rate | -4.0% |

| 10-Year Average Dividend Yield | 16.9% |

| Dividend Coverage Ratio | 0.6 |

The Lowdown on Global Net Lease Inc

Global Net Lease Inc is clearly geared to contrarian income investors who are willing to adopt a wait-and-see approach.

To compensate for some of the risk involved with Global Net Lease stock, investors get dividends and the potential for significant share-price appreciation (if the company can reduce its debt and generate profits).