Global Net Lease Stock: A Compelling 13.6%-Yielder

REIT Pick Could Pay Off for Contrarians

Patient contrarian investors should take a look at Global Net Lease Inc (NYSE:GNL), a high-yielding real estate investment trust (REIT) focused on commercial properties. With interest rates set to begin falling in September and into 2025, many of these capital-intensive REITs will see their financing costs begin to decline, resulting in margin expansion. What better reason to put Global Net Lease stock in the spotlight today?

This REIT acquires commercial properties that are then leased back to the occupant. Properties are situated in the U.S., as well as Western and Northern Europe. (Source: “Corporate Overview,” Global Net Lease Inc, last accessed August 8, 2024.)

Global Net Lease owns approximately 1,304 properties comprised of 66.8 million square feet. An impressive 96% of the properties are leased, with a weighted average remaining lease term of 6.9 years. This transmutes into years of steady cash flow. (Source: “Portfolio Overview,” Global Net Lease Inc, last accessed August 8, 2024.)

The negatives for Global Net Lease are the ongoing losses and significant debt obligations that have scared off investors. Global Net Lease stock is down 18.2% in 2024 and 26.4% over the past year to August 8, which provides an opportunity for contrarian investors.

As you wait for a turnaround, you collect a nice forward dividend yield of 13.6% and have an opportunity for GNL stock to rally.

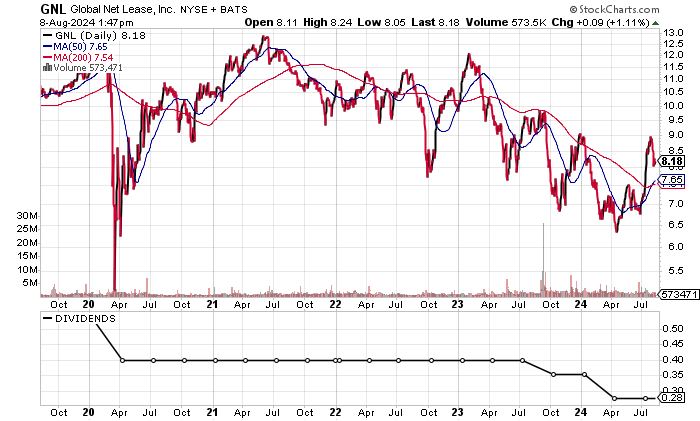

On the chart, Global Net Lease stock has recovered its 50-day moving average (MA) of $7.79 and 200-day MA of $8.05. Look for the 50-day MA to recover the 200-day MA. This would be bullish.

The upside potential is significant. GNL stock traded at a 52-week high of $11.58 in September 2023 and as high as $30.21 in June 2015.

Chart courtesy of StockCharts.com

Revenues Surge as Profits Set to Rise

Global Net Lease Inc grew revenues from 2019 to 2021 prior to the small decline in 2022. This was followed by a 36.6% jump to the record $518.6 million in 2023. Revenues have grown in nine of the last 10 years, and the outlook for 2024 is bullish.

| Fiscal Year | Revenues (Millions) | Growth |

| 2019 | $305.4 | 8.6% |

| 2020 | $330.1 | 8.1% |

| 2021 | $392.3 | 18.9% |

| 2022 | $379.6 | -3.3% |

| 2023 | $518.6 | 36.6% |

(Source: “Global Net Lease, Inc.,” MarketWatch, last accessed August 8, 2024.)

Analysts estimate that Global Net Lease will drive revenues to $820.2 million in 2024, followed by a flat $820.3 million in 2025. (Source: “Global Net Lease, Inc (GNL),” Yahoo! Finance, last accessed August 8, 2024.)

Global Net Lease generates strong gross margins, hitting over 80% in 2021 and 2022.

| Fiscal Year | Gross Margins |

| 2019 | 79.5% |

| 2020 | 79.1% |

| 2021 | 81.6% |

| 2022 | 80.7% |

| 2023 | 70.8% |

One of the company’s issues is the inconsistency as far as its generally accepted accounting principles (GAAP) profitability. After producing GAAP profits in 2018 and 2019, Global Net Lease experienced four straight years of losses.

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2019 | $0.39 | 3,800.0% |

| 2020 | -$0.09 | -123.5% |

| 2021 | -$0.20 | -121.5% |

| 2022 | -$0.09 | 56.0% |

| 2023 | -$1.71 | -1,801.8% |

(Source: MarketWatch, op. cit.)

After adjusting for non-recurring items, Global Net Lease reported an adjusted profit of $0.05 per diluted share in 2023.

Analysts expects the company to report an adjusted profit of $1.04 per diluted share in 2024 and $0.75 per diluted share in 2025. (Source: MarketWatch, op. cit.)

A look at the funds statement shows consistent free cash flow (FCF). This allows Global Net Lease to pay dividends and reduce its debt.

| Fiscal Year | FCF (Millions) | Growth |

| 2019 | $128.7 | -10.1% |

| 2020 | $170.5 | 32.5% |

| 2021 | $184.6 | 8.3% |

| 2022 | $154.3 | -16.4% |

| 2023 | $99.2 | -35.7% |

(Source: MarketWatch, op. cit.)

On the balance sheet, there was $4.95 billion in total debt at the end of June. There is $122.2 million in cash and the working capital is strong, so liquidity shouldn’t be an issue. (Source: Yahoo! Finance, op. cit.)

A plus is that Global Net Lease covered its interest expense with higher earnings before interest and taxes (EBIT) in three straight years prior to 2023.

| Fiscal Year | EBIT (Millions) | Interest Expense (Millions) | Interest Coverage Ratio |

| 2020 | $87.6 | $71.8 | 1.22X |

| 2021 | $117.9 | $94.3 | 1.25X |

| 2022 | $120.6 | $97.5 | 1.24X |

| 2023 | -18.0 | $179.4 | N/A |

(Source: Yahoo! Finance, op. cit.)

The Piotroski score, an indicator of a company’s balance sheet, profitability, and operational efficiency, shows a weak reading of 3.0, which is near the bottom of the 1.0 to 9.0 range. Prior to 2023, Global Net Lease’s Piotroski score averaged a far better 5.0.

Global Net Lease Stock: Dividend Cut, But It Should Be Safe

Global Net Lease cut its quarterly dividend to $0.275 per share in April and July, from the previous $0.354 per share in January.

With the cut, Global Net Lease stock’s annual dividend of $1.10 per share represents a forward yield of 13.6%, which is below the five-year average yield of 17.1%. The high yield is due to the weak share price.

Given the debt, I don’t expect dividends to be increased in the near future. Although I do expect Global Net Lease stock’s dividend to continue given the move towards adjusted profits and the positive FCF.

| Metric | Value |

| Dividend Growth Streak | N/A |

| Dividend Streak | 10 years |

| Dividend 7-Year CAGR | -5.7% |

| 10-Year Average Dividend Yield | 18.1% |

| Dividend Coverage Ratio | 0.6X |

The Lowdown on Global Net Lease Stock

While the company’s dividend cuts are disappointing, we are seeing some positive signs on the revenue and profitability side that could drive FCF higher. This would be positive for maintaining dividends and paring down the debt.

Global Net Lease stock is geared to contrarian income investors willing to adopt a wait-and-see approach while collecting a good dividend yield.