Global Net Lease Stock: A 14.4%-Yielder for Contrarian Investors

GNL Stock a Compelling REIT at $7.64?

Today’s stock pick in the spotlight is Global Net Lease stock.

The Federal Reserve just cut the fed funds target range by another 25 basis points at the November Federal Open Market Committee (FOMC) meeting. And we could see the interest rate cuts extend into December and 2025.

Declining rates will help real estate investment trust (REIT) structures that tend to carry high debt. Lower financing costs could drive capital expenditures and boost gross margins and the bottom line.

With all this said, a small-cap, high-yielding REIT to consider is Global Net Lease Inc (NYSE:GNL). The REIT’s business model involves buying commercial properties that are then leased back to the occupant(s). Global Net Lease has properties in the U.S. and Western and Northern Europe. (Source: “Corporate Overview,” Global Net Lease Inc, last accessed November 12, 2024.)

There are four reportable segments: (1) Industrial & Distribution; (2) Multi-Tenant Retail; (3) Single-Tenant Retail; and (4) Office. At the end of September, Global Net Lease managed a portfolio of 1,223 properties covering 61.9 million square feet. (Source: “Global Net Lease Reports Third Quarter 2024 Results,” Global Net Lease Inc, November 12, 2024.)

An impressive 96% of the properties are leased with a weighted average remaining lease term of 6.3 years. This transmutes into steady cash flow for years.

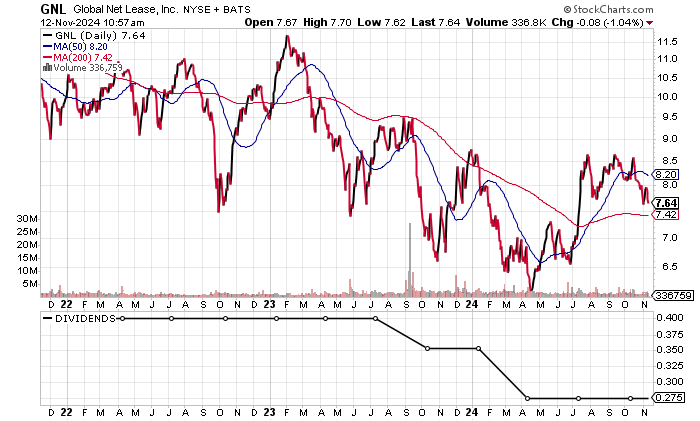

The major risks for investors are the losses and significant debt obligations. Income investors willing to assume the risk receive regular dividends that have been in place for 10 years. And given that GNL stock is down 25% from its 52-week high of $10.19, the forward yield is a high 14.4%.

Chart courtesy of StockCharts.com

Third Quarter Slightly Below Estimates

After generating record revenues of $518.6 million in 2023, Global Net Lease reported $605.9 million in revenues in the first nine months of 2024, which was up 96.5% versus its $308.4 million for the same period in 2023.

Third-quarter revenues of $196.6 million made for a 66.3% increase versus the revenues in the third quarter of 2023, but they were slightly down from the $203.3 million in the second quarter of 2024. The drop was attributed to asset dispositions in the third quarter of 2024. (Source: Global Net Lease Inc, op. cit.)

Global Net Lease has a pathway to come close to the consensus estimate. Analysts estimate that revenues will surge by 57.3% to $810.3 million in 2024, followed by a slight decline to $800.2 million in 2025. (Source: “Global Net Lease, Inc. (GNL),” Yahoo! Finance, last accessed November 12, 2024.)

A concern for investors is the company’s inconsistency in delivering generally accepted accounting principles (GAAP) profitability. Global reported losses in four straight years, including a loss of $1.71 per diluted share in 2023, its biggest loss since 2014.

Analysts expect Global Net Lease to narrow its GAAP loss to $0.12 per diluted share in 2024 and then -$0.09 per diluted share in 2025. (Source: Yahoo! Finance, op. cit.)

Note that REITs generally look at the adjusted funds from operations (AFFO) to decide on their dividend payout. In the case of Global Net Lease, it reported AFFO of $0.32 per share in the third quarter versus $0.33 per share in the second quarter and $0.36 per share in the year-ago third quarter. The company will need to improve on this, but the lower interest rates should help as long as the economy holds up.

Looking ahead, Global Net Lease estimates AFFO of between $1.30 and $1.40 per share for 2024. (Source: Global Net Lease Inc, op. cit.)

The company’s total debt stood at $4.8 billion at the end of September, paired with $127.3 million in cash and strong working capital. Global Net Lease has reduced its net debt by $445.0 million so far in 2024. I don’t expect liquidity to be an issue at this time. (Source: Yahoo! Finance, op. cit.)

The Piotroski score, an indicator of a company’s balance sheet, profitability, and operational efficiency, shows a decent reading of 6.0, which is comfortably above the midpoint of the 1.0 to 9.0 range.

Global Net Lease Stock Dividend Dependent on Improvements

Global Net Lease is at a low point as far as its dividend goes, but the hope is that its operations will improve and allow for higher dividends.

Global Net Lease stock’s current quarterly dividend is $0.275 per share or $1.10 annually. This has been in place for three straight quarters prior to $0.354 per share in January 2024 and October 2023. Prior to this, the quarterly dividend was $0.40 per share dating back to April 2020.

Its forward yield of 14.4% is above the five-year average yield of 12.77%.

Global Net Lease stock’s dividend coverage ratio of 0.8 times is on the weak side, so there could be another dividend cut if the situation doesn’t improve.

I generally like to see higher dividends over time, but the strong expected increase in revenues and narrowing losses could lead to higher dividends down the road.

| Metric | Value |

| Dividend Streak | 10 years |

| Dividend 7-Year CAGR | -5.7% |

| 10-Year Average Dividend Yield | 18.6% |

| Dividend Coverage Ratio | 0.8X |

The Lowdown on Global Net Lease Stock

While Global Net Lease stock is not the typical dividend pick you would add given the dividend cuts, an improvement in operations could allow for higher dividends.

For the contrarian income investor, Global Net Lease stock is a strong risk/reward opportunity that offers both major price appreciation and the collection of dividends.