Gladstone Commercial Stock: 8.22%-Yielder Up 12% in 2024

Geared to Monthly Income Investors

Have you ever considered a real estate investment trust (REIT), like Gladstone Commercial stock?

The recent years of high interest rates proved difficult for companies buying and operating high-cost, fixed assets. High financing costs cut into margins and impact profitability.

REITs are investment vehicles that have suffered due to the risks and uncertainties related to higher interest rates.

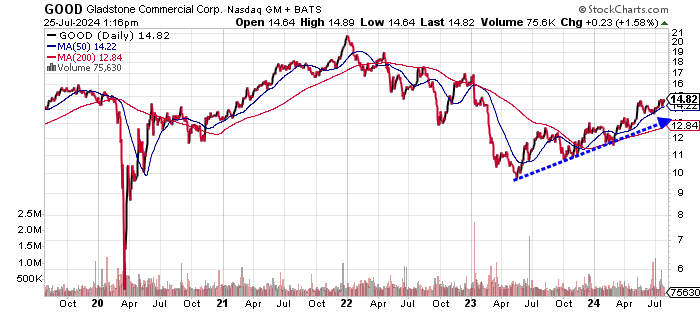

But, after collapsing during the pandemic and the subsequent period of rising interest rates, REITs have rallied from their lows.

Take the case of Gladstone Commercial Corporation (NASDAQ:GOOD), a small, $605.0-million-market-cap REIT stock that has rallied over 90% since the pandemic low of $7.59.

The company is focused on investing in single-tenant, net-lease industrial properties nationwide. Gladstone Commercial operated a portfolio of 132 industrial and office properties spread across 27 states as of March 31, 2024.

The company’s client base is broad, comprised of different industries and regions. The occupancy rate, which is hovering at 98.9%, has never fallen below 95% since 2003. This is impressive given the macro environment. (Source: “Company Overview” Gladstone Commercial Corporation, last accessed July 25, 2024.)

Income investors would be happy to hear that GOOD shareholders receive a monthly dividend. As an added bonus, Gladstone Commercial stock has rallied 12% in 2024 (as of July 25).

Gladstone Commercial stock traded at a 52-week high of $15.04 on May 15, but it remains well below its 10-year high of $26.13 in January 2022. I view this as a decent risk/reward opportunity.

Chart courtesy of StockCharts.com

Steady Revenues & Free Cash Flow

Gladstone Commercial Corporation is all about delivering steady revenue growth and providing income investors with monthly income.

The REIT’s revenues grew in four consecutive years to the record $149.0 million in 2022, prior to slipping 0.9% in 2023…though that was still the second highest revenue figure in history. Gladstone Commercial reported revenue growth in nine straight years prior to 2023. Even during the pandemic in 2020, the REIT managed to grow revenues by 16.4%.

| Fiscal Year | Revenues (Millions) | Growth |

| 2019 | $114.4 | 7.1% |

| 2020 | $133.2 | 16.4% |

| 2021 | $137.7 | 3.4% |

| 2022 | $149.0 | 8.2% |

| 2023 | $147.6 | -0.9% |

(Source: “Gladstone Commercial Corporation,” MarketWatch, last accessed July 25, 2024.)

Analysts estimate that Gladstone Commercial will report a slight revenue contraction of 2.6% to $143.8 million in 2024, followed by a 2.2% increase to $147.0 million in 2025. (Source: “Gladstone Commercial Corporation (GOOD),” Yahoo! Finance, last accessed July 25, 2024.)

The REIT’s gross margins have held steady at above the 70%-handle since 2019. The reading in 2023 was the second highest since 2019.

| Fiscal Year | Gross Margins |

| 2019 | 84.5% |

| 2020 | 76.2% |

| 2021 | 76.0% |

| 2022 | 77.7% |

| 2023 | 78.2% |

On the bottom line, Gladstone Commercial Corporation has failed to produce generally accepted accounting principles (GAAP) profits in four of the last five years, but look for some improvement to come.

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2019 | -$0.15 | N/A |

| 2020 | $0.09 | -160.0% |

| 2021 | -$0.12 | -233.3% |

| 2022 | -$0.04 | -66.7% |

| 2023 | -$0.19 | 375.0% |

(Source: MarketWatch, op. cit.)

Analysts expect Gladstone Commercial to return to GAAP profitability of $0.04 per diluted share in 2024 and $0.08 in 2025. (Source: Yahoo! Finance, op. cit.)

While the company works on its profitability, it has managed to deliver 10 consecutive years of positive free cash flow (FCF).

The strong FCF should allow Gladstone Commercial stock to continue with its regular dividend payments.

| Fiscal Year | FCF (Millions) | Growth |

| 2019 | $52.6 | NA |

| 2020 | $59.1 | 12.4% |

| 2021 | $64.8 | 9.5% |

| 2022 | $62.4 | -3.7% |

| 2023 | $53.7 | -13.9% |

(Source: MarketWatch, op. cit.)

The main risk with Gladstone Commercial is its total debt of $723.6 million on the balance sheet. For now, there are no immediate issues given that the company has decent working capital and has managed to pay its interest obligations. (Source: Yahoo! Finance, op. cit.)

To put it in another way, Gladstone has managed to cover its interest expense via its earnings before interest and taxes (EBIT). But we could definitely see some improvement here.

| Fiscal Year | EBIT (Millions) | Interest Expense (Millions) | Interest Coverage Ratio |

| 2020 | $41.8 | $26.8 | 1.56X |

| 2021 | $37.8 | $26.9 | 1.41X |

| 2022 | $43.2 | $32.5 | 1.33X |

| 2023 | $42.3 | $37.3 | 1.13X |

(Source: Yahoo! Finance, op. cit.)

The Piotroski score, an indicator of a company’s balance sheet, profitability, and operational efficiency, shows a manageable reading of 5.0. This is just above the midpoint of the 1.0-to-9.0 range.

GOOD Stock’s Dividends Should Be Safe

For the income investor seeking some monthly income, Gladstone Commercial stock has paid dividends in 234 straight quarters. The company is consistent with its payments. (Source: “Gladstone Commercial Corporation Announces Monthly Cash Distributions for July, August and September 2024 and Earnings Release and Conference Call Dates for its Second Quarter Ended June 30, 2024,” Gladstone Commercial Corporation, July 9, 2024.)

| Metric | Value |

| Dividend Streak | 22 years |

| Dividend 7-Year CAGR | -3.1% |

| 10-Year Average Dividend Yield | 11.7% |

| Dividend Coverage Ratio | 1.0 |

The Lowdown on Gladstone Commercial Stock

You are not going to see strong growth with Gladstone Commercial Corporation, but what a shareholder will get in return is steady monthly income and the potential for some moderate price appreciation.