Frontline Stock: 10%-Yielder Hiked Dividend 67%

Why FRO Stock Is Up 74% Year-Over-Year

It’s tough to keep up with the sentiment on crude oil prices. In the span of less than 24 hours, three different analysts covering crude oil opined, “Oil prices fall on weaker U.S. consumer demand, China data,” “Oil edges up as summer demand hopes offset downbeat China data,” and “Oil prices rise after booking best week since April.”

When it comes to crude oil, it’s better to take a long-term view. Despite the talk of transitioning to green energy and becoming carbon-neutral by 2050, the fact is, the world is going to need oil and natural gas for decades. And since most countries aren’t home to vast oil and gas reserves, they have to be shipped all over the world.

That makes oil and gas marine shipping stocks like Frontline Plc (NYSE:FRO) so compelling.

Near-term industry tailwinds have been giving many marine shipping companies a big boost. For instance, the marine shipping market has been significantly affected by events in the Red Sea that have been forcing vessels to take longer routes.

According to the Defense Intelligence Agency, rerouting ships around Africa adds one to two weeks of transit time and about $1.0 million in fuel costs for each trip. (Source: “Houthi Attacks Placing Pressure on International Trade,” Defense Intelligence Agency, “ last accessed June 17, 2024.)

Ongoing fears have been juicing overall ocean spot freight rates, and those rates could surpass $20,000 per day and even reach a pandemic-era peak of $30,000 until early 2025. (Source: “Fears Are Rising Ocean Freight Rates May Surpass $20,000 With No Relief for Global Trade Into 2025,” CNBC, June 13, 2024.)

Bad news for consumers, since businesses pass those added costs on to you and me. For shipping companies like Frontline Plc, though, it’s been an economic windfall, which has been helping juice Frontline stock’s share price and variable dividends.

The company, formerly called Frontline Ltd, owns one of the largest, youngest, and most energy-efficient fleets in the marine shipping industry. It ships crude oil and oil products in the Arabian Gulf, the North Sea, West Africa, and the Caribbean. The company’s fleet of ships includes:

- 41 very large crude carriers (VLCCs), which are each capable of carrying 2.0 million barrels of oil

- 23 Suezmax ships, which are designed to move through the Suez Canal and are capable of carrying more than 1.0 million barrels of crude oil

- 18 Aframax vessels, which are capable of carrying up to 600,000 barrels of crude oil

(Source: “Fleet Overview,” Frontline Plc, last accessed June 17, 2024.)

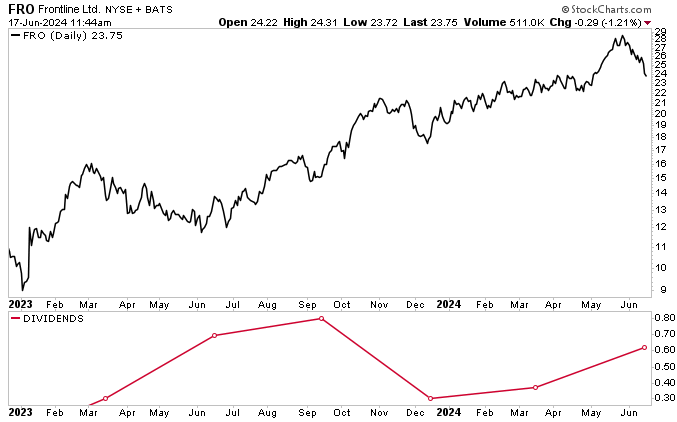

Since I first wrote about Frontline in March 2021, FRO stock (adjusted for dividends) has rallied by an impressive 275%. On May 28, 2024, Frontline stock hit a new 52-week intraday high of $28.68, its highest level since 2011.

FRO stock has given up some of those gains due to concerns about the outlook for crude oil prices, but it continues to trade at its highest levels in more than a decade, at $23.75 as of this writing. This puts Frontline stock up by 23% year-to-date and 74% year-over-year.

The outlook for FRO stock is solid, with analysts providing a 12-month median share-price target of $26.00. This points to potential upside of approximately 10%.

The bullish calls come with expectations that Frontline’s earnings per share (EPS) will rise from $2.63 in 2023 to $3.39 in 2024 and $3.50 in 2025. (Source: “Frontline plc (FRO),” Yahoo! Finance, last accessed June 17, 2024.)

Chart courtesy of StockCharts.com

Frontline Plc Reported Solid 1st-Quarter Results

For the first quarter ended March 31, Frontline announced that its revenues increased by 16% year-over-year to $578.3 million. It reported earnings of $180.8 million, or $0.81 per share, and adjusted earnings of $137.9 million, or $0.62 per share. (Source: “FRO – First Quarter 2024 Results,” Frontline plc, May 30, 2024.)

During the quarter, Frontline took delivery of the remaining 13 VLCCs from Euronav NV (NYSE:EURN) as part of a previously announced acquisition of 24 VLCCs.

As a result, it achieved average daily spot VLCC time charter equivalent (TCE) earnings of $48,100 per day. This was made up of $54,200 per day for the company’s existing VLCC fleet prior to the acquisition of the 24 VLCCs and $42,300 for the VLCCs delivered as a result of the acquisition.

The TCE earnings for the VLCCs delivered during the quarter were primarily impacted by positioning and $4,900 per day due to ballast days.

Also during the quarter, Frontline Plc entered agreements to sell its five oldest VLCCs (built in 2009 and 2010) and two of its oldest Suezmax tankers (built in 2010) for an aggregate net sales price of $382.0 million. After the repayment of existing debt on those vessels, the sales transactions are expected to generate net cash proceeds of about $275.0 million.

Moreover, net cash proceeds of about $692.0 million from the sales and refinancing of vessels allowed Frontline to repay $100.0 million that was drawn under a $275.0-million senior unsecured revolving credit facility. It will also enable the company to repay $295.0 million drawn under a loan in relation to its acquisition of the aforementioned 24 VLCCs.

Commenting on the quarterly results, Lars H. Barstad, Frontline Plc’s CEO, said, “Our first quarter earnings were solid, as markets remained firm throughout the quarter, and LR2 rates offered proper volatility as returns reached six digits in January 2024. The asset classes we deploy have gradually offered better returns as we progress in 2024.” (Source: Ibid.)

The outlook for Frontline is excellent: the spot TCE rate for VLCCs in the first quarter was $48,100, while the estimate for the rate in the second quarter is $60,400. The estimated average daily breakeven rate for VLCCs is $31,200.

Management Increased Payout 67% Quarter-Over-Quarter

Frontline’s goal is to distribute quarterly dividends that are equal or close to its EPS (adjusted for non-recurring items). The timing and amount of Frontline stock’s dividends is, of course, at the discretion of the company’s board of directors. (Source: “Dividend History,” Frontline plc, last accessed June 17, 2024.)

The board was quick to act during the COVID-19 crisis, suspending FRO stock’s dividends in late 2020 and only reinstating them in October 2022 at $0.15 per share.

Because Frontline stock’s distributions are based on the company’s earnings, they fluctuate, but for the most part, the quarterly payouts have been pretty robust.

As you can see in the below table, Frontline Plc declared a first-quarter 2024 dividend of $0.62 per share, to be paid on June 28. That was a 67% increase over the $0.37 it paid out in March 2024, but an 11% decrease from the $0.70 it paid out in June 2023.

| Payable Date | Distribution Per Share |

| June 28, 2024 | $0.62 |

| March 27, 2024 | $0.37 |

| December 29, 2023 | $0.30 |

| September 29, 2023 | $0.80 |

| June 30, 2023 | $0.70 |

| March 31, 2023 | $0.77 |

As of this writing, Frontline Plc’s quarterly distribution of $0.62 per share works out to a forward annual dividend yield of 10.32%.

Typically, a high dividend yield is a result of a lower share price, but as noted above, that’s not the case with FRO stock. It recently hit a new 52-week high and has been trading at its highest levels since 2011.

The Lowdown on Frontline Plc

Frontline is an outstanding marine shipping company that recently acquired 24 modern VLCCs, reported solid first-quarter results, and raised its quarterly distribution. Moreover, the demand for VLCCs is high.

During the first quarter, the company strengthened its balance sheet. The net cash proceeds from the sales and refinancing of vessels allowed Frontline Plc to pay some debt. This completed Frontline Plc’s strategy of freeing up capital through re-leveraging part of its existing fleet and selling older non-eco vessels to finance its acquisition of new ships.

Going forward, strong spot TCE estimates bode well for Frontline stock’s price and ultra-high-yield dividends.