FLEX LNG Stock Yielding 11.28%

Maritime LNG Shipper Generating Strong FCF

Today, my dividend-loving readers, I’m going to take a good look at FLEX LNG stock.

Liquefied natural gas (LNG) is natural gas that undergoes a process where it’s cooled down to liquid form for easier transportation. That means LNG can be transported without the need for more complicated and expensive pressurized storage transport solutions.

In the maritime LNG transport space, FLEX LNG Ltd (NYSE:FLNG) specializes in the transport of LNG via its fleet of 13 modern vessels.

The company currently has long-term, fixed-rate charter contracts for 11 of its vessels, while one vessel is used for variable usage. This allows for some revenue certainty. (Source: “Company Profile,” FLEX LNG Ltd, last accessed July 11, 2024.)

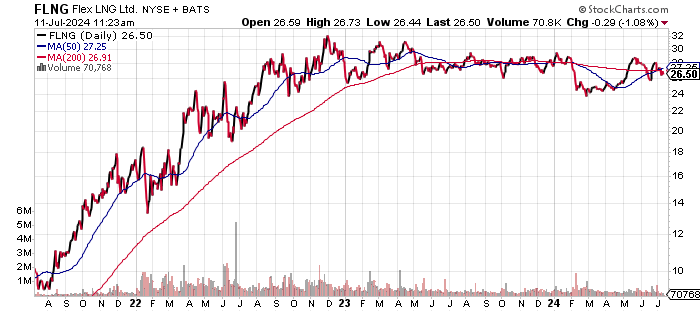

A look at the chart shows FLNG stock down 8.3% this year and 14.3% over the past year to July 11.

FLEX LNG stock is currently trading just below both its 50-day moving average (MA) of $27.67 and 200-day MA of $28.20.

Technically, if FLEX LNG stock could reclaim its 50-day MA, we could see a test of the 200-day MA and a breakout to above $30.00.

Chart courtesy of StockCharts.

Consistent Revenues & Profitability

FLEX LNG Ltd grew its revenues by 209.2% from 2019 to the record $371.0 million in 2023.

The company’s revenues grew in each of the last five years resulting in a compound annual growth rate (CAGR) of 27.5% during this period.

| Fiscal Year | Revenues (Millions) | Growth |

| 2019 | $120.0 | 55.4% |

| 2020 | $164.5 | 37.1% |

| 2021 | $343.4 | 108.8% |

| 2022 | $347.9 | 1.3% |

| 2023 | $371.0 | 6.6% |

(Source: “FLEX LNG Ltd,” MarketWatch, last accessed July 11, 2024.)

The company has produced revenues of $300.0 million during the past three years. Based on the first-quarter revenues of $90.2 million, I expect revenues to come in around the current levels in 2024.

For revenues to ramp higher, FLEX LNG will need to expand its fleet and/or increase the shipping fees. Expansion should not be an issue given the positive free cash flow (FCF) and profitability.

FLEX LNG Ltd delivers extremely strong gross margins, with 80%-plus readings over the last three years.

| Fiscal Year | Gross Margins |

| 2019 | 76.1% |

| 2020 | 75.3% |

| 2021 | 81.2% |

| 2022 | 81.0% |

| 2023 | 81.1% |

The gross margin expansion has helped FLEX LNG deliver higher generally accepted accounting principles (GAAP) profitability, which peaked in 2022 before declining in 2023.

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2019 | $0.31 | 6.9% |

| 2020 | $0.15 | -51.7% |

| 2021 | $3.04 | 1,929.2% |

| 2022 | $3.51 | 15.5% |

| 2023 | $2.22 | -36.8% |

(Source: MarketWatch, op. cit.)

On an adjusted basis, analysts expect FLEX LNG Ltd to earn $2.55 per diluted share in 2024 versus $2.52 per diluted share in 2023. Earnings per share are expected to be $2.50 in 2025. (Source: MarketWatch, op. cit.)

A bright spot has been the company’s move to positive FCF in 2022 and 2023. A continuance of positive FCF should allow FLEX LNG to continue with dividends as well as fleet expansion.

| Fiscal Year | FCF (Millions) | Growth |

| 2019 | -$245.0 | N/A |

| 2020 | -$619.6 | 152.9% |

| 2021 | -$54.4 | -91.2% |

| 2022 | $208.9 | -483.7% |

| 2023 | $175.0 | -16.2% |

(Source: MarketWatch, op. cit.)

A look at the balance sheet reveals $1.8 billion in total debt that’s partly offset by $383.2 million in cash. (Source: “FLEX LNG Ltd (FLNG),” Yahoo! Finance, last accessed July 11, 2024.)

The interest coverage ratio is a manageable 2.7 times. FLEX LNG has also consistently covered its interest payments via higher earnings before interest and taxes (EBIT).

| Fiscal Year | EBIT (Millions) | Interest Expense (Millions) | EBIT/Interest Ratio |

| 2020 | $50.0 | $41.8 | 1.20X |

| 2021 | $218.5 | $56.2 | 3.89X |

| 2022 | $264.7 | $76.6 | 3.46X |

| 2023 | $228.8 | $108.7 | 2.10X |

(Source: Yahoo! Finance, op. cit.)

The Piotroski score is an indicator of a company’s balance sheet, profitability, and operational efficiency. FLEX LNG shows a reasonable reading of 5.0, which is just above the midpoint of the 1.0 to 9.0 range.

FLEX LNG Stock: Healthy Yield Combines Regular & Special Dividends

FLEX LNG stock’s forward yield of 11.28%, largely due to the price weakness, is attractive. A rally in FLNG stock would result in a slightly lower yield, but you would see the share price rise. (Source: Yahoo! Finance, op. cit.)

The recent few years of dividend history show that the current regular quarterly dividend of $0.75 per share has been in place since December 2021, compared to $0.40 per share in September 2021.

In addition to the regular dividend, FLEX LNG paid special dividends of $0.125 per share in November 2023, $0.25 in February 2023, and $0.50 in September 2022.

| Metric | Value |

| Dividend Streak | 6 years |

| 10-Year Average Dividend Yield | 4.7% |

| Dividend Coverage Ratio | 1.3X |

Whether the company’s current quarterly dividend is sustainable is uncertain given the high payout ratio. This is the risk, but so far, there have been no announced changes.

The Lowdown on FLEX LNG Stock

Institutional ownership represents only 20.4% of the outstanding FLNG shares, but the insider interest is extremely high at 43.1%. This share structure suggests that insiders are more motivated to deliver. (Source: Yahoo! Finance, op. cit.)

FLEX LNG stock is ideal for the income investor who wants an above-average dividend yield and an opportunity for capital appreciation.