Fidus Stock: A Tech-Heavy, 11.63%-Yielding BDC

Fidus Investment Boasts High Return Potential

Good news: the business climate should improve under the expansionary economic policies of President-elect Donald Trump over the next four years. Moreover, a lower-interest-rate environment will also provide a boost to capital-intensive businesses and leaders in the U.S.

A business development company (BDC) is ideal for income investors to play this situation, since its mandate is to distribute at least 90% of its taxable income and tax-exempt interest annually to shareholders. The better the investments, the higher the potential returns.

Consider Fidus Investment Corp (NASDAQ:FDUS), a BDC with a market cap of $708.8 million that is one third invested in information technology (IT) services companies. This could translate into higher potential returns for the company.

Fidus invests in debt and equity capital with a focus on lower-middle-market companies in the U.S.

The BDC’s top investment sectors include IT services (33.7%), business services (11.5%), health-care products (8.4%), component manufacturing (8.0%), and transportation services (5.1%). (Source: “Investor Relations, ” Fidus Investment Corp, last accessed December 30, 2024.)

As of September 30, Fidus Investment managed an investment of 85 active portfolio companies with a combined fair value of $1.09 billion. The weighted average yield on the debt investments amounted to 13.8%. (Source: “Fidus Investment Corporation Announces Third Quarter 2024 Financial Results,” Fidus Investment Corp, December 30, 2024.)

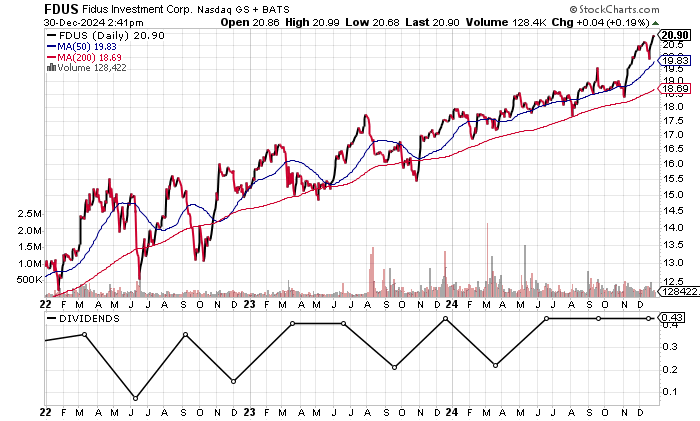

At the time of writing, Fidus stock was trading at $20.90 after reaching a record $21.68 on December 12.

The stock sits above both its 50-day moving average (MA) of $20.43 and 200-day MA of $19.88. This is technically significant, as there’s a golden cross on the Fidus stock chart, which is a bullish technical crossover when the 50-day MA is above the 200-day MA. The pattern supports upside moves.

Chart courtesy of StockCharts.com

Bull Case Supported by Strong Growth

Fidus Investment Corp reports revenues as total investment income and earnings as net investment income.

Results on both the top and bottom lines have been strong, helping to support a sustainable dividend policy.

In 2023, the BDC reported total investment income of $130.1 million, up 38.3% from $94.1 million in 2022 and $90.4 million in 2021. (Source: “Form-10K,” Fidus Investment Corp, December 30, 2024.)

In the third quarter, Fidus Investment delivered total investment income of $38.4 million, up from $34.2 million in the year-ago third quarter. The results support higher results for 2024.

Analysts estimate that the BDC will drive total investment income growth of 11.7% to $145.4 million in 2024, followed by $147.1 million in 2025. (Source: “Fidus Investment Corporation (FDUS), ” Yahoo! Finance, last accessed December 30, 2024.)

Fidus Investment has also been consistently profitable, with net investment income surging 40% to $65.1 million in 2023 versus $46.5 million in 2022, and159.4% above the $25.1 million in 2021. (Source: Fidus Investment Corp, op. cit.)

The company’s third-quarter 2024 net investment income was $0.64 per share versus $0.63 per share in the third quarter of 2023.

The adjusted net investment income came in at $0.61 per share, down from $0.68 per share a year earlier but $0.04 above the consensus estimate. This was the BDC’s third beat over the past four quarters.

Fidus Investment is on pace to meet the analyst consensus of $2.27 per share in 2024 and $2.11 per share in 2025. (Source: Yahoo! Finance, op. cit.)

The BDC’s balance sheet is manageable, with $471.4 million in total debt and $54.4 million in cash. Fidus’ total debt to equity ratio of 71.6% is manageable given the strong results and working capital. (Source: Yahoo! Finance, op. cit.)

Dividend Falls in 2024, But Yield Remains High

Fidus Investment pays two dividends each quarter, with a smaller supplemental dividend followed by a regular dividend. Fidus stock’s dividends have moved up and down over time based on the results, which is not unusual in this type of business.

The BDC paid dividends of $2.43 per share in 2024, compared to $2.88 per share in 2023. This is not a concern, as I expect some inconsistencies given the business.

Fidus stock’s fourth-quarter combined dividend was $0.61 per share, comprised of a regular dividend of $0.43 per share and a supplemental dividend of $0.18 per share.

The current dividend equates to $0.61 for the quarter, representing a forward yield of 11.63%. I expect Fidus stock’s dividend to hold around this amount or to dip slightly lower in 2025.

The Lowdown on Fidus Stock

Fidus Investment is well-managed as reflected by the return on equity of 14.43%.

While the total dividend fell in 2024, I’m not concerned; I expect some volatility given the nature of the business.

If interest rates continue to decline in 2025 and 2026 and businesses decide to invest, Fidus Investment could deliver better results, higher dividends, and a rally in Fidus stock.