Euronav Stock: Shares of This 41.4%-Yielder at Record Levels

Euronav Transformation in Full Swing

It’s time to talk about Euronav stock again.

I’ve given you a look at Euronav NV (NYSE:CMBT) before, but that was back in 2021. Suffice it to say, a lot has happened to the company since then.

Back then, it was known as a midstream shipping company that was engaged in the shipping and storage of crude oil worldwide. It also offered floating, storage, and offloading (FSO) services.

Fast forward to today and Euronav is a totally transformed company. It’s still a leading midstream oil and gas company, but it looks entirely different. Over the last couple of years Euronav has taken strides to diversify, decarbonise, and accelerate the optimization of its current crude oil tanker fleet.

In December 2023, Euronav entered an agreement to purchase 100% of the shares in CMB NV’s green ships and green technology arm, CMB.TECH, for $1.15 billion. CMB.TECH is a cleantech maritime group that builds, owns, operates, and designs large marine and industrial applications that run on dual-fuel diesel-hydrogen and diesel-ammonia engines and monofuel hydrogen engines. (Source: “Euronav to acquire CMB.TECH as part of its new strategy,” CMB, December 22, 2023.)

Through the acquisition of CMB.TECH, Euronav created a group with around 160 ships in dry bulk, container shipping, chemical tankers, offshore wind, and oil tankers.

According to the company, a key trend in the shipping industry is providing low-emission ships, and Euronav is looking to play a leading role in the decarbonization of shipping and as the go-to destination for green ships.

By divesting less-efficient, older tankers and reinvesting the proceeds in newbuilds and modern secondhand vessels, or technical upgrades, CMB will optimize Euronav’s large, remaining fleet.

Euronav is now the main entity within the CMB Group. The name of the main company has changed to CMB.TECH, but Euronav will continue to be the oil shipping company within the CMB.Tech group.

Investors agreed to change the company’s name and switch the ticker symbol on the NYSE from “EURN” to “CMBT.” That change was effective July 15. The actual name change of the company takes effect in October.

Strong Second-Quarter Results

For the second quarter ended June 30, 2024, Euronav announced that second-quarter net income increased 14% year over year to $184.3 million, or $0.95 per share. This far exceeded Wall Street’s calls for earnings of $0.33 per share. Year-to-date net profits doubled to $679.6 million, or $3.43 per share. (Source: “Euronav Announces Q2 2024 Results Transformation In Full Swing,” Euronav NV, August 8, 2024.)

The company reported second-quarter revenue of $252.0 million, topping analyst forecasts of $196.4 million.

During the quarter, Euronav took delivery of seven newbuilding vessels and signed contracts for three offshore wind vessels and four new tugboats to strengthen its portfolio of hydrogen-powered ships.

The company also completed the sale of Euronav’s ship management arm, Euronav Ship Management Hellas, to Anglo Eastern, as well as the sale of two ships. Alsace (built in 2012) was sold for a gain of $27.5 million and CMA CGM (2024) was sold for a gain of $15.6 million. Euronav also completed the sale of three VLCCs.

Commenting on the results, Alexander Saverys, the company’s chief executive officer, said, “The transformation of Euronav to CMB.TECH is in full swing: we have completed the sale of older tankers, we have added accretive time charters to our portfolio, we have taken delivery of 7 futureproof newbuildings, and contracts were signed for 3 offshore wind vessels and 4 new tugboats…”

“During these very busy times, we have realised another strong result in Q2 bringing our YTD net profit to 679.6 million USD. It’s full steam ahead at CMB.TECH to decarbonise today, navigate tomorrow!”

Second-Quarter Dividend of $4.57 Declared

Euronav makes a lot of money. In 2023, it generated free cash flow (FCF) of $461.35 million. It uses that FCF to support its dividend and pay down debt. In the second quarter of 2024, Euronav stock paid out $4.57 per share. (Source: “History of return to shareholders,” Euronav NV, last accessed August 12, 2024.)

In July, the company announced an intermediary dividend of $1.15 per share, or $7.02 per share on an annual basis, for a current forward yield of 41.42%.

Euronav stock also provides value to shareholders through share buybacks. In April, the company purchased 256,333 shares on the NYSE at an average price of $16.66 per share, for a total cost of $4.27 million. It also acquired 7,438 shares on the Euronext Brussels Exchange for an average price of €15.45 for a total cost of €114,988. (Source: “Share Buyback,” Euronav NV, April 15, 2024.)

Including these two transactions, Euronav has repurchased 24,807,878 shares, or 11.73% of the total outstanding share count.

Euronav Stock at Record Levels

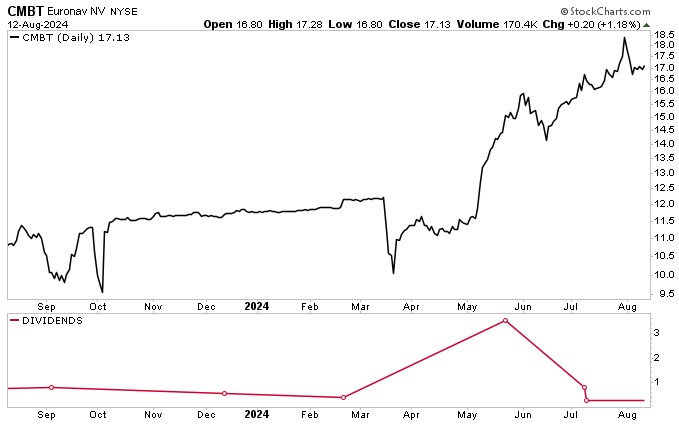

Euronav stock has been on a tear over the last year, hitting a new record intraday high of $18.43 on July 31, 2024. CMBT stock has given up some of that ground to profit-taking and knee-jerk investors running for the exits earlier in the month, when the broader markets melted down for a couple of days.

Still, Euronav stock continues to trounce the broader market, trading up:

- 28% over the last three months

- 45.5% year to date

- 58.0% year over year

Chart courtesy of StockCharts.com

The Lowdown on Euronav Stock

Euronav is a midstream energy stock that is going through a massive transformation, one that is expected to turn it into the de facto name in the decarbonization of shipping and go-to destination for green ships.

It recently reported strong second-quarter financial results, paid a $4.57-per-share dividend in the second quarter, declared a $1.15-per-share intermediary dividend in July, has a current backlog of $2.1 billion, has taken delivery of seven newbuilding vessels, completed the sale of older tankers, added accretive time charters, and signed contracts for three offshore wind vessels.

The company’s new name doesn’t officially kick in until October, but with its new direction, it’s already making waves. And Euronav stock shareholders have been able to sit back and enjoy the massive 41% dividend and shares trading at record levels.