EPD Stock: High-Yielding Dividend Aristocrat Hits Record High

Enterprise Products Increases Quarterly Distribution Again

Investors love energy stocks, because they can provide big dividends. Unfortunately, these stocks can also be volatile, rising and falling on the price of crude, where we are in the economic cycle, and geopolitical tensions. However, one energy pick might be bucking this trend: EPD stock.

Enterprise Products Partners LP (NYSE:EPD) is an energy play that has been rewarding buy-and-hold investors with excellent long-term capital appreciation and a reliably growing dividend.

Not only has Enterprise Products Partners raised its annual distribution for the last 27 years, making it a dividend aristocrat, but EPD stock is thumping the broader market, having just hit a new record high.

Enterprise Products Partners might sound like a generic multi-level marketing company, but it’s actually a midstream oil and gas company that is responsible for moving natural gas, natural gas liquids (NGLs), crude oil, and petrochemical & refined products.

And it gets paid whether drillers are making money or not. That’s because Enterprise Products Partners earns a fee for each barrel that gets shipped. (Source: “Investor Deck, May 2024,” Enterprise Products Partners LP, last accessed August 7, 2024.)

And the company has a lot of pipelines: 50,000+ miles of natural gas, NGLs, crude oil, refined products, and petrochemical pipelines. (Source: “Operations,” Enterprise Products Partners LP, last accessed August 8, 2024.)

Enterprise Products’ combined operations also include:

- 260+ million barrels of NGL, refined products, and crude oil storage capacity

- 300+ millions of barrels (MMBbls) of liquid storage capacity

- 5 new gas plants in 2024–2026 that will increase processing by 1.5 billion cubic feet per day (Bcf/d)

- 20 deepwater docks handling NGLs, petrochemicals, crude oil, and refined products

Another Strong Quarter

For the second quarter ended June 30, 2024, Enterprise announced that net income increased 12% year over year to $1.4 billion, or $0.64 per unit. Distributable cash flow (DCF) was $1.8 billion, compared to $1.7 billion in the same period last year. (Source: “Enterprise Reports Results for Second Quarter 2024,” Enterprise Products Partners LP, July 30, 2024.)

Adjusted cash flow from operations (CFFO) was $2.1 billion, compared to $1.9 billion for the second quarter of 2023. Adjusted CFFO was $8.4 billion for the 12 months ended June 30, 2024. Enterprise’s payout ratio, which is made up of distributions to common unitholders and partnership common unit buybacks, for the 12 months ended June 30, 2024, was 55% of adjusted CFFO.

During the second quarter, the partnership repurchased $40.0 million worth of its common units. Including these purchases, Enterprise has repurchased 50% of is $2.0-billion common unit buyback program.

The company didn’t provide any guidance, but Wall Street analysts expect Enterprise Products’ earnings to grow from $2.52 per share in 2023 to $2.72 per share in 2024, rising to $2.86 per share in 2025. (Source: “Enterprise Products Partners L.P. (EPD),” Yahoo! Finance, last accessed August 7, 2024.)

Quarterly Payout Hiked to $0.525 Per Unit

Thanks to its reliable, strong free cash flow (FCF)—$4.3 billion in 2023 and $6.0 billion in 2022—Enterprise has been able to provide shareholders with a growing annual distribution and buybacks. In 2023, it repurchased $918.0 million worth of its common stock.

EPD stock is also a dividend aristocrat that has raised its annual dividend for 27 consecutive years.

Sometimes, Enterprise raises its payout more than once a year, too. In July, the company declared a quarterly cash distribution of $0.525 per unit, or $2.10 on an annual basis, for a current yield of 7.26%. (Source: “Distribution & DRIP,” Enterprise Products Partners LP, last accessed August 7, 2024.)

The $0.525 quarterly payout also represents a five-percent increase over the $0.50 paid out in the third quarter of 2023. This also marks the second time that Enterprise has increased its distribution in 2024.

That dividend payout is safe, too. The payout ratio is 77.4%. There’s every reason to believe that Enterprise will keep its status as a dividend aristocrat alive in 2025 and beyond.

In fact, Enterprise Products is the only company with an “A” rating and a dividend yield in excess of seven percent.

EPD Stock Thumping Broader Market

Dividend hogs can’t help but be pleased with Enterprise’s 27-year track record of raising its annual dividend. They must be pleased with the partnership’s incredible long-term capital appreciation, too.

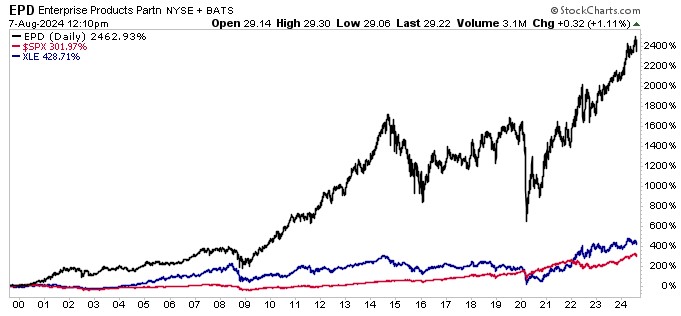

Over the last 25 years, with dividends reinvested, EPD stock has returned profits of 2,463%.

That’s with dividends reinvested. Had you opted to take those quarterly payouts in cash, EPD stock’s total return over the last 25 years slips to 544%.

Over the same time frame, the S&P 500 has returned profits of 302%, while Energy Select Sector SPDR Fund (NYSEARCA:XLE) has returned profits of roughly 430%.

The stock’s near-term gains have been impressive, too. On July 30, Enterprise Products stock hit a new record intraday high of $29.86. It continues to trade near those records and is, as of this writing, up 17% year to date and 18.7% year over year.

The outlook for EPD stock remains robust, too, with Wall Street analysts providing a 12-month share price target range of $33.08 to $37.00 per share. This points to potential upside of roughly 13.5% to 27%.

Chart courtesy of StockCharts.com

The Lowdown on EPD Stock

What’s not to like about Enterprise Products Partners LP?

The company continues to generate excellent financial results, expand its operations, and make strategic acquisitions.

Thanks to its diversified, fee-based structure, Enterprise is able to report consistently strong financial results, which helps support its growing annual dividend and juice the EPD stock price.