Enterprise Products Stock Joins Dividend Aristocrats Club

7.5%-Yield EPD Stock Rewards Shareholders

The dividend aristocrat club is exclusive; only the top dividend stocks can become members. Only companies that have raised their dividends for at least 25 consecutive years—and belong to the S&P 500—qualify as dividend aristocrats.

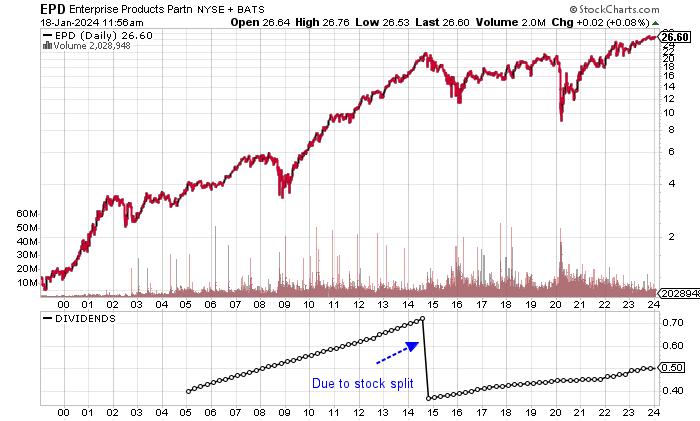

Enterprise Products Partners LP (NYSE:EPD) became a dividend aristocrat in 2023 after raising its dividends for the 25th straight year.

The company is one of the top providers of midstream energy services in North America. It distributes natural gas, natural gas liquids (NGLs), crude oil, refined products, and petrochemicals. (Source: “Investor Resources,” Enterprise Products Partners LP, last accessed January 18, 2024.)

For income investors, Enterprise Products stock is an ideal long-term play that’s geared toward returning capital to shareholders.

EPD stock has been paying quarterly dividends of $0.50 per share, representing a forward yield of 7.54% (as of this writing). (Source: “Distribution Payments,” Enterprise Products Partners LP, last accessed January 18, 2024.)

For growth investors, Enterprise Products stock has low volatility, with its shares trading between $24.66 and $27.95 over the past 52 weeks (as of this writing). The stock currently sits just below its 52-week high of $27.95, which it achieved on October 17, 2023.

EPD stock has tons of potential for price appreciation; it traded as high as $30.87 in July 2019 and as high as $41.38 in September 2014.

Chart courtesy of StockCharts.com

Enterprise Products Partners LP Has Strong Fundamentals

Enterprise Products’ revenues more than doubled from 2020 to a record-high $58.19 billion in 2022.

Currently trading around one times the company’s 2022 revenues, Enterprise Products stock is ideal for conservative income investors.

Analysts estimate that Enterprise Products Partners LP will report lower revenues of $47.96 billion for 2023 but will rebound with $49.60 billion in revenues in 2024. Its revenues will largely depend on the state of the economy and whether there’s going to be a slowdown. (Source: Yahoo! Finance, op. cit.)

| Fiscal Year | Revenues (Billions) | Growth |

| 2020 | $27.20 | N/A |

| 2021 | $40.81 | 50.0% |

| 2022 | $58.19 | 42.6% |

(Source: “Enterprise Products Partners L.P. (EPD),” Yahoo! Finance, last accessed January 18, 2024.)

The company’s bottom line shows two straight years of growth in terms of generally accepted accounting principles (GAAP)-diluted earnings per share (EPS).

Analysts expect Enterprise Products Partners LP to report earnings of $2.50 per diluted share for 2023, which would be good, considering the company’s estimated revenue decline. The company is expected to come back with $2.65 per diluted share in 2024. (Source: Ibid.)

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2020 | $1.71 | N/A |

| 2021 | $2.11 | 22.4% |

| 2022 | $2.50 | 18.5% |

(Source: Ibid.)

Enterprise Products Partners LP is a free cash flow (FCF) machine. It generated more than $6.0 billion annually in 2021 and 2022.

The company’s high FCF allowed it to pay $4.1 billion in common dividends and buy back $250.0 million worth of its own common shares in 2022.

| Fiscal Year | FCF (Billions) | Growth |

| 2020 | $2.60 | N/A |

| 2021 | $6.29 | 141.9% |

| 2022 | $6.08 | -3.3% |

(Source: Ibid.)

Enterprise Products Partners LP should have no problem being able to continue returning capital to its shareholders.

The partnership’s balance sheet is healthy, despite $29.3 billion in debt at the end of September 2023. The company’s high profits and FCF can enable it to easily deal with the debt obligations. (Source: Yahoo! Finance, op. cit.)

Enterprise Products has easily covered its interest expense via higher earnings before interest and taxes (EBIT) from 2020 through 2022. The company’s interest coverage ratio in 2022 was a healthy 5.6x.

| Fiscal Year | EBIT (Billions) | Interest Expense (Billions) |

| 2020 | $5.05 | $1.29 |

| 2021 | $6.10 | $1.28 |

| 2022 | $6.94 | $1.24 |

(Source: Ibid.)

Enterprise Products Partners LP’s Piotroski score—which is an indicator of a company’s balance sheet, profitability, and operational efficiency—is a strong reading of 8.0, which is just below a perfect Piotroski score of 9.0.

No Concerns Regarding Dividend Safety

I expect Enterprise Products Partners LP to continue paying dividends and extend its dividend growth streak.

EPD stock’s forward yield of 7.54% is just below its five-year average dividend yield of 7.74%.

Enterprise Products’ payout ratio of 79.5% might seem high, but it’s manageable, given the company’s business performance, consistent profitability, and high FCF. (Source: Yahoo! Finance, op. cit.)

| Metric | Value |

| Dividend Growth Streak | 25 Years |

| Dividend Streak | 27 Years |

| 7-Year Dividend Compound Annual Growth Rate | 3.3% |

| 10-Year Average Dividend Yield | 9.2% |

| Dividend Coverage Ratio | 1.9x |

The Lowdown on Enterprise Products Partners LP

In my view, Enterprise Products stock is one of the top midstream energy dividend stocks for investors who are looking for steady income and growth.

Moreover, consider that 32.7% of Enterprise Products Partners LP’s outstanding shares are held by company insiders, which makes the executives more inclined to make sure things run smoothly.

EPD stock’s low volatility and steady dividends are ideal for conservative income investors.