Enterprise Products Stock: 7%-Yield Dividend Aristocrat Has 20% Upside

Why EPD Stock Is Worth Considering

If you’re an income investor looking for a long-term energy play that provides big share-price gains and reliably growing, high-yield distributions, it would be tough to find a better play right now than Enterprise Products Partners LP (NYSE:EPD).

Not only has the company raised its dividends for the last 26 years, making it a dividend aristocrat, but it has reported excellent financial results. Moreover, Enterprise Products’ stock price has been on fire lately.

And thanks to the constant demand for midstream oil and natural gas services, the outlook for Enterprise Products Partners LP is solid for years to come. Despite massive levels of investment in the alternative energy sector, even the most bearish energy analysts don’t think the green transition will be rolled out as quickly as initially thought.

Just three percent of the global energy supply comes from wind and solar, while electric vehicle (EV) use stands at around three percent. Meanwhile, hydrocarbons account for about 80% of the world’s energy supply. That’s down by just three percent over the last 25 years. (Source: “Is It Time To Abandon the Idea of Phasing Out Oil and Gas?,” OilPrice.com, March 30, 2024.)

The demand for coal is expected to decline, mostly to be replaced by demand for natural gas, which will need to be transported by pipelines.

That’s good news for EPD stockholders.

As a midstream energy company, Enterprise Products is responsible for moving natural gas, natural gas liquids (NGL), crude oil, petrochemicals, and refined products. It has more than 50,000 miles of natural gas, NGL, crude oil, refined product, and petrochemical pipelines. (Source: “Investor Deck: February 2024,” Enterprise Products Partners LP, last accessed April 2, 2024.)

Enterprise Products’ combined operations also include:

- More than 300 million barrels (MMBbl) of liquid storage capacity

- 29 natural gas processing plants

- 26 fractionators

- Four new gas plants in 2024–2025 that are scheduled to increase processing by 1.2 billion cubic feet per day (Bcf/d)

- 20 deepwater docks that handle NGL, petrochemicals, crude oil, and refined products

- An ethylene export terminal with export capacity of more than 2.2 billion pounds per year

(Sources: Ibid. and “Operations,” Enterprise Products Partners LP, last accessed April 2, 2024.)

The company gets paid whether drillers are making money or not. That’s because the partnership earns a fee for each barrel that gets shipped through its system.

Suffice it to say, Enterprise Products Partners LP has a wide-moat business. Even if you wanted to cut into its business, chances are you couldn’t do it. The costs to lay rival pipelines, processing plants, deepwater docks, and export terminals start in the billions of dollars.

Record-Best Financial Results in 2022 & 2023

Following record-best financial results in 2022, Enterprise Products Partners LP finished 2023 with strong fourth-quarter results. Those quarterly results included record-high net income; total gross operating margin; adjusted earnings before interest, tax, depreciation and amortization (EBITDA); cash flow; and equivalent pipeline volumes.

In the fourth quarter of 2023, Enterprise Products’ operating income went up by 8.8% year-over-year to $1.9 billion, while its net income climbed by 10.3% year-over-year to $1.6 billion, or $0.72 per share. (Source: “Enterprise Reports Results for Fourth Quarter 2023,” Enterprise Products Partners LP, February 1, 2024.)

The partnership’s distributable cash flow (DCF) inched up in the fourth quarter to $2.1 billion. Its fourth-quarter DCF provided 1.8 times coverage of its February 2024 distribution. The company retained $932.0 million of DCF in the fourth quarter.

Enterprise Products Partners LP’s adjusted cash flow provided by operating activities (CFFO) was $2.2 billion in the fourth quarter of 2023, compared to $2.1 billion in the fourth quarter of 2022. Its adjusted FCF in the fourth quarter of 2023 was $1.2 billion, compared to $1.4 billion in the same quarter of 2022.

During the quarter, the company handled record-high equivalent pipeline volumes of 12.7 million barrels per day.

The partnership’s full-year 2023 operating income was up by less than one percent, at $6.9 billion, while its full-year net income was mostly flat at $5.65 billion, or $2.52 per share.

Enterprise Products’ full-year DCF was down slightly at $7.6 billion and provided 1.7 times coverage of its distributions declared in 2023. The company retained $3.2 billion of DCF in 2023, which it can use to reinvest in its business, repurchase its own common units, and reduce its debt.

Enterprise Products Partners LP’s full-year adjusted CFFO was $8.1 billion in both 2022 and 2023. Its adjusted FCF was $4.8 billion in 2023, up from $3.0 billion in 2022.

In 2023, Enterprise Products completed the construction of $3.5 billion worth of capital growth projects.

Enterprise Products Partners LP Hiked Payout for 26th Consecutive Year

Thanks to its reliable, high free cash flow (FCF)—$3.0 billion in 2022 and $4.3 billion in 2023—Enterprise Products has been able to reward its shareholders with growing distributions and share buybacks.

In 2023, the company repurchased $918.0 million worth of its own common stock. (Source: “Investor Deck: February 2024,” Enterprise Products Partners LP, op. cit.)

In January 2024, the partnership increased its quarterly cash distribution by 5.1% year-over-year and three percent quarter-over-quarter to $0.515 per unit, for a yield of 6.83% (as of this writing). (Source: “Distribution Payments,” Enterprise Products Partners LP, last accessed April 2, 2024.)

The company’s dividend is safe, too; its payout ratio is 78.5%. Furthermore, as an FCF machine, Enterprise Products could raise its distribution again in 2024.

Enterprise Products Stock Price Crushing the S&P 500

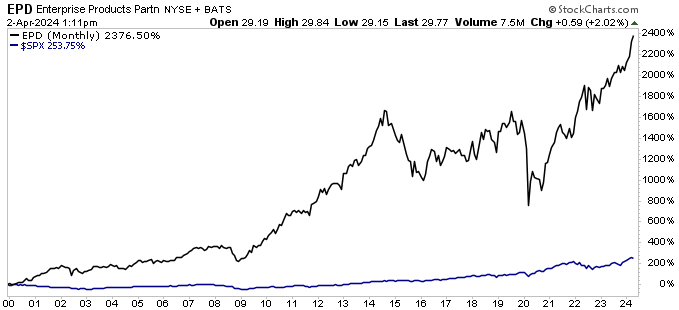

On top of its dividends and share buybacks, Enterprise Products Partners LP has a rising, market-thumping share price. Since the start of 2000, with dividends reinvested, EPD stock has provided total returns of 2,376%. Over the same time frame, the S&P 500 has provided returns of just 253%.

Reinvesting the dividends makes a big difference. Had an investor not reinvested Enterprise Products stock’s dividends and simply pocketed the cash, the stock would have provided returns of 546%.

As of this writing, shares of Enterprise Products Partners LP are up by:

- 8.5% over the last month

- 13% year-to-date

- 9.5% over the last six months

- 15% year over year

Those are big moves, and Wall Street analysts think EPD stock has plenty more room to run. They’ve provided a 12-month share-price target of $36.00, which points to potential gains of approximately 21%.

Chart courtesy of StockCharts.com

The Lowdown on Enterprise Products Partners LP

Right now, you need to look for a reason not to like Enterprise Products stock. The company continues to generate excellent financial results, organically expand its operations, and make strategic acquisitions.

Despite significantly lower commodity prices and natural gas processing margins, Enterprise Products Partners LP’s diverse, fee-based structure has helped it report terrific financial results, including record-best results in 2022 and 2023.

As mentioned earlier, the partnership increased its cash distribution in February 2024 by 5.1% year-over-year, with its fourth-quarter 2023 DCF providing 1.8 times coverage of that distribution.

In 2023, Enterprise Products Partners LP completed $3.5 billion worth of capital growth projects. It began 2024 with $6.8 billion worth of major organic growth projects under construction. Of that, $1.1 billion is for the Texas Western Products System and two natural gas processing plants in the Permian Basin, which are scheduled to be completed this year.

These projects provide visibility to new sources of cash flow for 2024 and beyond.