8.2%-Yield Energy Transfer LP Stock Up 11% in 2024

Why ET Stock Is Worth Considering

Oil is currently trading around $80.00 per barrel after breaking above $100.0 on several occasions since 2010.

While the fear of a death to the oil trade surfaced with the election of Joe Biden as president, that hasn’t materialized, and I believe the fears were overblown. Green energy will grow in importance, but my view is that oil and natural gas will remain relevant for decades.

It will take time for the world to convert to green energy, so in the meantime, it makes sense for investors to hold some dividend-paying energy stocks.

For instance, there’s Energy Transfer LP (NYSE:ET), which has a market cap of $51.7 billion. I like Energy Transfer LP stock, given that the company’s business is less dependent on volatile oil prices than it is on the state of the overall economy.

The company is involved in the midstream segment of the oil and gas industry. Its services comprise processing, storing, transporting, and marketing crude oil, natural gas liquids (NGL), and refined products. The partnership has about 125,000 miles of pipelines and exports liquefied petroleum gas (LPG) to more than 40 countries. (Source: “Investor Presentation: May 2024,” Energy Transfer LP, last accessed June 13, 2024.)

For income investors, the company has paid dividends for 19 consecutive years and has increased its dividends for the last two years.

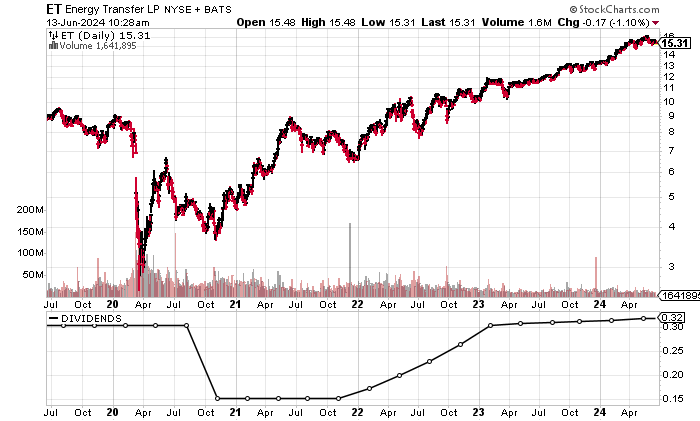

With ET stock, investors not only get nice, steady dividends, but they get the possibility of share-price appreciation. As of June 13, the stock advanced 11.0% this year, just below the advance of the S&P 500 over the same period.

Chart courtesy of StockCharts.

Energy Transfer LP’s Revenues & Profits Set to Grow

The COVID-19 pandemic jolted the operations of Energy Transfer as economic activity plummeted and drove down the global demand for energy.

The partnership’s revenues fell by 28.2% in 2020 prior to rebounding by 73.1% in 2021, rising to a record-high level in 2022, and contracting in 2023. (Source: “Energy Transfer LP,” MarketWatch, last accessed June 13, 2024.)

Its revenues are expected to rise over the next two years. Analysts estimate that Energy Transfer will grow its revenues by an impressive 14.4% to $89.9 billion in 2024 and by 3.6% to $93.2 billion in 2025. (Source: “Energy Transfer LP (ET),” Yahoo! Finance, last accessed June 13, 2024.)

Clearly, the actual results will be largely dependent on the global economy.

| Fiscal Year | Revenues (Billions) | Growth |

| 2019 | $54.21 | N/A |

| 2020 | $38.95 | -28.1% |

| 2021 | $67.42 | 73.1% |

| 2022 | $89.88 | 33.3% |

| 2023 | $78.59 | -12.6% |

(Source: MarketWatch, op. cit.)

Energy Transfer LP’s gross margins declined in 2021 and 2022 prior to expanding in 2023. Going forward, lower financing costs will help its margins.

| Fiscal Year | Gross Margin |

| 2019 | 20.5% |

| 2020 | 26.3% |

| 2021 | 19.9% |

| 2022 | 14.9% |

| 2023 | 17.6% |

Moving to the bottom line, Energy Transfer LP has largely been profitable in terms of generally accepted accounting principles (GAAP)-diluted earnings-per-share (EPS), with the exception of a loss in 2020, which was during the pandemic.

Analysts expect the company to report much higher earnings of $1.45 per diluted share in 2024 and $1.62 per diluted share in 2025. (Source: Yahoo! Finance, op. cit.)

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2019 | $1.33 | N/A |

| 2020 | -$0.24 | -118.0% |

| 2021 | $1.89 | 887.3% |

| 2022 | $1.40 | -26.1% |

| 2023 | $1.09 | -21.9% |

(Source: MarketWatch, op. cit.)

Energy Transfer LP has also been a free cash flow (FCF) machine, which supports the company’s capital expenditures and steady dividends.

| Fiscal Year | FCF (Billions) | Growth |

| 2019 | $2.19 | N/A |

| 2020 | $2.42 | 10.2% |

| 2021 | $8.51 | 251.8% |

| 2022 | $5.73 | -32.6% |

| 2023 | $6.48 | 13.1% |

(Source: MarketWatch, op. cit.)

Energy Transfer LP’s balance sheet showed $54.2 billion in total debt and $1.95 billion in cash at the end of March. (Source: Yahoo! Finance, op. cit.)

On the surface, the debt burden seems high, but high debt isn’t unusual in a high-capital-expenditure industry.

Moreover, the company has consistently covered its interest payments via higher earnings before interest and taxes (EBIT), especially over the last three years. In 2023, Energy Transfer LP’s interest coverage ratio was manageable at 3.2 times.

This suggests the company has no financial problems at this time.

| Fiscal Year | EBIT (Billions) | Interest Expense (Billions) |

| 2020 | $2.7 | $2.33 |

| 2021 | $9.14 | $2.27 |

| 2022 | $8.38 | $2.31 |

| 2023 | $8.18 | $2.58 |

(Source: Yahoo! Finance, op. cit.)

Energy Transfer LP’s Piotroski score—an indicator of a company’s balance sheet, profitability, and operational efficiency—is a reasonable 5.0, which is just above the midpoint of the Piotroski score’s range of 1.0 to 9.0.

Earnings Should Drive Energy Transfer LP Stock’s Dividend Growth

ET stock’s forward dividend yield of 8.2% (as of this writing) is below its five-year average dividend yield of 10.05%.

This suggests there’s some room for dividend growth, given the company’s higher expected profitability, which could lead to FCF growth.

| Metric | Value |

| Dividend Growth Streak | 2 Years |

| Dividend Streak | 19 Years |

| 7-Year Dividend Compound Annual Growth Rate | 1.3% |

| 10-Year Average Dividend Yield | 13.2% |

| Dividend Coverage Ratio | 2.3 |

The Lowdown on Energy Transfer LP

Energy Transfer LP stock is an ideal midstream oil and gas play with above-average share-price appreciation potential and a healthy dividend yield over past decade.

For that reason, EY stock is worth keeping an eye on.