Ellington Financial Stock: 12%-Yielder Hits New Record High

Ellington Financial Pays Reliable Monthly Dividend

Today’s spotlight is on Ellington Financial stock.

Mortgage real estate investment trusts (mREITs) are a sensitive gauge of interest rates. When interest rates are low, mREITs flourish. But they can struggle when interest rates are high, with borrowing costs and vacancies undercutting profit margins. So, with interest rates set to start coming down, the outlook for mREITs is picking up.

Not that all mREITs have taken a hit in this high-interest-rate environment. There’s one mREIT that has done particularly well regardless: Ellington Financial Inc (NYSE:EFC).

Ellington Financial is an mREIT that invests in financial assets, such as residential and commercial mortgage loans, residential and commercial mortgage-backed securities, consumer loans, and asset-backed securities backed by consumer loans, home equity lines, lien loans, and other strategic investments. (Source: “Q2 2024 Investor Presentation,” Ellington Financial Inc, August 6, 2024.)

At 46%, the company’s $2.73-billion portfolio is mostly made up of residential transition loans and other mortgage loans. This is followed by non-qualified mortgage loans and retained non-qualified mortgage residential mortgage-backed securities at 16%.

Back in late 2023, the company announced that it had closed on its previously announced merger with Arlington Asset Investment Corp. (Source: “Ellington Financial Completes Merger With Arlington Asset Investment Corp.,” Ellington Financial Inc, December 14, 2023.)

The acquisition significantly increased Ellington Financials’ market capitalization to above $1.0 billion, with attractive long-term unsecure debt and preferred equity capital. The merger is also expected to drive accretive earnings growth, provide more efficient access to capital markets, and enhance long-term growth potential.

Strong Second-Quarter Results

For the second quarter ended June 30, 2024, Ellington Financial reported net income of $52.3 million, or $0.62 per share, up 94% from $26.9 million, or $0.32 per share, in the first quarter of 2024. This resulted in year-to-date earnings of $79.2 million, or $0.94 per share. (Source: “Ellington Financial Inc. Reports Second Quarter 2024 Results,” Ellington Financial Inc, August 6, 2024.)

Adjusted distributable earnings were $28.3 million, or $0.33 per share. That’s up 18% from first-quarter adjusted earnings of $0.28 per share.

The company ended the second quarter with a book value per common share of $13.92, which includes the effects of the second-quarter dividend of $0.39 per share. The closing price for Ellington Financial stock on June 30 was $11.96 per share.

Commenting on the results, Laurence Penn, the company’s chief executive officer and president, said, “Driven by broad-based contributions from our diversified credit and Agency portfolios, as well as from our reverse mortgage platform Longbridge, Ellington Financial generated a non-annualized economic return of 4.5% for the second quarter, and grew adjusted distributable earnings and book value per share sequentially.”

Declares Monthly Dividend of $0.13 Per Share

As noted above, Ellington Financial stock paid out $0.39 per share in the second quarter, or $0.13 per share on a monthly basis. The company has maintained that payout level in the third quarter, paying out $0.13 per share in both July and August. This works out to an annual distribution of $1.56 per share for an annual forward dividend yield of 12.06%.

EFC Stock at Record Levels

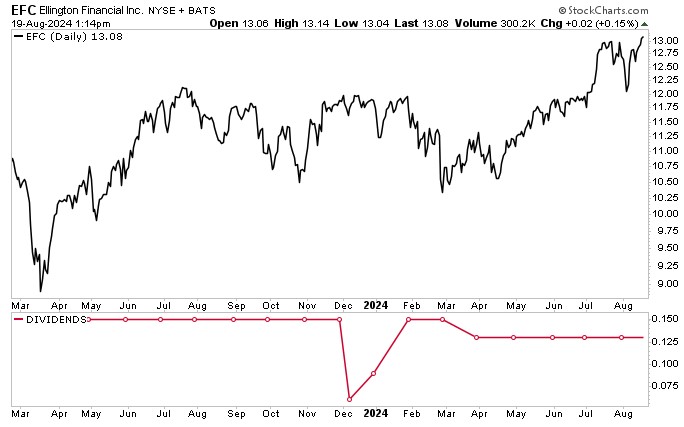

Strong financial results and optimism around lower interest rates are helping juice Ellington Financial stock. On August 20, EFC stock hit an intraday high of $13.20 per share, topping its June 2021 record high of $13.17 a share.

As of this writing, Ellington Financial stock is up:

- 17% over the last six months

- 12% year to date

- 17% year over year

The outlook for Ellington Financial stock remains robust, with Wall Street expecting it to hit fresh highs over the coming quarters. Analysts have provided a 12-month share price range of $13.25 to $15.00, which points to potential gains of up to 14.5%.

Chart courtesy of StockCharts.com

The Lowdown on Ellington Financial Stock

Ellington Financial Inc is an mREIT with a diversified portfolio of financial assets. It reported strong second-quarter results, added new investments in a wide array of credit strategies, and continued to add securities in lower-yielding sectors, including agency and non-agency residential mortgage-backed securities.

Looking forward, the company’s investment pipeline remains strong. Loan originators are not only helping to feed that pipeline, but they’re also showing strong profitability. All of which, management believes, positions the company for continued portfolio and earnings growth over the rest of the calendar year.