10.5%-Yielding Dorian LPG Stock at Record-High Price Level in 2023

Why LPG Stock Is Poised to Reward Investors

All eyes are on crude oil, and for good reason: it’s been bullish in the second half of this year.

But investors shouldn’t forget about natural gas and liquefied petroleum gas—or the midstream companies that help get those products to market.

One liquefied petroleum gas shipping company worth paying attention to is Dorian LPG Ltd (NYSE:LPG). Its stock crushed the market in 2022, and it has maintained those winning ways in 2023.

Dorian LPG is a leading owner and operator of 25 modern very large gas carriers (VLGCs). These vessels are capable of carrying up to 2.0 million barrels of oil. The company’s fleet has an average age of eight years, which is well below the global fleet’s average age of 10.3 years. (Source: “Investor Presentation: November 2023,” Dorian LPG Ltd, last accessed November 13, 2023.)

Moreover, Dorian LPG Ltd—along with MOL Energia Pte. Ltd.—is the co-owner and co-manager of the Helios LPG Pool, which operates 27 vessels.

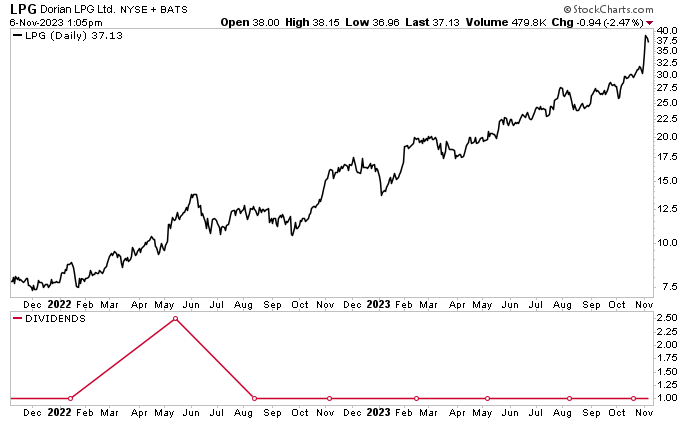

I’m quite fond of Dorian LPG stock, which I’ve been following for almost two years. In 2022, the stock ripped 108% higher. As of this writing, LPG stock is up by 186% since I wrote about it in February 2022 and up by 103% since I wrote about it in January 2023. It’s also up by 130% year-to-date and 131% year-over-year.

Dorian LPG stock may already be trading at record-high levels, but Wall Street thinks it has more room to run. Analysts have provided a 12-month high share-price target for Dorian LPG Ltd of $43.50, which points to potential gains of 17.5%.

Chart courtesy of StockCharts.com

Why the bullish take?

From a fundamental perspective, the outlook for Dorian LPG Ltd is bright.

Propane and butane prices increased in Northwest Europe and Northeast Asia in the third quarter of this year, compared to the second quarter. (Source: “Dorian LPG Ltd. Announces Second Quarter Fiscal Year 2024 Financial Results,” Dorian LPG Ltd., November 2, 2023.)

The average price of propane in Northwest Europe rose from about $452.00 per metric ton in the second quarter to more than $520.00 per metric ton in the third quarter. The price of propane in Eastern Europe experienced an even bigger increase, climbing from an average of $530.00 per metric ton in the second quarter to $634.00 per metric ton in the third quarter.

Butane prices in Northwest Europe and Northeast Asia followed a similar trend.

The biggest influence on the liquefied petroleum gas trade in the third quarter was the shipping market. The Baltic VLGC index rose from an average of about $95.70 per metric ton in the second quarter to about $121.10 per metric ton in the third quarter.

The volatility of the Baltic VLGC index has reached record-high levels in 2023. Furthermore, the tight VLGC supply and demand balance, strong arbitrage, and logistical constraints have kept freight rates above their five-year highs.

This trend should continue, with the demand for liquefied petroleum gas supported by growth in the Far East and India. (Source: “Investor Presentation: November 2023,” Dorian LPG Ltd, op. cit.)

Dorian LPG should benefit from the growth of trade routes, including from the U.S. Gulf to Japan and from the U.S. to Northwest Europe. In fact, congestion at the Panama Canal has been forcing reroutes to Asia through the Suez Canal and the Cape of Good Hope.

Moreover, a “wave” of new chemical and propane dehydrogenation (PDH) plants are either under construction or planned to be constructed around the world. This should juice the demand for midstream companies like Dorian LPG.

In China alone, seven PDH plants opened in 2022, nine were slated to open by the end of 2023, and a further eight are slated to open in 2024. This will add 13.96 million metric tons of PDH capacity. For 2025 and 2026, there are plans to add five million metric tons of PDH capacity per year.

Q2 Revenues Up 90.5% & Net Income Up 276% Year-Over-Year

For the second quarter of fiscal 2024, ended September 30, 2023, Dorian LPG announced that its revenues increased by 90.5% year-over-year to $144.7 million. (Source: Dorian LPG Ltd., November 2, 2023, op. cit.)

Its net income jumped in the quarter by 276% year-over-year to $76.5 million, or $1.89 per share, while its adjusted net income increased by 336% year-over-year to $75.0 million, or $1.85 per share. The big increase in adjusted net income was a result of high revenue growth, $1.2 million in interest income, and a reduction of $1.7 million in interest and financing costs.

Dorian LPG Ltd’s adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) advanced in the second fiscal quarter by 126% year-over-year to a record-high $104.56 million.

The company’s time charter equivalent (TCE) rate per operating day in the second fiscal quarter was $65,128, a 60.3% increase from $40,632 in the same period of last year. Meanwhile, its vessel operating expenses per day in the quarter were $10,858.

Dorian LPG Ltd. Declared 9th Irregular Dividend

On October 6, Dorian declared a fiscal second-quarter irregular cash dividend of $1.00 per share, for a yield of 10.51%.

On November 2, while announcing the company’s fiscal second-quarter results, John C. Hadjipateras, the company’s chairman, president, and CEO, commented, “Following record adjusted EBITDA in the quarter, we declared our ninth dividend demonstrating our commitment to creating shareholder value, while maintaining sensible leverage levels and flexibility for fleet renewal.” (Source: Ibid.)

LPG stock’s dividend is safe; the company’s payout ratio is just 62.99%, which is well below the 90% threshold I’m willing to stomach.

The Lowdown on Dorian LPG Stock

What’s not to like about Dorian LPG Ltd right now?

It’s a great energy shipping company that’s been firing on all cylinders. It reported excellent fiscal second-quarter results, which included record-high adjusted EBITDA, high revenue growth, and triple-digit earnings and adjusted earnings growth.

LPG stock’s share price is at record-high levels, and the company recently declared its ninth dividend.

Solid fundamentals in the liquefied petroleum gas freight market point to the company continuing its momentum for the foreseeable future. This bodes exceptionally well for Dorian LPG stock’s price and high-yield dividends.