DMLP Stock: 10.5%-Yielder Hits Fresh Record High

Dorchester Minerals Has Paid Dividends Since 1982

Since 2022, West Texas Intermediate (WTI) crude oil has mostly traded in a tight range with a support level near $69.00 per barrel. And that’s close to where it’s trading right now. However, there are a number of factors that could send oil prices higher over the near term.

First, President Donald Trump is looking to cut off Iran’s crude sales, full stop. If successful, this would take 1.3 million barrels of oil per day off the markets. When the Trump administration imposed sanctions on Iran in 2018, the price of crude oil jumped to more than $75.00 per barrel.

President Trump is also expected to impose tariffs on Canadian and Mexican oil imports. If he does, this will invariably send crude oil prices higher. Canada sent 1.42 billion barrels of crude to the U.S. in 2023, which amounts to around four million barrels of oil per day. Or, put another way, the U.S. imports 60% of its crude oil from Canada. (Source: “Trump tariffs on Canadian oil expected to raise U.S. gasoline prices if enacted next month,” CNBC, February 11, 2025.)

And while the U.S. may have more oil than any other country, many of the country’s oil refineries, especially those in the Midwest and Western states, are designed to only accept Canadian oil. It’s not as if you can just flip a switch and go from refining heavy Canadian crude to lighter, less dense crude oil.

Keep in mind that tariffs are a tax that importers pass onto their customers. Tariffs on Canadian crude would lift crude oil prices and fuel prices at the pump; as much as $0.15 to $0.30 per gallon.

President Trump has also hinted that he may impose tougher sanctions on Russia, which is a major exporter of oil to the global markets.

Now, should the U.S. impose strict sanctions on Iran and Russia and tariffs on Canadian energy (oil and electricity), oil prices could respond the same way they did in 2018. And that should be good news for a domestic oil producer like Dorchester Minerals LP (NASDAQ:DMLP), an oil and gas exploration and production (E&P) company.

Dorchester Minerals was formed in January 2003 with the combination of Dorchester Hugoton, Ltd., Republic Royalty Company, L.P., and Spinnaker Royalty Company, L.P.

Dorchester Minerals owns producing and non-producing crude oil and natural gas mineral, royalty, overriding royalty, net profits, and leasehold interests across 28 states. (Source: “Investor Relations,” Dorchester Minerals LP, last accessed March 3, 2025.)

The company also recently closed two previously announced acquisitions of mineral, royalty, and overriding royalty interests. (Source: “Dorchester Minerals, L.P. Announces Two Acquisitions of Mineral, Royalty and Overriding Royalty Interests,” Dorchester Minerals LP, September 30, 2024.)

The partnership’s independent engineering consultant has estimated that its total proved oil and gas reserves consist of 17 million barrels of oil equivalent. Approximately 86% of these reserves is attributable to the Dorchester Minerals’ royalty properties and 14% is attributable to its net profits interest. (Source: “Dorchester Minerals, L.P. Announces 2024 Results,” Dorchester Minerals LP, February 20, 2025.)

Oil and natural gas liquids accounted for 65% of proved reserves as of December 31, 2024, all of which were classified as “proved developed producing.”

Solid Third-Quarter Results

Coming out of the 2020 health crisis, Dorchester delivered strong revenue growth of 93.4% in 2021 and 82.8% in 2023, before retracing a modest 4.1% in 2023. Lower energy prices in 2024 saw its revenue drop slightly for a second straight year.

For 2024, the company announced that revenue slipped 1.3% on an annual basis to $161.5 million, from $163.7 million in 2023.

Again, coming out of the 2020 health crisis, Dorchester Minerals has been posting solid earnings, with income jumping 217% in 2021 to $1.94 per share before climbing 73.2% in 2022 to $3.35 per share.

Lower commodity prices saw the company’s earnings slip to $2.85 per share in 2023 and $2.13 per share in 2024.

A Dividend Every Year Since 1982

Dorchester Minerals has also been reporting reliable free cash flow (FCF) over the years, including the three highest levels of FCF on record in 2022 ($147.1 million), 2023 ($139.8 million), and 2024 ($132.6 million). (Source: “Dorchester Minerals, L.P. (DMLP),” Yahoo! Finance, last accessed March 3, 2025.)

Why does this matter?

FCF is what companies use to pay dividends, pay down debt, and make capital expenditures. And Dorchester has paid an annual dividend every year since 1982. (Source: “Distribution History,” Dorchester Minerals LP, last accessed March 3, 2025.)

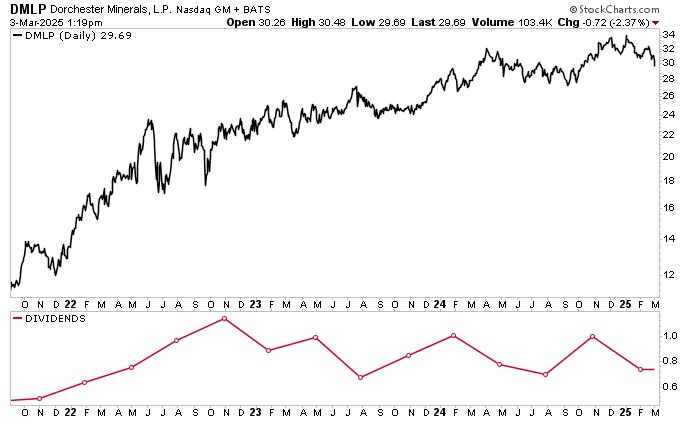

It’s important to note that the partnership’s quarterly distribution varies based on its earnings. In the second quarter of 2024, Dorchester Minerals paid $0.70 per share, and in the third quarter, it paid $0.99 per share.

In February, DMLP stock paid a fourth-quarter distribution of $0.73 per share, for the quarter ended December 31, 2024. This works out to an annual distribution of $3.22 per share, for a forward dividend yield of 10.57%. That’s pretty close to the five-year average dividend yield of 11.06%. (Source: “Dorchester Minerals, L.P. Announces Its Fourth Quarter Distribution,” Dorchester Minerals LP, January 23, 2025.)

DMLP Stock Hits Record High

DMLP stock has been on a nice run since bottoming during the 2020 health crisis, rallying an impressive 450%. On January 3, 2025, DMLP units hit a record intraday high of $34.06.

DMLP stock has given up short-term ground since then, but the outlook remains solid over the long run.

While the energy sector and DMLP stock will face uncertainty, shareholders can still rely on their quarterly payout to help ride out near-term volatility.

Chart courtesy of StockCharts.com

The Lowdown on DMLP Stock

Dorchester Minerals is a great oil and gas E&P that has been reporting consistently solid financial results and paying out a reliable, high-yield distribution. And the outlook for Dorchester Minerals, DMLP stock, and its distribution remains robust, too.

That’s good news for the 154 institutions that hold 26.1% of all outstanding shares. DMLP stock’s biggest holder is Morgan Stanley, with 1.06 million shares, or 2.23% of all outstanding shares. To put that number into perspective, those 1.06 million shares help provide Morgan Stanley with $3.4 million in annual dividends. (Source: “Dorchester Minerals, L.P. (DMLP),” Yahoo! Finance, last accessed March 3, 2025.)