DMLP Stock: 10.17%-Yielder Near 10-Year High

Energy Will Become Key Focus with New Presidency

The energy sector could see increased activity and reduced regulation over the next four years under President-elect Donald Trump. Oil and gas projects that were put on hold could restart.

And a small-cap energy company like Dorchester Minerals LP (NASDAQ:DMLP), with a market capitalization of $1.6 billion, could benefit from this kind of more favorable environment.

The company’s roots date back to January 2003 with the combination of Dorchester Hugoton, Ltd., Republic Royalty Company, L.P., and Spinnaker Royalty Company, L.P.

Dorchester Minerals owns producing and non-producing crude oil and natural gas mineral, royalty, overriding royalty, net profits, and leasehold interests across 28 states. (Source: “Investor Relations,” Dorchester Minerals LP, last accessed December 2, 2024.)

Income investors would be happy to know that DMLP stock has paid dividends in 22 consecutive years, on top of delivering price appreciation.

DMLP stock is nearing its 10-year high of $35.74, plus it has advanced around 100% over the last five years.

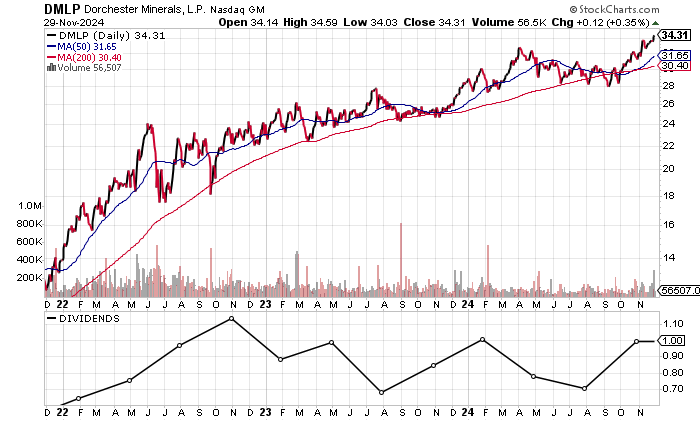

The chart below shows Dorchester Minerals stock trading above both its 200-day moving average (MA) of $31.78 and 50-day MA of $32.92.

For technicians, DMLP stock is also in a golden cross—a bullish technical crossover when the 50-day MA is above the 200-day MA. This suggests there could be additional gains to come.

Chart courtesy of StockCharts.com

Dorchester Minerals Reports Strong Third Quarter

Dorchester delivered exceptional revenue growth in 2021 and 2022 as the country emerged from the pandemic. The decline in 2023 was partly caused by lower energy prices.

| Fiscal Year | Revenues (Millions) | Growth |

| 2019 | $78.8 | N/A |

| 2020 | $46.9 | -49.5% |

| 2021 | $93.4 | 93.4% |

| 2022 | $170.8 | 82.8% |

| 2023 | $163.8 | -4.1% |

(Source: “Dorchester Minerals, L.P.,” MarketWatch, last accessed December 2, 2024.)

This year looks promising following strong results to date on both the top and bottom lines.

Dorchester Minerals reported revenues of $53.5 million in the third quarter, up 25.6% versus $42.6 million in the year-ago third quarter.

The company’s revenues of $121.8 million for the nine months to September 30 represented a 9.7% gain compared to $113.4 million in the same period in 2023. (Source: “Dorchester Minerals, L.P. Announces Third Quarter Results,” Dorchester Minerals LP, October 31, 2024.)

The bottom line points to a profitable company highlighted by consistent generally accepted accounting principles (GAAP) profits. GAAP income has been strong since the pandemic.

Dorchester Minerals reported a decline in 2023, but it was still the second highest profit in history.

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2019 | $1.50 | -7.1% |

| 2020 | $0.61 | -59.2% |

| 2021 | $1.94 | 217.1% |

| 2022 | $3.35 | 73.2% |

| 2023 | $2.85 | -15.1% |

(Source: MarketWatch, op. cit.)

The third quarter saw the company’s GAAP earnings jumping 19.2% year over year to $0.87 per diluted share, up from $0.73 per diluted share for the comparative third quarter in 2023.

On a year-to-date basis, Dorchester Minerals earned $1.89 per diluted share, slightly down from $1.94 per diluted share for the same period in 2023.

As revenues and profits grow, the company has also produced strong free cash flow (FCF), including a record $147.1 million in 2022 followed by $139.8 million in 2023. This compared to $66.1 million in 2019 prior to the $39.4 million in 2020. (Source: MarketWatch, op. cit.)

The strong FCF supports a consistent dividend with DMLP stock as well as Dorchester’s capital expenditures.

The company’s balance sheet is exceptional, with only $1.1 million in total debt and $56.5 million in cash and strong working capital. (Source: “Dorchester Minerals, L.P. (DMLP),” Yahoo! Finance, last accessed December 2, 2024.)

Steady Dividends Should Continue with DMLP Stock

Dorchester Minerals has paid dividends in 22 consecutive years.

The most recent quarterly dividend was raised to $0.99 per share in November, up from $0.70 per share in August and $0.78 per share in May.

DMLP stock’s dividends paid were $3.49 per share in 2024 versus $3.40 per share in 2023. While the company’s recent dividends were significantly higher than $1.53 per share in 2021 and $1.39 per share in 2020, they are below the dividends in the years prior to 2020, so there is room to grow.

Over the past 10 years, the average dividend yield was 15.1%. This means DMLP shareholders have received a nice dividend return for each dollar invested.

| Metric | Value |

| Dividend Streak | 22 years |

| Dividend 7-Year CAGR | 18.9% |

| 3-Year Average Dividend Yield | 13.4% |

| 10-Year Average Dividend Yield | 15.1% |

The Lowdown on DMLP Stock

Dorchester Minerals LP is well-managed, as reflected in its return on equity of 39.7%.

Clearly, investing in DMLP stock has returned strong price appreciation and steady dividends to income investors.