Discounted Stellantis Stock Yielding 10.68%

Green Energy Push to Drive EV Growth

If you’re interested in auto stocks, it might be time to take a look at Stellantis stock.

Auto stocks have been under pressure, especially those focused on expanding their electric vehicle (EV) presence.

Fears of lower demand for higher-priced EVs and a lack of EV infrastructure in the country has turned the market against automakers. The feeling is that, until EV prices drop and the charging network accelerates, consumer demand will be sluggish.

But if you take a long-term view, the EV market should pick up, which would benefit an automaker like Stellantis NV (NYSE:STLA).

The company is a major global legacy automaker that is focused on expanding its presence in EVs. Stellantis has operations in over 30 countries and sells in over 130 global markets. (Source: “About Us,” Stellantis NV, last accessed August 15, 2024.)

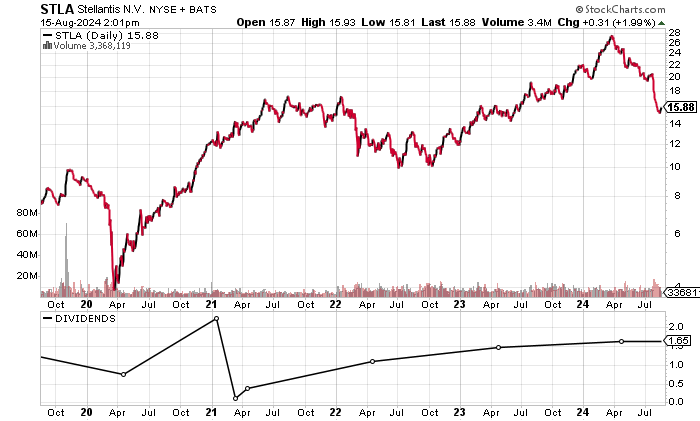

STLA stock was flying high after reaching a record $29.51 on March 25, prior to collapsing 30.5% over the past three months and 21.6% over the last month to August 15.

Hovering just above its 52-week low of $15.12 set on August 13, Stellantis stock currently provides a compelling risk/reward opportunity, while also having a juicy forward yield of 10.68%.

Chart courtesy of StockCharts.com

Expect a Few Hiccups; Think Long-Term

Stellantis NV reports in the euro (EUR) . The exchange rate at time of writing was one EUR equals USD$1.00 and vice versa: USD$1.00 is worth EUR0.91.

All of the tables in this article are displayed in the EUR, while the estimates are reported in the USD. I will also present the estimates in the EUR based on the current exchange rate.

The company’s revenues have risen in three consecutive years following the significant decline during the pandemic in 2020. Stellantis reported a record EUR189.5 billion in 2023.

| Fiscal Year | Revenues (EUR; Billions) | Growth |

| 2019 | 108.2 | N/A |

| 2020 | 47.7 | -56.0% |

| 2021 | 149.4 | 213.5% |

| 2022 | 179.6 | 20.2% |

| 2023 | 189.5 | 5.5% |

(Source: “Stellantis N.V.,” MarketWatch, last accessed August 15, 2024.)

The company is expected to see some contraction in 2024 prior to rebounding in 2025.

Analysts estimate that Stellantis will report an 8.3% drop in revenues to USD$187.27 billion or around EUR170.6 billion. Note the actual reported number will depend on the exchange rate at that time. (Source: “Stellantis N.V. (STLA),” Yahoo! Finance, last accessed August 15, 2024.)

On a positive note, 2025 is expected to see the company’s revenues rebound 4.5% to USD$195.7 billion or around EUR178.3 billion.

Stellantis reported a five-year second highest gross margin in 2023.

| Fiscal Year | Gross Margins |

| 2019 | 21.0% |

| 2020 | 19.7% |

| 2021 | 19.7% |

| 2022 | 19.7% |

| 2023 | 20.2% |

The bottom line points to consistent generally accepted accounting principles (GAAP) profitability. This included three straight years of growth following 2020 to the high in 2023.

| Fiscal Year | GAAP-Diluted EPS (EUR) | Growth |

| 2019 | 1.82 | N/A |

| 2020 | 1.34 | -26.5% |

| 2021 | 4.51 | 237.4% |

| 2022 | 5.31 | 17.8% |

| 2023 | 5.94 | 11.8% |

(Source: MarketWatch, op. cit.)

Analysts expects Stellantis to report a lower adjusted profit of USD$4.60 per diluted share or around EUR4.19 per diluted share in 2024, down from USD$6.40 per diluted share in 2023.

The situation is expected to improve in 2025 with consensus calling for an adjusted USD$4.87 or around EUR4.44 per diluted share. (Source: Yahoo! Finance, op. cit.)

The company’s funds statement shows consistent free cash flow (FCF) with four straight years of growth to the record level in 2023.

| Fiscal Year | FCF (EUR Billions) | Growth |

| 2019 | 2.08 | N/A |

| 2020 | 3.29 | 58.5% |

| 2021 | 8.53 | 159.3% |

| 2022 | 10.95 | 28.3% |

| 2023 | 12.29 | 12.3% |

(Source: MarketWatch, op. cit.)

On the balance sheet, there was USD$32.26 billion in total debt and USD$38.07 billion in cash at the end of June. This should present no issues for Stellantis. (Source: Yahoo! Finance, op. cit.)

Moreover, the company has easily covered its interest expense with higher earnings before interest and taxes (EBIT).

| Fiscal Year | EBIT (EUR Millions) | Interest Expense (EUR) | Interest Coverage Ratio |

| 2020 | 3.1 | 191,000 | 16.4X |

| 2021 | 15.9 | 770,000 | 20.7X |

| 2022 | 20.7 | 1.2 million | 17.4X |

| 2023 | 23.8 | 1.3 million | 17.9X |

(Source: Yahoo! Finance, op. cit.)

The Piotroski score, an indicator of a company’s balance sheet, profitability, and operational efficiency, shows a weak reading of 3.0 for Stellantis. This is near the bottom of the 1.0 to 9.0 range. Prior to 2023, the company’s Piotroski score had averaged a far better 6.0.

Stellantis Stock Dividend Expected to Hold

Stellantis stock currently pays a quarterly dividend of $0.415 per share, representing a forward yield of 10.68%. The higher yield is due to the weak share price, which I feel is an opportunity. (Source: Yahoo! Finance, op. cit.)

The payout ratio here is relatively low at 35.6%, which affords the company the ability to continue paying dividends. Whether Stellantis will raise dividends will depend on the financial results, which at this time are expected to see earnings fall in 2024.

| Metric | Value |

| Dividend Growth Streak | 2 years |

| Dividend Streak | 4 years |

| 10-Year Average Dividend Yield | 5.4% |

| Dividend Coverage Ratio | 3.0X |

The Lowdown on Stellantis Stock

Contrarian long-term income investors should look at Stellantis stock given the high yield and price deterioration.

A turnaround in EV sales and lower interest rates could drive up demand and generate a rally in STLA stock.