This Compelling Opportunity at 52-Week Low

There’s a pretty compelling opportunity in the dry bulk shipping industry right now: Diana Shipping stock.

The world’s shipping lanes transport dry bulk commodities across vast oceans. There is simply no other way to move these raw materials across continents, so this translates into vast opportunities for dry bulk shippers. Major items include iron ore, coal, and grain.

A small dry bulk water shipper that has seen its shares under pressure is Diana Shipping Inc (NYSE:DSX). The company currently owns and operates a fleet of 40 dry bulk vessels. (Source: “About Us,” Diana Shipping Inc, last accessed July 30, 2024.)

The $325.0-million-market-cap company has lost 26.5% over the year to July 30, trading at a 52-week low of $2.64 on July 26.

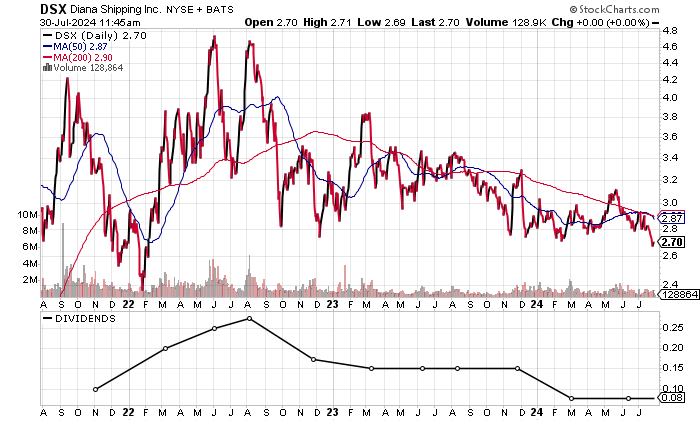

On the chart, Diana Shipping stock is currently hovering below its 50-day moving average (MA) of $2.91 and 200-day MA of $3.03.

A recovery of the 50-day MA would be encouraging and offer a pathway to the 200-day MA and a higher stock price.

At the current price and given the 16.73% yield, Diana Shipping stock looks compelling.

Chart courtesy of StockCharts

Diana Shipping Stock: Revenues Set to Rebound

Diana Shipping Inc is highly dependent on the world trade of dry bulk materials and the state of the global economies.

In a strong trade cycle, the cost of shipping could rise given the demand for dry bulk carriers and vice versa when the economy slows.

Diana Shipping saw its revenues sink during the pandemic in 2020 before recovering in 2021 and hitting a record high in 2022. Revenues contracted in 2023, but are expected to rise by 2025.

| Fiscal Year | Revenues (Millions) | Growth |

| 2019 | $220.7 | -2.4% |

| 2020 | $169.7 | -23.1% |

| 2021 | $214.2 | 26.2% |

| 2022 | $290.0 | 35.4% |

| 2023 | $262.1 | -9.6% |

(Source: “Diana Shipping Inc,” MarketWatch, last accessed July 30, 2024.)

Analysts estimate that Diana Shipping Inc will report a slight decline in revenues to $254.8 million in 2024 prior to rebounding 20.8% to an estimated record $307.8 million in 2025. (Source: “Diana Shipping Inc (DSX),” Yahoo! Finance, last accessed July 30, 2024.)

A look at the gross margins point to a low reading of 40.7% in 2020, followed by a subsequent recovery from 2021 to 2023. The gross margin of 72.8% in 2022 was a 10-year high.

| Fiscal Year | Gross Margins |

| 2019 | 52.4% |

| 2020 | 40.7% |

| 2021 | 62.5% |

| 2022 | 72.8% |

| 2023 | 62.2% |

Diana Shipping delivered generally accepted accounting principles (GAAP) profitability over the last three years following the losses in 2019 and 2020. This included a record $1.36 per diluted share in 2022.

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2019 | -$0.17 | -271.3% |

| 2020 | -$1.62 | -848.6% |

| 2021 | $0.61 | 137.5% |

| 2022 | $1.36 | 123.0% |

| 2023 | $0.43 | -69.3% |

(Source: MarketWatch, op. cit.)

Adjusting for the non-recurring expenses, Diana Shipping Inc earned $0.39 per diluted share in 2023.

Analysts expected the company to report a lower adjusted $0.37 per diluted share in 2024, but then to follow that with a jump to $0.85 and as high as $1.30 per diluted share in 2025. This implies that Diana Shipping stock is trading at a mere 3.1 times its consensus 2025 earnings-per-share (EPS) estimate. (Source: Yahoo! Finance, op. cit.)

The company had positive free cash flow (FCF) in four of the last five years, including a nice rebound in 2023.

The strong FCF allows Diana Shipping to pay dividends and provides funds for capital expenditures and debt reduction.

| Fiscal Year | FCF (Millions) | Growth |

| 2019 | $46.6 | N/A |

| 2020 | $10.5 | -77.4% |

| 2021 | $63.1 | 499.5% |

| 2022 | -$75.4 | -219.5% |

| 2023 | $36.9 | 149.0% |

(Source: MarketWatch, op. cit.)

The balance sheet carried $628.2 million in total debt and $162.0 million in cash. (Source: Yahoo! Finance, op. cit.)

I don’t see any financial concerns at this time given the decent interest coverage ratio.

Diana Shipping has also consistently covered its interest payments via higher earnings before interest and taxes (EBIT) over the last three years.

| Fiscal Year | EBIT (Millions) | Interest Expense (Millions) | Interest Coverage Ratio |

| 2020 | -$114.0 | $20.2 | N/A |

| 2021 | $75.5 | $18.1 | 4.17X |

| 2022 | $143.8 | $24.7 | 5.82X |

| 2023 | $96.2 | $46.4 | 2.07X |

(Source: Yahoo! Finance, op. cit.)

The Piotroski score, an indicator of a company’s balance sheet, profitability, and operational efficiency, shows a weak reading of 3.0 or below the midpoint of the 1.0 to 9.0 range. We are not concerned given the FCF and interest coverage.

Profitability & FCF Support Dividends

Given the price deterioration, Diana Shipping stock has seen its forward dividend yield jump to 16.73%. (Source: Yahoo! Finance, op. cit.)

The forward dividend yield is well above the 10-year average dividend yield of 5.6%, so I expect the yield to normalize as the share price rallies.

Also note that the dividend payments have varied. The last two quarterly dividends were $0.075 per share (March and June 2024) prior to $0.15 per share in March, June, and August 2023. If Diana Shipping were to maintain the current dividend, the forward yield would be 13.89%.

| Metric | Value |

| Dividend Streak | 4 years |

| 10-Year Average Dividend Yield | 5.6% |

| Dividend Coverage Ratio | 1.5X |

The Lowdown on Diana Shipping Stock

The current global economy is under some pressure, but a sustained recovery would provide tailwinds in terms of the demand for dry bulk shipping.

Diana Shipping stock is near its 52-week low, but for income investors, the strong dividend yield helps to compensate for the risk and offers a compelling risk/reward opportunity.