Delek Logistics Stock: Offering a Juicy 10.38% Yield

Oil & Gas Transporter Regularly Raises Dividends

What’s so special about Delek Logistics stock?

Small-cap, high-dividend-yielding stocks that grow revenues, deliver strong profits, and produce free cash flow (FCF) are not common. These dividend stocks would be ideal for the income investor who wants higher dividend yields and is willing to assume some added risk.

That brings me to Delek Logistics Partners LP (NYSE:DKL), a midstream, energy master limited partnership (MLP) that owns, operates, acquires, and constructs crude oil and refined products logistics and marketing assets. The assets are company-owned and via joint ventures.

Delek’s key areas of operations include around the Permian Basin, the Delaware Basin, and other regions in the Gulf Coast area. This includes Texas, Tennessee, Arkansas, and Oklahoma. (Source: “Corporate Profile,” Delek Logistics Partners LP, last accessed July 17, 2024.)

The company made a strategic move to acquire 3Bear in June 2022 in a $628.0-million deal. 3Bear operates a crude, gas and water gathering, processing, and disposal business in the Northern Delaware Basin.

Delek Logistics stock has a current market valuation of $1.95 billion. The shares are down 23.5% from their 52-week high of $53.80 in December 2023, trading as high as $64.47 in September 2022. The price deterioration presents a contrarian opportunity.

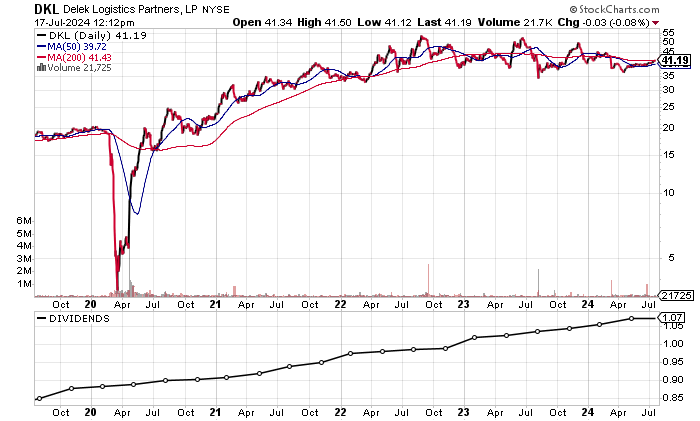

The chart shows DKL stock holding above its 50-day moving average (MA) of $39.70 but just below its 200-day MA of $42.80 in a bearish death cross. The technical picture is bearish, but patient income investors can collect the $4.28 in annual dividends with Delek Logistics stock and wait.

Chart courtesy of StockCharts

Revenues & Profits Set to Rise

The revenue picture has been inconsistent over the last five years, but Delek Logistics Partners LP has nearly doubled its revenues since 2019. The $1.0-billion-plus revenues in 2022 and 2023 were helped by the acquisition of 3Bear. Now we need to see the company generate organic growth.

| Fiscal Year | Revenues | Growth |

| 2019 | $584.0 million | -11.2% |

| 2020 | $563.4 million | -3.5% |

| 2021 | $700.9 million | 24.1% |

| 2022 | $1.04 billion | 47.4% |

| 2023 | $1.02 billion | -2.2% |

(Source: “Delek Logistics Partners L.P.,” MarketWatch, last accessed July 17, 2024.)

Analysts predict that Delek Logistics Partners will report a two-percent rise in revenues to $1.04 billion in 2024, followed by 2.1% growth to $1.06 billion in 2025. (Source: “Delek Logistics Partners, LP (DKL),” Yahoo! Finance, last accessed July 17, 2024.)

The company expanded gross margins in 2023. This was its third highest gross margin in 10 years.

| Fiscal Year | Gross Margins |

| 2019 | 30.2% |

| 2020 | 42.7% |

| 2021 | 36.7% |

| 2022 | 29.9% |

| 2023 | 36.5% |

On the bottom line, Delek Logistics has consistently delivered profits on a generally accepted accounting principles (GAAP) basis. There have been inconsistencies, but the results have been good. This means there should be no issues continuing to pay out dividends.

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2019 | $2.61 | -1.6% |

| 2020 | $4.18 | 60.4% |

| 2021 | $3.79 | -9.3% |

| 2022 | $3.66 | -3.6% |

| 2023 | $2.89 | -20.8% |

(Source: MarketWatch, op. cit.)

Analysts expect Delek to report a 19.7% increase to $3.46 per diluted share in its earnings for 2024. This is expected to be followed by $3.99 per diluted share in 2025. This translates into a forward price-earnings multiple of around 10.3 times the consensus 2025 earnings-per-share estimate, which should provide some cushioning for the stock. (Source: Yahoo! Finance, op. cit.)

A look at the funds statement points to consistent positive FCF. The strong FCF should allow Delek Logistics to continue to pay dividends and other corporate expenses.

| Fiscal Year | FCF (Millions) | Growth |

| 2019 | $122.1 | N/A |

| 2020 | $182.5 | 49.4% |

| 2021 | $259.9 | 42.4% |

| 2022 | $52.8 | -79.7% |

| 2023 | $138.2 | 161.8% |

(Source: MarketWatch, op. cit.)

A risk with Delek Logistics Partners LP is the total debt of $1.6 billion on its balance sheet at the end of March. This was largely due to the acquisition of 3Bear. (Source: Yahoo! Finance, op. cit.)

Energy companies generally carry higher debt, so I’m not that concerned at this time. The interest coverage ratio of 1.7 times could improve back to its five-year average of 3.0 times.

The following table shows that Delek Logistics has easily covered its interest expense via the higher earnings before interest and taxes (EBIT), so no worries for now.

| Fiscal Year | EBIT (Millions) | Interest Expense (Millions) | EBIT/Interest Ratio |

| 2020 | $202.4 | $42.9 | 4.72X |

| 2021 | $215.2 | $50.2 | 4.29X |

| 2022 | $241.8 | $82.3 | 2.94X |

| 2023 | $270.7 | $143.2 | 1.89X |

(Source: Yahoo! Finance, op. cit.)

The Piotroski score, an indicator of a company’s balance sheet, profitability, and operational efficiency, shows a decent reading of 6.0 for Delek. This is well above the midpoint of the 1.0–9.0 range.

Average Dividend Yield of 15.1% Over Past 10 Years

The current annual dividend is $4.28 per share, representing a forward yield of 10.28%.

Given the expected higher earnings, I expect the dividends will likely continue to rise.

| Metric | Value |

| Dividend Growth Streak | 11 years |

| Dividend Streak | 12 years |

| Dividend 7-Year CAGR | 6.9% |

| 10-Year Average Dividend Yield | 15.1% |

| Dividend Coverage Ratio | 1.3 |

The Lowdown on Delek Logistics Stock

In my view, the price weakness in Delek Logistic stock makes for a contrarian opportunity. The company has delivered decent fundamentals, and the dividend appears to be safe.

Delek Logistics Partners LP is ideal for the aggressive income investor who wants a higher yield along with the potential for strong capital gains.