CTO Realty Growth Stock a 9%-Yielder for Contrarian Investors

CTO Stock a Tiny REIT Play That Could Pay Off

The outlook for interest rates is that the Federal Reserve will begin cutting rates in June, and that it will cut them by as many as 100 basis points this year. Of course, the inflation situation could change and have an impact on when and how much interest rates will decline.

Since interest rates are set to ratchet lower, it makes sense for investors to look at interest rate-sensitive plays like real estate investment trusts (REITs). Although the share prices of many REITs have already been rallying in anticipation of lower interest rates, there are still many opportunities to find some lower-priced REIT stocks.

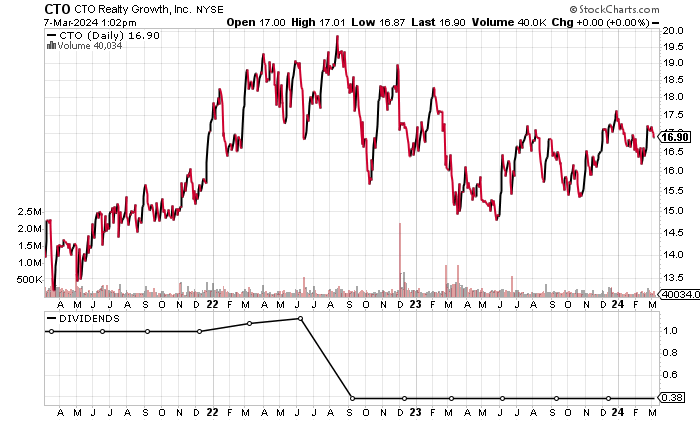

For instance, CTO Realty Growth Inc (NYSE:CTO) is down by 3.6% over the past year (as of this writing) to just north of its 52-week low of $15.63 in October 2023.

At its current price level, I see CTO Realty Growth stock as an opportunity.

CTO Realty Growth focuses on buying and managing high-quality, retail-based properties that are largely situated in high-growth markets in the U.S. The company also has a stake in Alpine Income Property Trust Inc (NYSE:PINE), which is a net lease retail REIT. (Source: “Corporate Profile,” CTO Realty Growth Inc, last accessed March 7, 2024.)

Chart courtesy of StockCharts.com

CTO Realty Growth Inc’s Fundamentals Should Improve if Economy Holds

CTO Realty Growth Inc grew its revenues for the past five consecutive years to a record-high $109.1 million in 2023. Its revenues even grew in 2020 amid the COVID-19 pandemic.

But with the economy expected to stall this year, analysts estimate that CTO Realty Growth will report flat revenues of $109.0 million for 2024, prior to reporting a 6.6% rebound to $116.1 million for 2025. (Source: “CTO Realty Growth, Inc (CTO),” Yahoo! Finance, last accessed March 7, 2024.)

Of course, much of what happens depends on the state of the economy.

| Fiscal Year | Revenues (Millions) | Growth |

| 2019 | $44.9 | N/A |

| 2020 | $56.4 | 25.5% |

| 2021 | $70.3 | 24.6% |

| 2022 | $82.3 | 17.1% |

| 2023 | $109.1 | 32.6% |

(Source: “CTO Realty Growth Inc.” MarketWatch, last accessed March 7, 2024.)

CTO Realty Growth Inc has generated strong gross margins, expanding them in 2022 and 2023, following declines in 2020 and 2021.

| Fiscal Year | Gross Margins |

| 2019 | 84.2% |

| 2020 | 73.0% |

| 2021 | 68.1% |

| 2022 | 72.2% |

| 2023 | 72.3% |

An issue with CTO Realty Growth has been the inconsistency of its generally accepted accounting principles (GAAP) profitability. After producing high diluted GAAP earnings-per-share (EPS) profits of $5.56 in 2020, the company produced softer results.

The situation is expected to worsen, with analysts announcing a consensus prediction of a loss of $0.41 per diluted share in 2024, followed by a loss of $0.51 per diluted share in 2025. (Source: Yahoo! Finance, op. cit.)

CTO Realty Growth Inc will need to deal with its expected losses because they could threaten the company’s ability to pay dividends.

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2019 | $7.68 | N/A |

| 2020 | $5.56 | -27.6% |

| 2021 | $1.56 | -71.9% |

| 2022 | -$0.09 | -105.6% |

| 2023 | $0.03 | 138.3% |

(Source: MarketWatch, op. cit.)

The company’s free cash flow (FCF) has been positive, which is supportive of dividends, but there’s some risk with the expected losses’ potential impacts on future FCF.

| Fiscal Year | FCF (Millions) | Growth |

| 2020 | $16.9 | N/A |

| 2021 | $27.6 | 63.3% |

| 2022 | $56.1 | 103.3% |

| 2023 | $46.4 | -17.3% |

(Source: Yahoo! Finance, op. cit.)

At the same time, CTO Realty Growth has to manage a debt of $500.7 million. (Source: Yahoo! Finance, op. cit.)

Moreover, the company’s interest coverage ratio of 1.3 in 2023 was weak. An encouraging sign is that the company has covered its annual interest expenses with higher earnings before interest and taxes (EBIT) in the last three straight years.

| Fiscal Year | EBIT (Millions) | Interest Expense (Millions) |

| 2020 | $5.4 | $10.4 |

| 2021 | $35.2 | $8.3 |

| 2022 | $10.7 | $10.4 |

| 2023 | $27.5 | $21.4 |

(Source: Yahoo! Finance, op. cit.)

CTO Realty Growth’s Piotroski score—an indicator of the company’s balance sheet, profitability, and operational efficiency—is a manageable reading of 6.0, which is well above the midpoint of the Piotroski score’s range of 1.0 to 9.0.

CTO Realty Growth Stock Has Dividend Streak of 49 Straight Years

For income investors, CTO Realty Growth Inc has paid dividends for 49 consecutive years. The negative at this time is a lack of dividend growth in recent years as the company works on improving its profitability.

CTO stock’s dividend history shows that a quarterly dividend of $0.38 per share has been in place since management slashed the distribution from $1.12 per share, which was paid out in June 2022. (Source: “Dividends,” CTO Realty Growth Inc, last accessed March 7, 2024.)

As of this writing, CTO Realty Growth stock’s quarterly payout of $0.38 per share translates to a forward yield of 8.99%, which is above its five-year average of 5.15%. The higher yield is due to a lower share price.

The company’s dividend coverage ratio of 1.2 is also on the weak side.

| Metric | Value |

| Dividend Streak | 49 Years |

| 7-Year Dividend Compound Annual Growth Rate | 78.1% |

| 10-Year Average Dividend Yield | 3.6% |

| Dividend Coverage Ratio | 1.2 |

The Lowdown on CTO Realty Growth Inc

My view is that CTO Realty Growth will try to maintain its dividend payments, but I don’t expect management to increase CTO stock’s dividend amount until the company’s profitability improves.

For income investors, it’s all about receiving dividends and waiting for the company to turn things around so its share price will rise.