Crescent Capital Stock: 10.07%-Yielder Up 16% Over Year

CCAP Stock Ideal for Income Investors

If you are an income investor who requires regular, consistent quarterly dividends and the opportunity for some capital appreciation, the solution may be a business development company (BDC) stock.

The setup of a BDC is to generate investment income via investing in small- and medium-sized companies, including distressed businesses. The BDC provides capital and expertise to help portfolio companies grow or work on the operational issues holding them back.

Investment income flowing from the investments is paid out as dividends to investors. The fact that a BDC is required to distribute a minimum of 90% of its taxable income along with its tax-exempt interest annually is a positive for income investors.

A top-performing BDC that has returned both capital and dividends to shareholders is Crescent Capital BDC Inc (NASDAQ:CCAP), a $721.6 -million-market-cap BDC.

Crescent Capital operates as a specialty finance company, originating and investing in the debt of private middle-market companies largely situated in the U.S. The debt tends to be below investment-grade, so there’s risk, but there’s also the potential for high reward.

The BDC has the mandate of maximizing the total return for shareholders via dividends and capital appreciation.

Crescent had investments in 183 portfolio companies with an aggregate fair value of $1.59 billion as of September 30, 2024. (Source: “Overview,” Crescent Capital BDC Inc, last accessed December 9, 2024.)

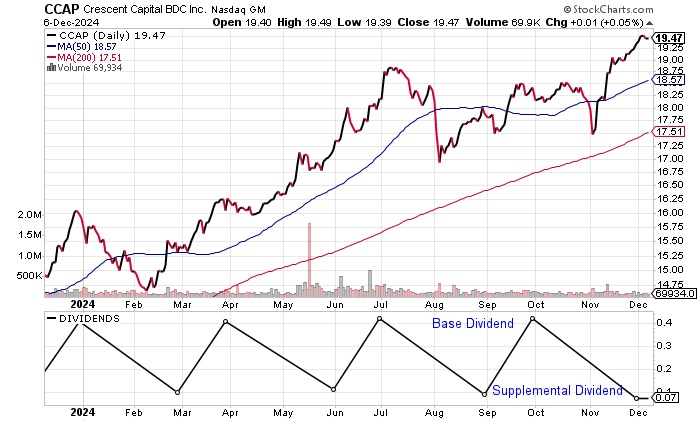

Crescent Capital stock is currently hovering just below its 52-week high of $19.63 achieved in July 2024, up 16% over the past year to December 9.

Trading at $19.47 at the time of writing, Crescent Capital stock is above both its 50-day moving average (MA) of $18.59 and 200-day MA of $18.12. Moreover, the CCAP chart shows a golden cross, which is a bullish technical crossover when the 50-day MA is above the 200-day MA. This suggests that there could be additional upside moves to come.

Chart courtesy of StockCharts.com

Strong Growth Drives Share Appreciation

Crescent Capital BDC Inc reports revenues as total investment income and earnings as net investment income.

The results on both the top and bottom lines have been strong.

The company’s total investment income was $184.1 million in 2023, up a stellar 57.8% from $116.7 million in 2022 and 95.9% above the $94.0 million in 2021. (Source: “Form-10K,” Crescent Capital BDC Inc, last accessed December 9, 2024.)

In the third quarter, Crescent Capital reported total investment income of $51.6 million, up from $48.2 million in the year-ago third quarter. (Source: “Crescent Capital BDC, Inc. Reports Third Quarter 2024 Earnings Results; Declares a Fourth Quarter Base Dividend of $0.42 Per Share, and a Third Quarter Supplemental Dividend of $0.07 Per Share,“ Crescent Capital BDC Inc, November 12, 2024.)

The third-quarter results give the company a pathway to surpass its 2023 results.

Analysts expect Crescent Capital BDC to grow its total investment income by 7.7% to $198.2 million in 2024. However, it’s expected to contract 10% to $178.4 million in 2025. (Source: “Crescent Capital BDC, Inc (CCAP),” Yahoo! Finance, last accessed December 9, 2024.)

A look at the bottom line shows strong growth. Crescent Capital reported net investment income of $2.30 per share in 2023, compared to $1.93 per share in 2022 and $1.67 per share in 2021.

In the third quarter, the net investment income was $0.64 per share, up from $0.59 per share in the third quarter of 2023. This beat the consensus of $0.57 per share by 11.3%, representing the fourth straight quarterly beat and the best result in four quarters.

Analysts expect Crescent Capital BDC to report higher net investment income of $2.41 per share in 2024 prior to dropping to $2.06 per share in 2025. (Source: Yahoo! Finance, op. cit.)

On the balance sheet, there was $857.2 million in total debt, which isn’t unusual for a BDC. The total debt to equity ratio of 114.5% is manageable given the strong profitability and free cash flow. (Source: Yahoo! Finance, op. cit.)

Crescent Capital Stockholders Get 8 Dividends a Year

Crescent Capital has paid dividends in five straight years, growing its dividend in each year.

The company pays two dividends each quarter or eight dividends annually. In each quarter, Crescent Capital stock pays a smaller supplemental dividend and a regular dividend.

In the recent declaration, the company announced a supplemental dividend of $0.07 per share payable on December 16, followed by a regular quarterly dividend of $0.42 per share to be paid on January 15, 2025, to record holders as of December 31.

Crescent Capital stock’s current dividend equates to $0.49 for the quarter, representing a forward yield of 10.07%.

The recent supplemental dividend was Crescent Capital stock’s lowest in 2024, compared to $0.09 per share in August, $0.11 per share in May, and $0.10 per share in February. With an expected decline in the company’s net investment income in 2025, its supplemental dividend could drop, but I expect the regular dividend to continue.

The Lowdown on Crescent Capital Stock

Crescent Capital is well-managed, as demonstrated by the return on equity of 12.8%.

Insiders hold a relatively high 12.5% of Crescent Capital stock, while institutional ownership is also decent at 48.6%. (Source: Yahoo! Finance, op. cit.)

For income investors, CCAP stock has delivered a high dividend yield along with moderate capital appreciation.