Colgate-Palmolive Company: Why Income Investors Should Consider CL Stock

CL Stock is One Stock to Consider Buying and Holding

Income investors want three things from an investment: a steady income, low volatility to preserve the capital, and growth. And one company that meets all three requirements is Colgate-Palmolive Company (NYSE:CL).

Colgate-Palmolive sells consumer products used for the likes of personal hygiene, home care, and pet nutrition. It operates in more than 200 countries, and North and South America and Europe accounting for three-quarters of sales.

Steady Income

CL stock was initiated in 1895, making 2017 the 122nd year that a dividend has been paid to investors. The dividend is currently paid on a quarterly basis.

The stock has paid out for 53 consecutive years as of this writing. This makes CL stock both a “dividend aristocrat,” as an S&P 500 company with at least 25 straight years of dividend hikes, and a “dividend king,” for being a company with 50 straight years of increases.

Currently, just over 50% of each dollar of earnings is paid out as a dividend; this is in line with the 10-year average. Therefore, as earnings increase, it is very easy for management to increase the dividend without negatively impacting the current financial situation.

Steady and Growing Earnings

One reason that the dividend is possible is Colgate-Palmolive’s steady and predictable earnings. Since the company operates in the consumer staples segment, sales remain constant regardless of the performance of the economy. For instance, the “Colgate” part of the company’s name is most commonly associated with toothpaste, an item needed by consumers in both booming and weak economic times.

Inflation comes from the cost of running the business, including manufacturing; for example, an increase in the costs of the components of toothpaste. If even one of the raw materials sees an increase in price, that means every tube will cost more to produce. In order to protect Colgate-Palmolive’s margins, the company increases the suggested retail price of the toothpaste or charges the same price as before, but for a smaller amount per tube.

But inflation is not the only way that the business sees growth; there is also attempts to increase Colgate-Palmolive’s market share around the world. But more recently, the focus has been on expanding margins. This is being done by cutting costs, such as lowering workforce numbers. This is one of the business’ top priorities, because the largest costs are wages.

Assuming there is no volume growth in terms of number of units sold, the reduction of the number of employees would affect the bottom line. However, volume growth is not a problem, since senior management is focused on increasing the number of units sold.

All this is evidenced by the annual earnings and forecasted earnings over the next few years. Below is a table of Colgate-Palmolive’s earnings for 2016 and the forecasted earnings for 2017 to 2020. As you will see, the steadiness and growth in earnings is on an upward trend.

| Annual Earnings | Year | Type Of Earnings |

| $2.81 | 2016 | Actual |

| $2.92 | 2017 | Forecasted |

| $3.17 | 2018 | Forecasted |

| $3.44 | 2019 | Forecasted |

| $4.03 | 2020 | Forecasted |

Stellar Returns

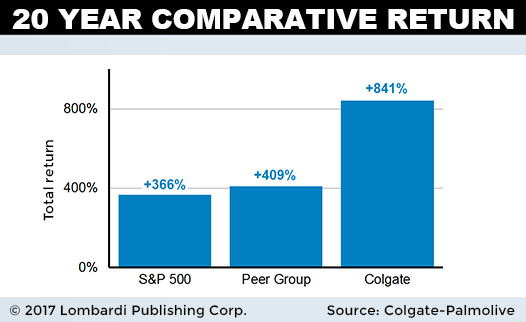

When comparing CL stock to its industry peers, its return is more than double that of its direct competition. Note that the companies that make up the returns of the peer group would see the same affect on inflation on their products, meaning inflation is not the reason for Colgate-Palmolive’s outperformance. Below is a chart that details this further:

The difference comes down to investors wanting to own top operators in the market. Just take a look at Colgate-Palmolive’s gross, operating, and net margins; the managerial focus means they’re likely to expand even further in the future. This is important because it means that more money is flowing down to the bottom line for each dollar of earnings, which means the potential for more possible dividend hikes and company growth.

When CL stock is compared to the S&P 500 Index, it appears to have done even better. The S&P 500 is used as a barometer because the companies within are those that receive the most attention due to their size and products and services; they are normally globally recognized brands. The index also represents 10 different sectors, which certainly helps.

What also helps is CL stock’s very low volatility0 when compared to the index. If the S&P 500 index moves one percentage point, CL stock moves only 0.46% on average. This is vital in a down market because it would mean the preservation of the overall capital in the stock.

Final Thoughts On CL stock

CL stock is a great example of how buying and holding a stock for a long time pays off. Colgate-Palmolive’s products will continue to sell well, and in turn the company will continue to pay a dividend. After over a century with potentially no change in the business model and a higher dividend today, dividend growth is likely to continue, with the average yield on the purchase price only increasing as more time is spent in the investment.

CL stock is currently offering a dividend yield of 2.08%.