Civitas Resources Stock: Mega-Merger Powers This 9.1%-Yielder

Future Looks Bright for CIVI Stock

Companies will often pursue mergers and acquisitions to drive growth. The strategy entails lots of capital, but if done correctly, the end result could be game-changing.

That’s the case with oil and natural gas producer Civitas Resources Inc (NYSE:CIVI), a $6.7-billion market-cap company that revamped its entire energy business following a major merger.

Civitas Resources is a byproduct of a significant $4.5-billion merger that brought together three of the top 10 oil producers in Colorado in November 2021. That merger included two publicly traded companies, Bonanza Creek Energy and Extraction Oil & Gas, plus the privately-held company Crestone Peak Resources. (Source: “Three-way Merger Creates Civitas Resources, New Denver-Based Oil Company,” Mining Connection, November 12, 2021.)

But if that initial merger wasn’t big enough, in June 2023, Civitas Resources Inc announced it would be acquiring the Permian basin oil and gas operations held by private equity firm NGP Energy Capital Management LLC in a $4.7-billion deal. (Source: “Civitas Resources Enters Permian Basin in $4.7 Billion Deal,” Reuters. June 20, 2023.)

That deal expanded Civitas Resources’ operations into the high-prospects shale region, and it’s expected to significantly ramp up the company’s revenues.

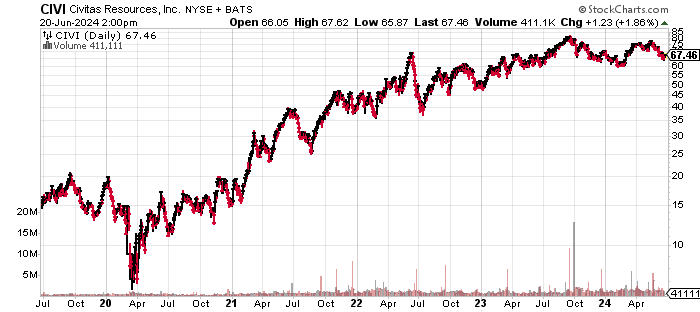

Despite Civitas Resources Inc’s two mega-deals, Civitas Resources stock has struggled.

As of June 20, CIVI stock was down by about 2.6% in 2024 and up by about 2.6% over the past year. It was also 23.3% below its 52-week high of $86.58 and just above its 52-week low of $60.38. At this level, I see the stock as a long-term opportunity for income investors who also want price-appreciation potential.

Chart courtesy of StockCharts

Merger & Acquisition Powered Civitas Resources Inc’s Growth

As you can see in the below table, Civitas Resources’ revenues prior to its initial merger were insignificant. The company’s revenues surged to $930.6 million in 2021 following the initial merger and exploded by 307.4% to $3.8 billion in 2022.

The revenue growth is expected to continue. Analysts estimate that Civitas Resources will report revenue growth of 58.1% to $5.5 billion in 2024 and growth of 4.4% to $5.74 billion in 2025. (Source: “Civitas Resources, Inc (CIVI),” Yahoo! Finance, last accessed June 20, 2024.)

| Fiscal Year | Revenues | Growth |

| 2019 | $313.2 Million | N/A |

| 2020 | $218.1 Million | -30.4% |

| 2021 | $930.6 Million | 326.7% |

| 2022 | $3.8 Billion | 307.4% |

| 2023 | $3.5 Billion | -8.23% |

(Source: “Civitas Resources Inc.” MarketWatch, last accessed June 20, 2024.)

Civitas Resources’ gross margins have held in the 70%–80% level in each of the last five years.

| Fiscal Year | Gross Margin |

| 2019 | 74.6% |

| 2020 | 73.6% |

| 2021 | 78.6% |

| 2022 | 79.0% |

| 2023 | 73.7% |

With its revenues ramping higher, Civitas Resources Inc will now need to focus on generating organic growth.

On the bottom line, the initial merger powered a significant increase in generally accepted accounting principles (GAAP) profits. The company’s GAAP-diluted earnings per share (EPS) declined in 2023 despite the company’s major acquisition that year. Much of the decline was due to the cost of that acquisition .

Adjusting for non-recurring expenses, Civitas Resources reported adjusted earnings of $9.44 per diluted share in 2023. This is expected to rise to $12.38 in 2024 and $14.30 in 2025. (Source: Yahoo! Finance, op. cit.)

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2019 | $3.24 | N/A |

| 2020 | $4.95 | 52.7% |

| 2021 | $4.74 | -4.3% |

| 2022 | $14.58 | 207.6% |

| 2023 | $9.02 | -38.2% |

(Source: MarketWatch, op. cit.)

Civitas Resources Inc has been largely free cash flow (FCF)-positive, with the initial merger boosting its FCF in 2022. But just like its profitability, the company’s FCF fell in 2023 due to its acquisition and capital expenditures.

Civitas Resources stock’s high FCF will support its steady dividends and allow it to raise those dividends.

| Fiscal Year | FCF (Millions) | Growth |

| 2019 | -$32.3 Million | N/A |

| 2020 | $95.0 Million | -394.4% |

| 2021 | $121.9 Million | 28.3% |

| 2022 | $1.1 Billion | 828.6% |

| 2023 | $729.6 Million | -35.5% |

(Source: MarketWatch, op. cit.)

Civitas Resources Inc’s balance sheet had $4.44 billion in total debt at the end of March, largely due to the 2023 acquisition. (Source: Yahoo! Finance, op. cit.)

The company has consistently covered its interest payments via higher earnings before interest and taxes (EBIT). Civitas Resources’ interest coverage ratio at the end of March was a healthy 3.2 times, which supports my view that there are no issues with the company’s financial obligations.

| Fiscal Year | EBIT (Millions) | Interest Expense |

| 2020 | $43.0 Million | N/A |

| 2021 | $261.5 Million | $9.7 Million |

| 2022 | $1.7 Billion | $22.6 Million |

| 2023 | $1.2 Billion | $166.7 Million |

(Source: Yahoo! Finance, op. cit.)

Civitas Resources Inc’s Piotroski score—an indicator of a company’s balance sheet, profitability, and operational efficiency—is a somewhat weak reading of 3.0, which is below the midpoint of the Piotroski score’s range of 1.0 to 9.0. I expect its score to improve, so I’m not concerned now.

Revenue & Earnings Growth Supports Higher Dividends

Civitas Resources Inc’s forward dividend yield of 9.06% (as of this writing) is attractive. Its payout ratio of 83.1% is on the high end, but it should decline as the company’s earnings rise. (Source: Yahoo! Finance, op. cit.)

Given the higher expected revenues and earnings, I forecast that the company’s FCF will remain strong, which would allow it to increase CIVI stock’s dividends.

| Metric | Value |

| Dividend Growth Streak | 3 Years |

| Dividend Streak | 4 Years |

| Dividend Coverage Ratio | 4.0 |

The Lowdown on Civitas Resources Inc

Civitas Resources Inc appears to have built a solid oil and gas business following its merger and major acquisition. The company now has to put things together and drive organic growth.

For income investors, Civitas Resources stock offers an attractive dividend yield and good share-price-appreciation potential.

CIVI stock has become a favorite of the institutional investor crowd, with 501 institutions holding 84.1% of the outstanding shares (as of this writing). The Canada Pension Plan Investment Board is the top institutional investor, with a 16.47% stake. (Source: Yahoo! Finance, op. cit.)