Civitas Resources Stock: A Compelling Energy Play Yielding 10.39%

Mid-Cap Oil & Gas Pick for Contrarians

Presidential hopeful and current Vice President Kamala Harris has suggested that she would not ban fracking oil and gas if she were to win the November presidential election.

Whether this is bullish for the broader energy sector is unknown, but what we do know is that the country wants to become more energy-independent, which includes exporting more oil and gas.

A mid-cap upstream oil and natural gas producer I believe is worth a look for contrarian income investors is Civitas Resources Inc (NYSE:CIVI). This company was bred from the $4.5-billion merger that combined Bonanza Creek Energy, Extraction Oil & Gas and Crestone Peak Resources with the previous Civitas Resources in November 2021. The merger brought together three of the top 10 oil producers in Colorado. (Source: “Three-way Merger Creates Civitas Resources, New Denver-based Oil Company,” MiningConnection, November 12, 2021.)

Civitas Resources followed this by acquiring the oil and gas operations in the Permian basin held by private equity firm NGP Energy Capital Management in a $4.7-billion deal in June 2023. (Source: “Civitas Resources enters Permian basin in $4.7 billion deal,” Reuters, June 20, 2023.)

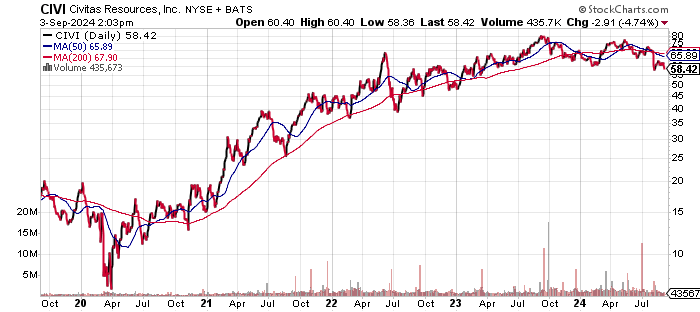

The deals led to a significant increase in annual revenues, but the market has punished CIVI stock with a 14.4% drop in 2024 as of September 3. Civitas Resources stock is currently well off from its 52-week high of $86.58 achieved in September 2023.

Chart courtesy of StockCharts.com

Revenues Set to Surge 56.8% This Year

The initial merger powered Civitas’ revenue growth to a record $3.79 billion in 2022, but this was followed by some weakness in 2023. However, revenues are set to explode higher in 2024.

| Fiscal Year | Revenues | Growth |

| 2019 | $313.2 million | N/A |

| 2020 | $219.1 million | -30.4% |

| 2021 | $920.6 million | 326.7% |

| 2022 | $3.79 billion | 307.4% |

| 2023 | $3.48 billion | -8.2% |

(Source: “Civitas Resources, Inc.,” MarketWatch, last accessed September 3, 2024.)

Analysts estimate that Civitas Resources will ramp up revenues by 56.8% to $5.46 billion in 2024, followed by $5.62 billion in revenues in 2025. (Source: “Civitas Resources, Inc. (CIVI),” Yahoo! Finance, last accessed September 3, 2024.)

Gross margins have held at the 70% level in each of the last five years.

| Fiscal Year | Gross Margins |

| 2019 | 74.6% |

| 2020 | 73.6% |

| 2021 | 78.6% |

| 2022 | 79.0% |

| 2023 | 73.7% |

With revenues moving higher, Civitas Resources will need to focus on generating organic growth.

On the bottom line, the initial merger drove a massive rise in generally accepted accounting principles (GAAP) profitability. While profits fell in 2023, the outlook is encouraging.

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2019 | $3.24 | N/A |

| 2020 | $4.95 | 52.7% |

| 2021 | $4.74 | -4.3% |

| 2022 | $14.58 | 207.6% |

| 2023 | $9.02 | -38.2% |

(Source: MarketWatch, op. cit.)

Adjusting for the non-recurring expenses, Civitas Resources reported an adjusted $9.44 per diluted share in 2023. This is expected to rise to $10.41 per diluted share in 2024 and $11.97 to as high as $14.56 per diluted share in 2025. (Source: Yahoo! Finance, op. cit.)

The second quarter showed progress. Civitas Resources reported an adjusted $478.7 million for the six months to June 30, more than doubling from $207.0 for the comparative six months in 2023. (Source: “Civitas Resources Reports Second Quarter 2024 Results,” Civitas Resources Inc, August 1, 2024.)

Civitas Resources has produced positive free cash flow (FCF) over the last four years, including the surge in 2022 following the initial merger.

On a positive note, adjusted FCF jumped to $381.0 million in the six months to June 30 versus $235.4 million in the comparative period. The growth in FCF was despite a significant $1.22 billion in capital expenditures, up from $566.5 million for the same period in 2023. (Source: Civitas Resources Inc, op. cit.)

| Fiscal Year | FCF | Growth |

| 2019 | -$32.3 million | N/A |

| 2020 | $95.0 million | -394.1% |

| 2021 | $121.9 million | 28.3% |

| 2022 | $1.13 billion | 828.6% |

| 2023 | $729.6 million | -35.5% |

(Source: MarketWatch, op. cit.)

The balance sheet showed $4.9 billion in total debt due largely to the acquisition in 2023, but I don’t expect any immediate issues. (Source: Yahoo! Finance, op. cit.)

Civitas Resources Inc has also consistently covered its interest expenses via higher earnings before interest and taxes (EBIT), especially over the last four years. The interest coverage ratio has been strong since 2021.

| Fiscal Year | EBIT | Interest Expense (Millions) | Interest Coverage Ratio |

| 2020 | $43.0 million | N/A | N/A |

| 2021 | $261.5 million | $9.7 | 27.0X |

| 2022 | $1.68 billion | $22.6 | 74.2X |

| 2023 | $1.17 billion | $166.7 | 7.0X |

(Source: Yahoo! Finance, op. cit.)

Civitas Resources’ Piotroski score, an indicator of a company’s balance sheet, profitability, and operational efficiency, shows a soft reading of 4.0, which is just below the midpoint of the 1.0 to 9.0 range. I expect this to improve as the company works on its operations.

Civitas Resources Stock: Dividends Look Safe

The forward dividend yield of 10.39% is attractive, and there is an opportunity for Civitas Resources stock to rally from the current level. The payout ratio of 73% is not an issue at this point, and it should decline as earnings rise. The dividend coverage ratio is a healthy 4.2 times, which should allow for higher dividends. (Source: Yahoo! Finance, op. cit.)

The upcoming ex-dividend date is September 12 to receive the next $1.52 per share dividend.

| Metric | Value |

| Dividend Streak | 4 years |

| 10-Year Average Dividend Yield | 2.3% |

| Dividend Coverage Ratio | 4.2X |

The Lowdown on Civitas Resources Stock

Institutions love Civitas Resources stock, with holdings increasing. Around 551 institutions hold 96.7% of the outstanding CIVI shares. The Canada Pension Plan Investment Board is the second largest institutional investor with a 9.68% stake. (Source: Yahoo! Finance, op. cit.)

Civitas Resources stock trades at an attractive 4.9 times the consensus 2025 earnings-per-share estimate and 1.0 times 2025 revenues.

In my view, Civitas Resources stock offers income investors an attractive dividend yield and above-average price appreciation potential.