Cheniere Energy Partners Stock: Undervalued 8%-Yielder Up 18% Since May

Why CQP Stock Is Compelling

An owner and operator of natural gas liquefaction and export facilities, Cheniere Energy Partners LP (NYSE:CQP) is another great midstream oil and gas company that’s been doing well thanks to strong industry tailwinds.

In the first half of 2023, deliveries of natural gas through pipelines to liquefied natural gas (LNG) export facilities in the U.S. hit a record high, averaging 12.8 billion cubic feet per day (Bcf/d). (Source: “Natural Gas Deliveries to U.S. LNG Export Facilities Set a Record in First-Half 2023,” U.S. Energy Information Administration, July 31, 2023.)

Over the first six months of 2023, LNG feed gas averaged eight percent (one Bcf/d) more than the 2022 average. It was also four percent (500 million cubic feet per day) more than in first six months of 2022.

That momentum is expected to continue, with the U.S. Energy Information Administration (EIA) predicting that U.S. LNG exports will average 12.0 Bcf/d in 2023 and 13.3 Bcf/d in 2024. The strong guidance is being fueled by a rising global demand for LNG and increased long-term contracting from customers.

This is good news for Cheniere Energy Partners. The Houston, Texas-based company is the largest producer and exporter of LNG in the U.S., serving integrated energy companies, utilities, and energy trading companies around the world. (Source: “Company Profile,” Cheniere Energy Partners LP, last accessed August 1, 2023.)

Cheniere Partners owns the Sabine Pass LNG terminal in Cameron Parish, Louisiana, which is one of the biggest LNG production facilities in the world.

The terminal has six liquefaction trains, which have a total production capacity of approximately 30 million tons per year (mtpa) of LNG. “Liquefication train” is a term that encompasses the various stages necessary to process, purify, and convert natural gas into LNG.

The Sabine Pass LNG terminal also has operational regasification facilities that include five LNG storage tanks, vaporizers, and three marine berths.

Cheniere Energy Partners LP is developing an expansion adjacent to the Sabine Pass project, consisting of up to three natural gas liquefaction trains with an expected total production capacity of about 20 mtpa of LNG.

The partnership also owns the Creole Trail Pipeline, which connects the Sabine Pass LNG terminal with a number of large interstate pipelines.

Cheniere Energy Partners LP’s Q1 Net Income Jumped to $1.9 Billion

For the first quarter ended March 31, Cheniere Energy Partners reported revenues of $2.9 billion, down by 12% from $3.3 billion in the same period of last year. (Source: “Cheniere Partners Reports First Quarter 2023 Results and Reconfirms 2023 Distribution Guidance,” Cheniere Energy Partners LP, May 2, 2023.)

The company’s net income increased significantly to $1.9 billion, from $159.0 million in the first quarter of 2022. The increase was primarily due to non-cash favorable changes in fair value of commodity derivatives and increased volumes of LNG delivered.

The partnership reported that its first-quarter adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) were essentially flat at $1.02 million, compared to $1.03 million in the first quarter of 2022.

In addition to announcing terrific first-quarter results, Cheniere Energy Partners LP reconfirmed its full-year distribution guidance in the range of $4.00 to $4.25 per unit. If the company can afford to increase its payout to the midpoint guidance level, which would be by 26% year-over-year, you know management expects the fabulous earnings growth to continue.

CQP Units’ Distribution Includes Base & Variable Amount

Cheniere Energy Partners stock’s quarterly distribution is made up of a base amount equal to $0.775 per unit and a variable amount that can fluctuate quarter to quarter.

Cheniere Energy Partners LP only switched to a variable distribution in early 2022. The variable part is equal to the remaining cash available per unit, which takes into consideration the amount of money reserved for annual debt repayment and capital allocation goals, anticipated capital expenditures to be funded with cash, and cash reserves to run the business.

On July 28, the partnership declared a cash distribution of $1.03 per share, made up of the base amount of $0.775 per unit and a variable amount of $0.255. That works out to a yield of eight percent. (Source: “Cheniere Partners Declares Quarterly Distributions,” Cheniere Energy Partners LP, July 28, 2023.)

You know CQP stock’s distribution is safe because the partnership raised its full-year distribution guidance to a range of $4.00 to $4.25 per unit. You don’t raise your distribution guidance when you know you can’t afford it. Cheniere Energy Partners can do this because of the ongoing high demand for LNG.

Moreover, Cheniere Energy Partners LP’s payout ratio is just 61.8%, which is far below the 90% threshold I’m willing to stomach. This gives the company more than enough financial wiggle room to raise its variable payout over the coming quarters if it so chooses. It could even elect to raise its base amount.

Cheniere Energy Partners Stock Has 35% Upside Potential

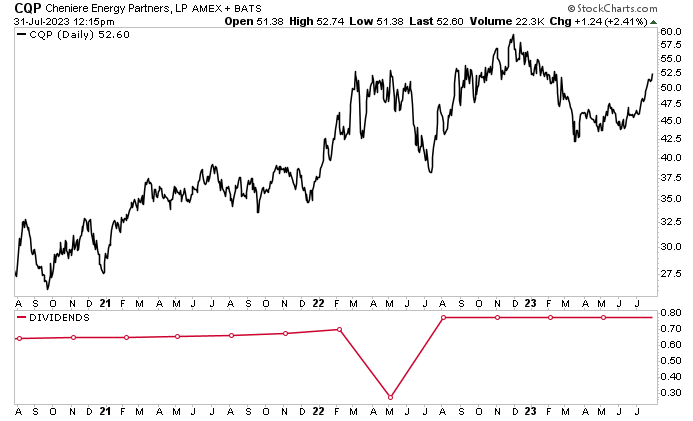

Cheniere Energy Partners units have been on a solid trajectory since the start of 2009, climbing by 4,274% over that time span. Over that period, the price of CQP units has expanded at a compound annual growth rate (CAGR) of 31.1%.

More recently, CQP stock has climbed by:

- 14% over the last month

- 18% over the last three months

- 13% year-over-year

Those are big, juicy gains, and the outlook for Cheniere Energy Partners stock is robust. Wall Street analysts have provided a 12-month high estimate of $71.00 per unit. This points to potential gains of 35%.

Chart courtesy of StockCharts.com

The Lowdown on Cheniere Energy Partners Units

As mentioned earlier, Cheniere Energy Partners LP is the biggest LNG producer and exporter in the U.S. As a result, it has a large, growing infrastructure that helps provide it with stable cash flow.

The high demand for LNG should help the partnership continue generating huge profits, which it passes along to CQP stockholders in the form of rising, high-yield dividends. Strong industry dynamics should also help juice the price of CQP units over the long run.