CareTrust REIT Inc: 5%-Yielder an Income Stock for a Wobbly Stock Market

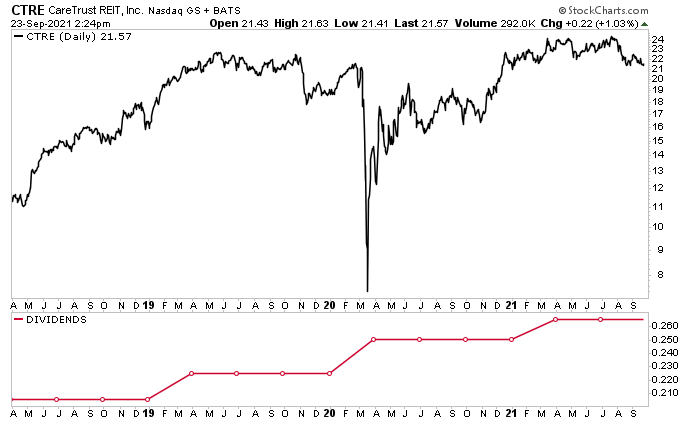

CareTrust Stock Has Raised Dividends Annually Since 2015

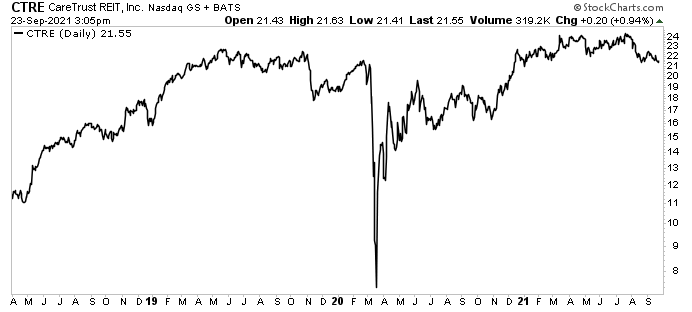

Shares of CareTrust REIT Inc (NASDAQ:CTRE) have made a strong recovery since the March 2020 coronavirus-fueled sell-off. During that stock market crash, CTRE stock cratered by 65%, bottoming at $6.62. By the end of the year, CareTrust stock had essentially erased all of those losses and was up by 16.2%, recovering by 227% since March.

It’s been a different story in 2021. Investors have been fretting over when the Federal Reserve will start tapering its generous monetary policy and when interest rates will start inching higher. Rising inflation and the highly contagious Delta variant of COVID-19 have also been putting a dent in the economic recovery.

All of these headwinds are holding back the bull market, with stocks only making modest gains over the last few months. The wobbly stock market has seen many stocks trade sideways.

CareTrust REIT Inc hasn’t escaped the gravity holding the stock market down. CTRE stock might be up by 30% year-over-year (trailing the S&P 500’s 35% gains), but it’s down by 0.5% year-to-date, meaning so far 2021 has been a wash for CareTrust stock.

Chart courtesy of StockCharts.com

Chart courtesy of StockCharts.com

Despite CTRE stock being flat year-over-year, Wall Street is bullish on the company. Of the analysts providing a 12-month price target for CareTrust stock, their average estimate is $26.00, with a high estimate of $28.00. That suggests potential growth of 20.6% to 30%, respectively.

It also suggests that CTRE stock is poised to grow faster than it has over the last five years. Between 2015 and 2020, CareTrust stock has risen at a compound annual growth rate of 15.2%. (Source: “Investor Presentation: June 2021,” CareTrust REIT Inc, last accessed September 28, 2021.)

Sadly, there’s no crystal ball to tell us where CTRE stock will be in a year. Regardless, income investors can take solace in knowing they can weather the uncertainty with CareTrust stock’s juicy dividend.

Not only that, CTRE stock has been providing raises to investors every year since 2015. It doesn’t matter whether the stock market is rising, falling, or moving sideways—or whether the economy is flourishing or ground to a halt—income hogs know they can rely on CareTrust REIT Inc to pad their bank accounts.

|

Period |

Total Dividends Paid |

|

2021 |

$1.06 |

|

2020 |

$1.00 |

|

2019 |

$0.90 |

|

2018 |

$0.82 |

|

2017 |

$0.74 |

|

2016 |

$0.68 |

| 2015 |

$0.64 |

(Source: “Dividend History,” CareTrust REIT Inc, last accessed September 28, 2021.)

On September 15, the company’s board of directors declared a quarterly dividend of $0.265 per share, or $1.06 on an annual basis. At the current price of CareTrust stock, this represents an annual dividend of five percent.

The company has a history of paying high-yield dividends. The 12-month trailing annual dividend yield is 4.8% and the five-year average dividend yield is 4.4%.

The current payout ratio is just 66%, meaning the dividend is more than safe and CareTrust REIT Inc has more than enough financial wiggle room to raise the payout again in 2022 (if it so chooses).

In 2020, CareTrust REIT had the biggest one-year return of all health-care REITs, with a total return of 13.7%. Second place went to Medical Properties Trust, Inc. (NYSE:MPW), with a total return of 8.9%. The following 13 companies were all in the red.

CareTrust REIT’s three-year total return was 53.2%, and its five-year total return was 157.1%.

Chart courtesy of StockCharts.com

About CTRE Stock

The outlook for CareTrust REIT Inc is solid because the company operates in one of the most in-demand industries.

The skilled nursing facility (SNF) industry had been battling unfavorable demographics for more than a decade. According to CareTrust, based on the birth rates beginning in the 1940s and current SNF utilization in the U.S., the industry is at the beginning of a 20+ year tailwind.

U.S. baby boomers started turning 75 in 2016. The average age for admittance to nursing homes is 79. Moreover, 40% of Americans who reach the age of 65 will move to a nursing home at some point.

CareTrust REIT Inc is a self-administered real estate investment trust (REIT) that owns, acquires, and leases seniors housing and health-care-related properties. The company’s diverse portfolio includes 223 health-care and seniors housing properties in 28 states. The company’s property portfolio consists of 23,345 operating beds/units. (Source: “Investor Presentation: June 2021,” CareTrust REIT Inc, op. cit.)

Those numbers are hardly stagnant. CareTrust is always looking to acquire properties it can lease to a diverse group of local, regional, and national seniors housing operators, health-care services providers, and other health-care-related businesses.

In early August, CareTrust announced that it had acquired two SNFs in the Austin, TX metropolitan area. They are the 119-bed Sedona Trace Health & Wellness Center in Austin and the 122-bed Cedar Pointe Health & Wellness Center in Cedar Park. The properties will be operated by affiliates of Ensign Group Inc (NASDAQ:ENSG), which took over operations on August 1.

100% of Rents Collected in 2021

One of the biggest concerns during the pandemic was how well REITs were doing with their occupancies and their rent collections. CareTrust REIT Inc’s rent collections have been exceptional in 2020 and 2021. Meanwhile, the occupancy rate among the company’s SNFs has been recovering.

Throughout 2020, CareTrust REIT collected 99% of its contractual rent every month. So far in 2021, that figure has hit 100% every month.

The REIT’s occupancy rates have been recovering nicely. In January 2020, the occupancy rates hit a low of 66.9%. Since then, they’ve grown to 69.9%, inching closer to their pre-pandemic occupancy of 77.7%.

That occupancy number should climb over the coming quarters. Greg Stapley, chairman and CEO, noted that there has been a pickup in tours at some of its assisted living facilities. (Source: “CareTrust REIT Announces Second Quarter 2021 Operating Results,” CareTrust REIT Inc, August 5, 2021.)

That doesn’t mean the company is out of the woods yet. The Delta variant of COVID-19 has been sweeping across the country, so skilled nursing and seniors housing providers are still in full pandemic mode.

Nevertheless, the company’s underlying metrics remain strong.

In the second quarter ended June 30, CareTrust REIT Inc collected 100% of its contractual rents, which helped the company report net income of $21.3 million, or $0.22 per share. That was a 12.6% increase over the second-quarter 2020 net income of $18.9 million, or $0.20 per share.

The REIT’s normalized funds from operations (FFO) were up by 11.4% year-over-year at $35.8 million, or $0.37 per share. Its normalized funds available for distribution (FAD) were up by 13.5% at $38.1 million, or $0.40 per share.

CareTrust REIT has more than $24.0 million in cash on hand and $100.0 million outstanding on its revolving credit line, with no scheduled debt maturities prior to 2024.

The company sold approximately 288,000 shares through its at-the-market equity program in the quarter, for gross proceeds of approximately $6.9 million. The current program has approximately $476.5 million in available authorization remaining.

Bill Wagner, CFO, commented, “With substantial availability on our revolver, and equity markets readily accessible to us at present, we continue to have a wide range of capital options for funding our opportunistic growth strategy.” (Source: Ibid.)

The Lowdown on CareTrust REIT Inc

CareTrust REIT Inc is a great health-care company with a diverse portfolio of properties, impeccable rent collection figures, and occupancy levels that are nearing pre-pandemic levels.

CareTrust stock’s performance in 2021 has been a little underwhelming, but its outlook is robust. In the meantime, investors can sit back and enjoy CTRE stock’s high-yield dividend, which the company has raised every year since 2015.