BW LPG Ltd: Outlook Positive for 26%-Yielder on Strong Industry Tailwinds

Energy Prices Rip Higher on Potential Canadian Tariffs

Industry tailwinds are a good reason to keep BW LPG Ltd (NYSE:BWLP), a global leader in liquified petroleum gas (LPG) shipping, on your radar.

The LPG market is experiencing robust growth as the world looks for cleaner, more energy-efficient fuels. LPG, which is known for its low-carbon emissions, is used widely in residential heating, transportation, cooking, and numerous industrial applications.

In 2023, the global LPG market was valued at $157.08 billion. It’s expected to grow 6.5% from 2024 through 2030, reaching more than $244.0 billion. (Source: “LPG Market Size and Growth Outlook to Reach USD 244.11 Billion by 2030,” Industry Today, February 3, 2025.)

Much of that demand is being energized by massive imports from countries such as China, India, and Japan. The U.S. is one of the biggest producers of LPG.

One of the most compelling LPG marine-shipping companies right now is BW LPG Ltd.

With a history that can be traced back to the 1930s, BW LPG is a world leader in LPG shipping. It boasts an operating fleet of 55 vessels: 29 owned Very Large Gas Carriers (VLGCs), 16 operated/chartered VLGCs, eight VLGCs with its India subsidiary, and two chartered medium gas carriers. (Source: “Our VLGC Fleet,” BW LPG Ltd, last accessed February 4, 2025.)

To meet the increased demand for LNG, BW LPG has been expanding its fleet. In 2024, the company took delivery of 12 VLGCs that it acquired from Avance Gas Holding Ltd back in August for $1.05 billion. In 2025, it expects to add an additional 13 VLGCs to its fleet.

With the expanded fleet, BW LPG said that it will maintain a balanced strategy targeting a coverage of 35% to 40% of tis fleet capacity using time charters and freight forward agreements. The current spot market price is trading in the $40,000-per-day range.

Q3 TCE Income of $46,800

For the third quarter ended September 30, BW LPG reported daily time charter equivalent (TCE) income of $46,800 and TCE income of $46,500 per calendar day, with 98% fleet utilization. (Source: “Earnings Presentation Q3 2024,” BW LPG Ltd, December 2, 2024.)

TCE income for the quarter was $145.5 million, with its India subsidiary delivering a stable TCE income of $32.9 million. This resulted in net profit after tax (NPAT) of $120.0 million.

Looking ahead at the time, management expected the market to remain solid for the remainder of 2024 and even in 2025, although it expects rates to fluctuate, which is typical. During the third quarter, spot rates swung from as low as $23,000 per day to $50,000 per day.

With normalized export volumes, freight rates in the U.S. Gulf have found an equilibrium level around the $40,000/day range. This is without congestion in the Panama Canal.

Quarterly Dividend of $0.42/Share

Returning capital to investors through its reliable dividend is a big part of BW LPG’s business plan. It aims for an annual payout ratio of 50% of NPAT. But that could jump to 75% to 100% of NPAT should certain net leverage ratio targets be met.

Since its IPO in 2013, the company has paid out more than 71% of its earnings as dividends. In 2023 alone, it paid out 98% of earnings. BW LPG hasn’t announced its fourth-quarter results at this time, so we don’t know how it did last year just yet. (Source: “Why invest in BW LPG,” BW LPG Ltd, last accessed February 4, 2025.)

It continues to be a dividend powerhouse in 2024. In the third quarter, BW LPG declared a dividend of $0.42 per share, or $3.28 per share on an annual basis, for a forward yield of 26.73%. The third-quarter payout represents 100% of shipping NPAT. (Source: “Key information relating to the cash dividend for Q3 2024,” BW LPG Ltd, December 2, 2024.)

Thanks to the company’s growing fleet, shareholders should be able to look forward to big dividends in the coming quarters. In 2023, BW LPG reported free cash flow (FCF) of $396.6 million. Over the trailing 12 months, FCF has been $553.0 million.

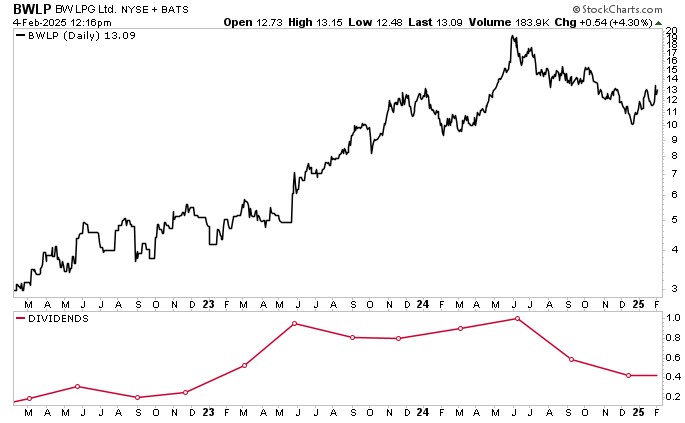

BWLP Stock Up 160% Over the Last 2 Years

The energy sector, including marine shipping stocks, is experiencing renewed interest over President Donald Trump’s proposed tariffs on Canada and Mexico. Potential tariffs have been postponed for a month, but concerns about how energy tariffs will affect the U.S. have juiced some energy stocks.

For example, tariffs against Canada would result in higher gas prices within days, with you and me paying $0.15 per gallon or more at the pump. Depending on the time of year, the U.S. imports roughly five to seven percent of its daily gas supply from Canada. And with some U.S. refineries designed to produce heavy Canadian oil, its not as if the U.S. can just reroute American oil to those refineries. (Source: “U.S. Natural Gas Prices Surge On Canada Tariffs, Massive Withdrawals,” OilPrice, February 3, 2025.)

As a result, BWLP stock has performed well over the last month, rallying 11.5%. The stock is also up 14.7% year to date and 36.8% on an annual basis. That’s the total return, including reinvested dividends. Had a shareholder opted to take the quarterly dividend in cash, the annual return would slip to just 11.5%.

Over the last two years, BLWP has posted total profits of 160%. If an investor didn’t reinvest those dividends, the return would slip significantly to 60%.

Chart courtesy of StockCharts.com

The Lowdown on BW LPG Ltd

BW LPG Ltd is the world’s leading owner and operator of VLGC vessels. It has a strong balance sheet and is expanding its fleet, with management expecting industry dynamics to remain solid for 2025.

Thanks to its solid FCF and NPAT, the company is able to provide investors with a reliable dividend. This includes a $0.42-per-share payout in the third quarter, for a forward yield of 26.73%.

That’s good news, not just for common shareholders, but also for the 149 institutional owners that hold 33.4% of all outstanding BWLP shares. Some of the biggest holders are Acadian Asset Management LLC, Vanguard Group Inc, Barclays plc, JPMorgan Chase & Co, and Goldman Sachs Group Inc.