British American Tobacco Stock: 8.34%-Yielder Beating S&P 500

A Long-Term Dividend-Payer

For income investors, the combination of receiving steady, growing dividends along with capital appreciation is ideal…and that’s what you get with British American Tobacco stock.

There are legacy dividend stocks you can leave in a long-term portfolio and not have to worry about. In my view, this is a prudent strategy of building long-term wealth.

That’s the case with British American Tobacco PLC (NYSE:BTI), a behemoth $78.5-billion-market-cap company that has paid dividends in 27 consecutive years. Not only that, but BTI stock is outperforming the S&P 500 this year, with a 22.1% advance as of August 1.

British American Tobacco is major player in the global tobacco market with its roots reaching back to 1902 in the U.K.

The company sells tobacco and nicotine products to over 170 markets worldwide. In an effort to offset some weakness in the traditional cigarette business, British American Tobacco PLC is also looking to offer products that have less of a health impact. (Source: “Our Business,” British American Tobacco PLC, last accessed August 1, 2024.)

But while the tobacco industry is facing obstacles, Expert Market Research estimates that the global tobacco market could grow to $1.06 trillion by the end of 2032, representing a compound annual growth rate (CAGR) of 2.1% from 2024 to 2032. (Source: “Global Tobacco Market Outlook,” Expert Market Research, last accessed August 1, 2024.)

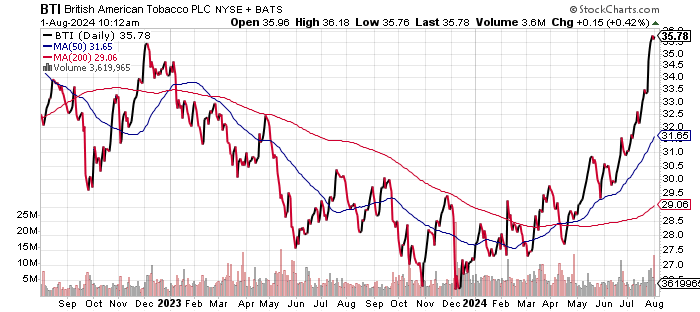

Despite the obstacles in the tobacco market, BTI stock is outperforming the S&P 500, just trading at a 52-week high of $35.91 on July 30. The 10-year high for British American Tobacco stock was $73.41 in June 2017.

Chart courtesy of StockCharts

Revenues Stabilize for This Free Cash Flow Machine

British American Tobacco reports its financial results in the British pound (GBP). In some cases, when the number is reported in the U.S. dollar (USD), I will also display the GBP equivalent based on the exchange of one USD representing 0.78 GBP.

While the company faces some hurdles, British American Tobacco PLC has largely delivered steady revenues and generated consistent profitability and tons of free cash flow (FCF). Note that the revenues translated into the USD represented a record in 2023.

| Fiscal Year | Revenues (Billions) | Growth |

| 2019 | GBP25.87 | N/A |

| 2020 | GBP25.76 | -0.4% |

| 2021 | GDP25.71 | -0.2% |

| 2022 | GDP27.67 | 7.6% |

| 2023 | GDP27.33 | -1.2% |

(Source: “British American Tobacco p.l.c.,” MarketWatch, last accessed August 1, 2024.)

Analysts estimate that British American Tobacco will report revenues of USD$34.14 billion (around GBP26.62 billion) in 2024, followed by 2.7% growth to USD$35.06 billion (around GBP27.35 billion) in 2025. (Source: “British American Tobacco p.l.c. (BTI),” Yahoo! Finance, last accessed August 1, 2024.)

Gross margins have held steady at the 80% handle over the last five years.

| Fiscal Year | Gross Margins |

| 2019 | 82.8% |

| 2020 | 82.7% |

| 2021 | 82.1% |

| 2022 | 82.6% |

| 2023 | 82.1% |

British American Tobacco has been consistently profitable based on generally accepted accounting principles (GAAP) with the exception of the loss in 2023 that was due to a surge in operating expenses.

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2019 | GBP2.40 | N/A |

| 2020 | GBP2.79 | 12.0% |

| 2021 | GBP2.96 | 6.0% |

| 2022 | GBP2.92 | -1.3% |

| 2023 | GBP-6.47 | -321.5% |

(Source: MarketWatch, op. cit.)

On an adjusted basis, the company delivered profits of USD$4.67 per diluted share (around GDP3.64) in 2023. This is expected to come in at USD$4.64 per diluted share (around GDP3.62) in 2024 and USD$4.85 per diluted share (around GDP 3.78) in 2025. (Source: Yahoo! Finance, op. cit.)

The estimates imply that British American Tobacco stock trades at reasonable 7.3 times its consensus 2025 earnings-per-share (EPS) estimate.

A look at the funds statement shows British American Tobacco delivering four consecutive years of higher FCF, including the record in 2023.

The strong FCF allows the company to pay dividends and reduce debt.

| Fiscal Year | FCF (Billions) | Growth |

| 2019 | GBP6.81 | N/A |

| 2020 | GBP7.59 | 11.4% |

| 2021 | GBP7.74 | 2.1% |

| 2022 | GBP8.38 | 8.2% |

| 2023 | GBP8.72 | 4.1% |

(Source: MarketWatch, op. cit.)

British American Tobacco held USD$40.4 billion in total debt and USD$6.6 billion in cash at the end of March. (Source: Yahoo! Finance, op. cit.)

The debt load shouldn’t pose any financial issues at this time given the healthy interest coverage ratio ( except for 2023).

British American Tobacco easily covered its interest payments via higher earnings before interest and taxes (EBIT) from 2020 to 2022. The past year 2023 was likely an outlier.

| Fiscal Year | EBIT (Millions) | Interest Expense (Millions) | Interest Coverage Ratio |

| 2020 | GBP10.46 | GBP1.78 | 5.88X |

| 2021 | GBP10.65 | GBP1.49 | 7.15X |

| 2022 | GBP10.99 | GBP1.66 | 6.62X |

| 2023 | GBP-15.17 | GBP1.89 | N/A |

(Source: Yahoo! Finance, op. cit.)

The Piotroski score, an indicator of a company’s balance sheet, profitability, and operational efficiency, indicates a manageable reading of 4.0 or just below the midpoint of the 1.0-to-9.0 range. The average from 2019 to 2023 was a far better 6.0. I’m not concerned given the FCF and interest coverage.

British American Tobacco Stock’s Dividends Likely to Increase

British American Tobacco stock has paid out dividends in 27 consecutive years while growing dividends in six straight years. The forward dividend yield is a healthy 8.34% despite the strong price appreciation so far in 2024. (Source: Yahoo! Finance, op. cit.)

The company’s forward dividend yield is slightly above the 10-year average dividend yield of 7.69%. The payout ratio of 59.1% is reasonable and suggests higher dividends on the horizon.

| Metric | Value |

| Dividend Growth Streak | 6 years |

| Dividend Streak | 27 years |

| Dividend 7-Year CAGR | 5.8% |

| 10-Year Average Dividend Yield | 8.0% |

| Dividend Coverage Ratio | 2.0 |

The Lowdown on British American Tobacco Stock

The company has proven to be a producer of steady results that allow for dividends and increases.

British American Tobacco stock is a fantastic long-term dividend-payer with the potential for moderate price appreciation.