BP Prudhoe Bay Royalty Trust: This Income Stream Yields 19.6%

Royalty Trust Pays Out 19.6%

Ever feel like it’s impossible to find a decent yield nowadays?

At one time, income investing used to be simple. You just had to save up a decent-sized nest egg and buy a few quality bonds. That would generate more than enough income to fund a comfortable retirement.

Today? Not so much. Yields on safe investments have fallen to record lows. Investors have bid up asset prices so much, it feels like even the devil himself couldn’t find a decent payout. And you start to wonder, “Where the heck can I find a decent yield?”

You might think it would be impossible, but it’s not. You just have to dig a little deeper…

Regular readers know I’m a big fan of a small investment niche called royalty trusts. These special corporations own the mineral rights to mines, oil wells, and other resource properties. They collect the income from the sale of a property’s assets (i.e. oil, gold, natural gas, etc.) and pass on the proceeds to shareholders.

One of my favorites? BP Prudhoe Bay Royalty Trust (NYSE:BPT). Although the company doesn’t get much attention in the investment press, institutional firms have long prized this firm for its large, oversized distribution checks. But retail investors can get in on the action, too.

The business is simple enough to wrap your head around.

BPT owns a collection of oil wells along the Alaska North Slope. The company receives a cut of production, up to a maximum of 90,000 barrels of oil per day.

But unlike regular energy companies, BP Prudhoe Bay Royalty Trust doesn’t explore for new oil wells. Management simply milks existing operations. All of the profits get paid out to shareholders.

And these operations are surprisingly profitable.

Operators drilled these wells decades ago. With all of the needed infrastructure in place, it doesn’t cost much to keep these facilities running.

As a result, the business gushes cash flow. For the month of April, BPT will pay out a quarterly distribution of $1.27 per unit. That comes out to an annual yield of 19.6%.

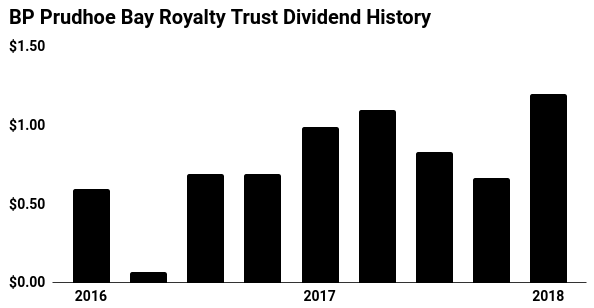

(Source: BP Prudhoe Bay Royalty Trust Investor Relations, last accessed April 13, 2018.)

To be clear, these higher-than-average yields come with higher-than-average risk.

Because production and oil prices vary, so does the distribution. As you can see in the chart above, payments vary wildly from quarter to quarter.

Analysts estimate that BP Prudhoe Bay Royalty Trust only has enough reserves to fund operations until the early 2020s. You could see this timetable extended, thanks to higher oil prices or new technology. Eventually, though, these oil wells—and by extension, the distribution—will run dry.

That said, royalty trusts like BPT still represent lucrative income streams. You just need to understand the risks and pitfalls upfront. And with a dividend yield approaching 20%, income investors should give this name a second look.