Big Yields In the Oil Patch

Oil stocks are about as popular as plane tickets to Florida in August — nobody wants to touch them

Industries go in and out of favor on Wall Street. When a sector falls out of fashion, traders will often dump great assets at firesale prices.

Case in point: the oil patch. Analysts have given up on the energy sector, chasing returns in cryptocurrencies and hot tech stocks. But for investors willing to comb through the market’s discount bin, you can often scoop up a bargain.

BP Prudhoe Bay Royalty Trust (NYSE:BPT) represents a textbook example. The partnership owns a collection of oil wells along the Alaska North Slope, which generate outsized income. And with a yield approaching 23%, units might look tempting for some income hunters.

BP Prudhoe Bay Royalty Trust resembles a true cash cow, first off.

Oil workers completed these wells decades ago. Management has all of the required infrastructures in place.

For owners, it’s time to take it easy and enjoy the fruit of those early investments. Unitholders only need to pay for overhead and routine maintenance. The costs to keep the wells going comes in at around $30.00 per barrel.

Most drillers plow their profits back into operations to grow production. In contrast, BPT is content to milk existing operations for oversized income. Each quarter, they mail out every penny of profit to investors.

You can work out the numbers easily.

BP Prudhoe Bay Royalty Trust is entitled to 14,760 barrels each day. With oil prices over $60.00, owners make a $30.00 profit on each barrel.

Based on some fifth-grade math, you find the trust generates a daily operating profit of $442,800. That number changes with oil prices. And the more units you own, the larger your piece of the action.

This has created quite the income stream for owners.

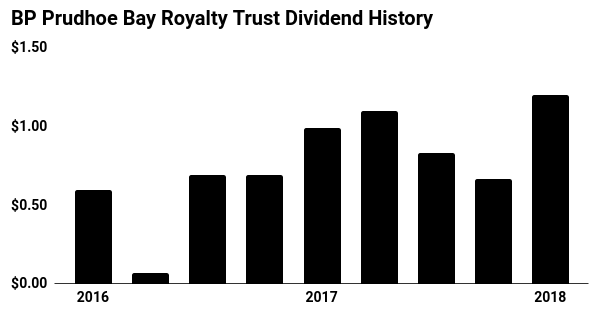

In January, PBT stock paid out a quarterly distribution of $1.23 per unit in distributions. On an annual basis, that comes out to a trailing yield of 23.1%.

(Source: “BP Prudhoe Bay Royalty Trust,” Google Finance, last accessed January 29, 2018.)

Those payments could get even larger. Oil prices have soared over the past few months, recently topping $65.00 per barrel. That means higher profits for BP Prudhoe Bay Royalty Trust, and higher distributions for shareholders.

You can’t call BPT stock a sure thing, of course.

Oil well profits move with energy prices. As you can see in the chart above, shareholders have stomached wild swings in their income.

Moreover, these wells (and by extension these distributions) will eventually run dry. In previous statements, management has said they expect to keep drilling until the early 2020’s. But if we see any recovery in the energy patch, however, these oil wells could stay in operation until 2027.

Bottom line, Wall Street hates the energy sector right now. But for investors willing to pick among the ruble, you can find some juicy payouts here. BP Prudhoe Bay Royalty Trust looks like one of those bargains.