BLMN Stock: A High-Yield Dividend Play the Market’s Overlooking

BLMN Stock: A Rare Gem in the Restaurant Sector

Income investors tend to love stable dividends stocks, and the restaurant sector has some hidden gems these days. While most people focus on traditional dividend-payers like utilities, real estate investment trusts (REITs), and business development companies (BDCs), restaurant stocks can offer solid income potential.

However, opportunities get better when investors disregard them, and restaurant stocks are trading at rock-bottom valuations.

Right now, Bloomin’ Brands Inc (NASDAQ:BLMN) is one such overlooked opportunity.

Despite strong financials and a history of rewarding BLMN stock investors, the company is being treated like we’re in some sort of an economic meltdown—like the one in 2020. Most investors could be missing the big picture here, but, in the process, they could be making BLMN stock a great opportunity for investors with a long-term view.

A Little About Bloomin’ Brands…

Tampa-Florida-based Bloomin’ Brands owns and operates a portfolio of well-known casual dining restaurants, both here in the U.S. and internationally. It operates through two business segments: U.S. and International Franchise.

Bloomin’ Brands has four concept restaurants:

- Outback Steakhouse, a casual steakhouse

- Carrabba’s Italian Grill, offering authentic Italian cuisine

- Bonefish Grill, which specializes in market-fresh fish from around the world hand-cut in-house every day

- Fleming’s Prime Steakhouse & Wine Bar, a classic American steakhouse

The company has more than 1,450 restaurants in 46 states, as well as in Guam and 12 countries. (Source: “Our Brands,” Bloomin’ Brands Inc, last accessed March 18, 2025.)

In order to stay competitive, Bloomin’ Brands has expanded into digital ordering as well. Furthermore, it is continuously improving its takeout and delivery services and on the efficiency of its restaurants.

Bloomin’ Brands’ Financials Hurt, But Not Broken

Last month, Bloomin’ Brands reported its financial results for the fourth quarter and full year of 2024. At the time, Mike Spanos, the newly appointed chief executive officer (CEO) of the company, said, “In my first six months, I have become even more confident that we have iconic brands with a strong right to succeed in on-trend, large scale categories.”

He added, “I am also aware that our current results are not what we expect and are not representative of our potential. We are making changes to address our near-term execution as well as drive sustainable sales and profit growth. Our guidance for the first quarter and full year is reflective of where we are and our go-forward short-term performance.” (Source: “Bloomin’ Brands Announces 2024 Q4 Financial Results,” Bloomin’ Brands Inc, February 26, 2025.)

As you can tell from the tone of Bloomin’ Brands’ CEO, the financial performance hasn’t been that great, and the near-term outlook isn’t that rosy either. And investors at the moment don’t like what the company is saying.

Wall Street analysts aren’t too excited either. They’re currently projecting a big decline in revenue in 2025, but stability in 2026.

Here’s the thing though: Bloomin’ Brands remains profitable. It was profitable in 2024, and it’s expected to remain profitable in 2025 and 2026. In fact, the company’s profitability is expected to increase between 2025 and 2026. (Source: “Analysis,” Yahoo! Finance, last accessed March 18, 2025.)

In addition to this, Bloomin’ Brands continues to generate cash flow from operations. This is where dividends come from for BLMN stock. In 2024, the company generated $216.0 million from operations.

BLMN Stock Offers an Attractive Dividend Yield

For income investors, dividends are the real reason to keep an eye on BLMN stock. Bloomin’ Brands has a strong track record of paying reliable, high-yield dividends, a rare trait in the restaurant sector.

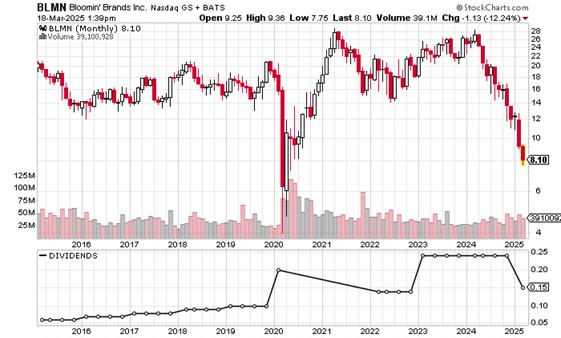

Currently, BLMN stock offers a dividend yield of over 10%, while the five-year average dividend yield is about 2.2%, making it an appealing choice for those looking to generate passive income.

How much income can be generated with BLMN stock?

Its most recently quarterly payment was $0.15 per share, for an annual dividend of $0.60 per share. It means investors can generate $60.00 per 100 shares bought.

With strong free cash flow, the company is well-equipped to maintain and even grow its dividend in the future. The payout ratio remains conservative, reducing the risk of another dividend cut.

Chart courtesy of StockCharts.com

The Lowdown on BLMN Stock

Despite the market’s current skepticism towards BLMN stock, it remains a decent, high-quality dividend stock. Bloomin’ Brands is financially strong, manages costs effectively, and continues to reward shareholders with a solid dividend.

With BLMN stock trading at a discount, income investors have a chance to grab an overlooked gem. The market fears could be overblown, making this an ideal time to scoop up shares while collecting a reliable stream of passive income.

Lastly, BLMN stock could be a contender for a short squeeze, as close to 17% of the entire float (shares available for trading) are currently short. (Source: “Statistics,” Yahoo! Finance, last accessed March 18, 2025.)

This could make the upside on BLMN stock much better.