BCE Stock: Steady 8.9%-Yielder on 54-Year Dividend Streak

BCE Stock’s Share-Price Weakness Presents Compelling Risk/Reward Opportunity

One of the top criteria I look for in income stocks is the stability of a company over long periods of time and the ability to pay consistent dividends. That’s what we have with BCE Inc (NYSE:BCE), the biggest telecommunications company in Canada.

The company offers the typical range of services associated with telecommunications companies, such as mobile, Internet, and streaming television solutions. BCE also owns Bell Media, which has interests in widely recognized television and radio assets. (Source: “BCE Overview,” BCE Inc, last accessed June 19, 2024.)

BCE Inc operates in what’s essentially a duopoly in Canada, meaning there are only two major nationwide players in its industry. This gives the company advantages, such as in its pricing.

But while the company holds a leading role in the Canadian telecommunications market, it has struggled to generate consistent financial growth.

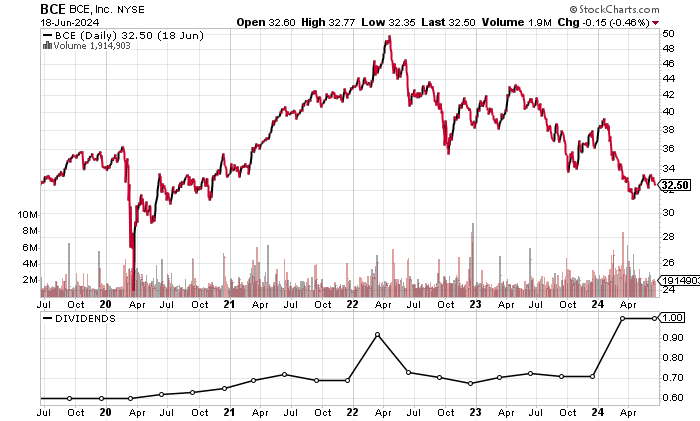

The result has been BCE stock declining by 17.5% in 2024 and 28.0% over the past year (as of this writing). On June 19, BCE stock was trading at $32.50, which was just above its 52-week low of $31.82 and 29.3% below its 52-week range high of $46.02. (Source: “BCE Inc. (BCE),” Yahoo! Finance, last accessed June 19, 2024.)

The major share-price deterioration provides a good risk/reward opportunity for contrarian income investors who are willing to wait for the share price to rise while being rewarded with steady dividends.

Chart courtesy of StockCharts.

BCE Inc Needs to Generate Higher Profits

BCE’s revenues have come in within the CA$22.0–CA$25.0 billion range for the last five years, with single-digit-percentage growth over the last three years. Its revenue growth rate is typical of what you’d expect from a large company in the telecommunications sector.

| Fiscal Year | Revenues (Billions) | Growth |

| 2019 | CA$23.79 | N/A |

| 2020 | CA$22.88 | -3.8% |

| 2021 | CA$23.45 | 2.5% |

| 2022 | CA$24.17 | 3.1% |

| 2023 | CA$24.67 | 2.1% |

(Source: “BCE Inc.” MarketWatch, last accessed June 19, 2024.)

BCE’s gross margins have consistently been above 40%, including a five-year best of 43.9% in 2023. With interest rates expected to decline, I would expect the company’s gross margins to continue to be strong.

| Fiscal Year | Gross Margin |

| 2019 | 42.8% |

| 2020 | 42.8% |

| 2021 | 43.0% |

| 2022 | 43.5% |

| 2023 | 43.9% |

On the bottom line, BCE Inc has largely reported generally accepted accounting principles (GAAP) profits.

As you can see in the following table, the lack of consistent growth in the company’s GAAP-diluted earnings per share (EPS) has been an issue. BCE reported a five-year low of $2.28 per diluted share for 2023, which led to share-price deterioration.

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2019 | CA$3.37 | N/A |

| 2020 | CA$2.53 | -25.0% |

| 2021 | CA$2.99 | 18.2% |

| 2022 | CA$2.98 | -0.3% |

| 2023 | CA$2.28 | -23.6% |

(Source: Ibid.)

BCE Inc’s free cash flow (FCF) has consistently been over CA$3.0 billion, and it rose in 2022 and 2023. The high FCF will allow the company to continue paying its healthy dividends and invest in improving its operations.

| Fiscal Year | FCF (Billions) | Growth |

| 2019 | CA$3.98 | N/A |

| 2020 | CA$3.55 | -10.8% |

| 2021 | CA$3.17 | -10.7% |

| 2022 | CA$3.23 | 1.9% |

| 2023 | CA$3.37 | 4.1% |

(Source: Ibid.)

BCE Inc’s balance sheet shows the company holding CA$31.1 billion in debt and CA$1.8 billion in cash and short-term investments. (Source: Ibid.)

The company’s debt isn’t a problem, and is typical of what you’d find in a heavy capital-intensive business. BCE’s healthy amount of cash provides a nice cushion so the company can ride out any issues.

The company has consistently covered its interest expenses via higher earnings before interest and taxes (EBIT). BCE Inc’s interest coverage ratio of 3.2 times at the end of 2023 suggests the company can easily pay its interest expenses.

| Fiscal Year | EBIT (Billions) | Interest Expense (Billions) |

| 2020 | CA$4.42 | CA$1.16 |

| 2021 | CA$5.05 | CA$1.11 |

| 2022 | CA$5.07 | CA$1.18 |

| 2023 | CA$4.84 | CA$1.52 |

(Source: Yahoo! Finance, op. cit.)

BCE’s Piotroski score—an indicator of a company’s balance sheet, profitability, and operational efficiency—is a reasonable 5.0, which is just above the midpoint of the Piotroski score’s range of 1.0 to 9.0.

No Concern With BCE Stock’s Dividends

BCE Inc’s forward dividend yield of 8.93% (as of this writing) is above its five-year average dividend yield of 5.98%. (Source: Yahoo! Finance, op. cit.)

The current high yield is largely due to BCE stock’s share-price deterioration and will likely move lower as the stock rallies.

| Metric | Value |

| Dividend Streak | 54 Years |

| 7-Year Dividend Compound Annual Growth Rate | 5.1% |

| 10-Year Average Dividend Yield | 6.7% |

| Dividend Coverage Ratio | 2.1 |

The Lowdown on BCE Inc

Most of the major telecommunication companies in Canada and the U.S. have been struggling to grow. The high interest rate environment has put pressure on their profitability.

But with a more favorable interest rate outlook, companies like BCE Inc should benefit. In the meantime, BCE stockholders receive nice dividends and an above-average opportunity for share-price appreciation.