BCE Stock: 10.61%-Yielder Pursues Major Change

A 54-Year-Dividend-Payer for Contrarian Investors

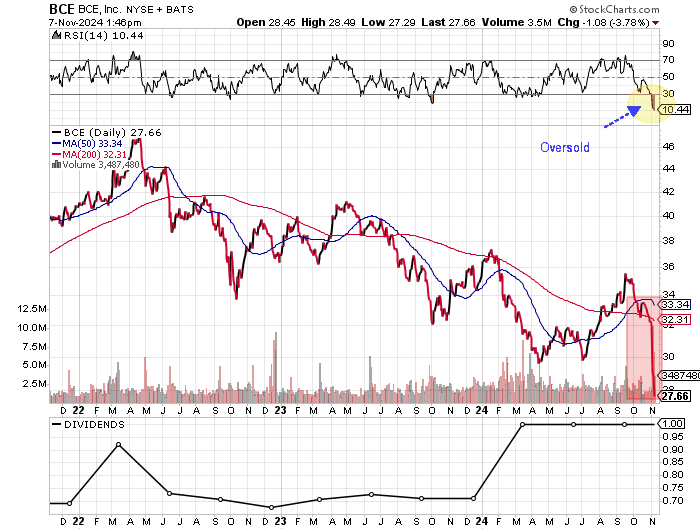

The past year has been terrible for investors in BCE Inc (NYSE:BCE). BCE stock is down 29.8% this year, including a 15.8% drop over the last month (to November 7).

At the root of the company’s problem is its failure to generate organic growth. BCE is about to try to change that, but it won’t be easy.

For the income investor, investing in BCE stock means collecting a regular quarterly dividend and hoping that the company can turn things around.

BCE Inc is the largest telecommunications company in Canada with broad interests in mobile, internet, and streaming television. (Source: “BCE Overview,” BCE Inc, last accessed November 7, 2024.)

But, so far, the company has failed to drive the kind of organic growth investors want to see. In an attempt to remedy this, BCE has made several significant changes that may or may not work out.

Chart courtesy of StockCharts.com

Focusing on Core Fiber Business to Drive Growth

The first major strategy shift was the seemingly sudden divestiture of BCE Inc’s 37.5% ownership stake in Maple Leaf Sports and Entertainment for $4.7 billion Canadian (CAD) to Rogers Communications Inc (NYSE:RCI). The deal still needs to be approved, but this is expected to happen by mid-2025. (Source: “Canadians can count on TSN for Toronto Maple Leafs and Toronto Raptors game action through access to content rights for 20 years; BCE sells its minority stake in MLSE,” BCE Inc, September 18, 2024.)

The decision of BCE to sell what has been a growth area in sports entertainment, specifically its interest in the Toronto Maple Leafs and Toronto Raptors franchises, was surprising.

To help with the transition, BCE Inc will maintain the right to broadcast the games of the two teams for the next 20 years.

While the sale will not be cleared until 2025, BCE has already pursued a major acquisition. The company’s wholly-owned subsidiary, Bell Canada, will spend a major portion of the proceeds to acquire 100% of U.S.-based Ziply Fiber in a deal valued at around CAD$5.0 billion (US$3.65 billion) in cash and the assumption of around CAD$2.0 billion in debt.

After/if the acquisition is approved (which is expected in the second half of 2025), BCE will expand its fiber business to the U.S. Ziply Fiber is a major provider of fiber internet in the Pacific Northwest, with about 1.3 million fiber locations located in four states. (Source: “BCE to acquire Ziply Fiber, accelerating its fibre growth strategy across North America,” BCE Inc, November 4, 2024.)

There are plans to grow this by another three million fiber locations during the next four years. By 2028, Bell estimates it will be the third-largest fiber internet provider in North America.

“This acquisition marks a bold milestone in Bell’s history as we lean into our fibre expertise and expand our reach beyond our Canadian borders. Fibre is at the heart of what we do, and we’re proud to connect people and businesses and enable them to do more through our fibre networks. By bringing together Bell and Ziply Fiber’s exceptional talent, we’ll accelerate our growth while continuing to deliver significant value for our customers and shareholders,” said Mirko Bibic, BCE’s president and chief executive officer.

Work-in-Progress in Soft Third Quarter

BCE Inc reported a soft third quarter, which lends support to the fact that the company needs to make changes to try to reenergize growth. (Source: “BCE reports third quarter 2024 results,” BCE Inc, November 7, 2024.)

Its operating revenues came in at CAD$5.97 billion in the third quarter, down 1.8% versus the third quarter in 2023.

BCE’s adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) of CAD$2.72 billion was a 2.1% year-over-year increase, but adjusted earnings per share fell 7.4% to CAD$0.75.

The company’s free cash flow jumped 20.3% to CAD$832.0 million due to BCE making fewer capital expenditures.

BCE also lowered its guidance for 2024, which is not what investors want to see.

These results support the company’s decision to divest non-core assets and focus on its fiber assets.

BCE Inc is betting on success in the U.S. amid added regulatory issues in Canada. Whether this will work out will take time to determine. This adds risk to the shares.

BCE Stock’s Dividend Growth to Be Paused

BCE stock paid out US$2.92 per share in dividends over the last four quarters, with its last payment being US$0.734 per share in September.

Given the price deterioration in BCE stock, the forward dividend yield based on the recent payment has jumped to 10.61%, well above the five-year average dividend yield of 6.27%.

There are clearly concerns with the company’s soft operating results and whether its recent strategic moves will be successful. Less than positive results could force BCE to reduce its dividend.

At this point, BCE stock is maintaining its annual dividend of around US$2.90 per share at least through 2025. After this, the situation could change once the proposed deals have been completed (which should give us a better sense of their success).

BCE Inc has indicated that it will pause its dividend growth. The company wants to see its dividend payout ratio and net debt leverage ratios move lower towards its target policy ranges.

The Lowdown on BCE Stock

The major price deterioration in BCE stock provides a decent risk/reward for contrarian income investors willing to wait for the company’s strategic moves to pan out, while being rewarded with dividends.