10.9%-Yielding Bain Capital Specialty Finance Stock’s Dividend Raised 3x in 12 Months

Why BCSF Stock Is Attractive

High interest rates are only good for business development companies (BDCs) if they have a lot of floating-rate loans. Fortunately for Bain Capital Specialty Finance Inc (NYSE:BCSF), 94.8% of its $2.0-billion total investment portfolio consists of senior secured, floating-rate loans.

That has helped the company report double-digit net investment income growth and high earnings, as well as increase its quarterly dividends. It has also helped juice Bain Capital Specialty Finance stock’s price.

What exactly is a BDC?

At Income Investors, we refer to BDCs as “alternative banks.” That’s because they operate like traditional financial institutions but, unlike regular banks, don’t serve the general public. BDCs have no branches or ATMs, and they don’t provide mortgages, checking accounts, or credit cards.

Instead, BDCs have carved out a lucrative niche in the financing marketplace: lending capital to small and midsized private companies. These clients need more funds than those typically provided by traditional bank loans.

Big Wall Street banks shun small and midsized companies because they aren’t large enough to go public. Therefore, BDCs fit right into the “sweet spot” of the U.S. financial sector, the huge gap between commercial and investment banks.

When I say “small and midsized” companies, I’m not talking about your local corner store or diner. BDCs typically lend capital to companies that generate between $20.0 and $100.0 million in yearly sales. Three well-known clients of BDCs are Impossible Foods Inc., Rug Doctor, and Smashburger, Inc.

While BDCs are a lifeline for businesses that need an influx of cash, they’re also a boon for dividend hogs. BDCs legally have to pay out at least 90% of their taxable income to investors as dividends. And the dividend yields can be quite high, averaging 10.7%. That’s more than twice the yield of the broader financial sector and significantly higher than the 1.5% average yield on the S&P 500.

That explains why BDCs have remained one of Wall Street’s best-kept secrets for years.

About Bain Capital Specialty Finance Inc

Bain Capital Specialty Finance is a BDC that specializes in direct loans to middle-market companies in North America, Europe, and Australia.

It typically invests in companies with earnings before interest, taxes, depreciation and amortization (EBITDA) between $10.0 and $150.0 million. The BDC seeks out senior investments involving a first or second lien on collateral, a senior first lien, mezzanine debt, etc. (Source: “Bain Capital Specialty Finance, Inc. (BCSF),” Yahoo! Finance, last accessed August 22, 2023.)

Its diverse portfolio comprises investments in 142 companies in 30 industries. By industry, its largest investments include aerospace and defense; high tech; business services; consumer goods; healthcare and pharmaceuticals; and transportation. (Source: “Second Quarter Ended June 30, 2023 Earnings Presentation,” Bain Capital Specialty Finance Inc, August 9, 2023.)

The weighted average yield at amortized cost on Bain Capital Specialty Finance Inc’s investment portfolio is 12.8%.

Q3 Net Investment Income Jumped 20%

For the third quarter of fiscal 2023, ended June 30, Bain Capital Specialty Finance announced that its net investment income climbed by 20% quarter-over-quarter to $38.9 million, or $0.60 per share. Its total investment income inched up by 1.3% sequentially to $75.7 million. (Source: “Bain Capital Specialty Finance, Inc. Announces June 30, 2023 Financial Results and Declares Third Quarter 2023 Dividend of $0.42 per Share,” Bain Capital Specialty Finance Inc, August 8, 2023.)

The company’s third-quarter net income was flat quarter-over-quarter, at $0.45 per share, but was up by 66.6% from its net income in the same period of last year, which was $0.27 per share.

For the three months ended June 30, Bain Capital Specialty Finance invested $197.5 million in 46 companies, including $119.8 million in six new companies.

Commenting on the results, Bain Capital Specialty Finance Inc’s CEO, Michael Ewald, noted, “Our net investment income increased 20% quarter-over-quarter driven by the continued benefits of higher interest rates across our well-diversified portfolio of largely senior secured, floating rate loans.” (Source: Ibid.)

Quarterly Dividend Raised 23% YOY to $0.42/Share

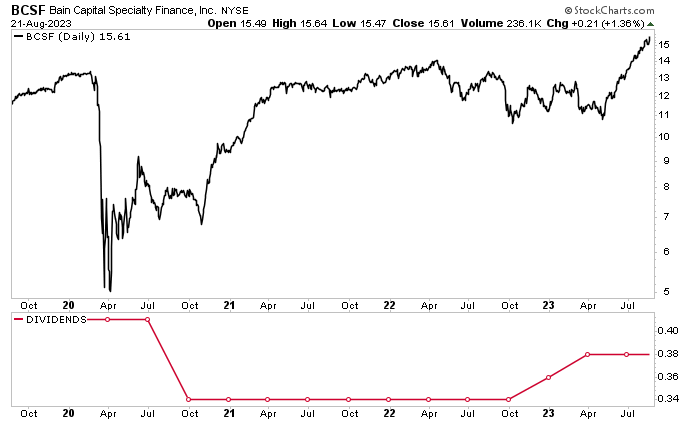

As a result of Bain Capital Specialty Finance Inc’s high earnings and the continued stable credit performance across its high-quality portfolio, the company’s board raised BCSF stock’s regular quarterly dividend by 10.5% quarter-over-quarter and 23% year-over-year to $0.42 per share, for a yield of 10.91%.

Perhaps equally as impressively, the dividend boost was Bain Capital Specialty Finance stock’s third dividend increase in the past 12 months. (Source: “Stock Information,” Bain Capital Specialty Finance Inc, last accessed August 22, 2023.)

With a payout ratio of 83.4%, there’s certainly room for Bain Capital Specialty Finance to increase its payout over the coming quarters.

Moreover, the company’s high earnings have been helping energize its share price, which is up by 28% over the last month and 39% year-to-date. BCSF stock hit an all-time high of $15.85 on August 10 and continues to have big long-term growth potential.

Chart courtesy of StockCharts.com

The Lowdown on Bain Capital Specialty Finance Inc

Bain Capital Specialty Finance Inc is a fabulous BDC that throws off a lot of money.

Its management has been reporting wonderful financial results and has raised its high-yield dividends three times over the last 12 months. Thanks to high interest rates and the company’s senior secured, floating-rate loans, there’s every possibility that the company will raise Bain Capital Specialty Finance stock’s dividend again in the near term.