Atlantica Stock: 8.09%-Yielder Nears 52-Week High

Renewable Energy Stocks Are the Future

Have you ever heard of AY stock?

If not, you need to know about this energy pick.

The weak July jobs report and evidence that the U.S. economy is stalling may pressure the Federal Reserve to start cutting interest rates at the next Federal Open Market Committee (FOMC) meeting in September. Of course, the Fed will also need to see inflation continue to cool.

In my view, the Fed has mismanaged the yield curve, but hopefully it won’t send the county into a tailspin.

As interest rates ratchet lower in 2024 and 2025, so will the return on treasury bills. Investors accustomed to the high interest income will need to consider high-dividend-yielding stocks to generate the income required.

This is where a company like Atlantica Sustainable Infrastructure PLC (NASDAQ:AY) comes in. The mid-cap stock has paid dividends in 11 consecutive years, raising its dividends in the last seven straight years.

The sustainable infrastructure company focuses on renewable energy projects. Atlantica’s current portfolio comprises 2.2 gigawatt (GW) of operating assets. The company’s projects in development include around 2.0 GW of renewable energy and 5.8 GWh of storage.

Atlantica’s objective is to drive sustainable infrastructure projects while delivering long-term value to investors. (Source: “Company Overview,” Atlantica Sustainable Infrastructure PLC, last accessed August 6, 2024.)

Atlantica stock pays out $1.78 per share in annual dividends and yields a nice 8.09%. So, you can collect the dividends and wait for AY stock to once again move towards its 10-year high of $48.49, last achieved in January 2021. The stock is just below its 52-week high of $23.57 in August 2023.

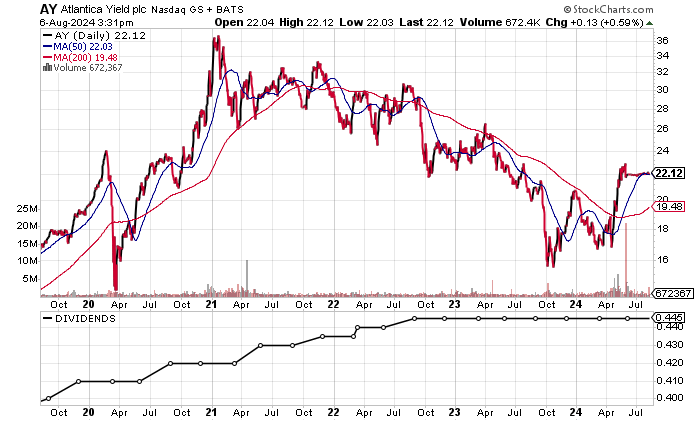

The chart shows Atlantica stock in a golden cross formation. This is a bullish technical crossover when the 50-day moving average (MA) is above the 200-day MA.

Chart courtesy of StockCharts.com

A Free Cash Flow Machine

Atlantica Sustainable Infrastructure PLC has consistently delivered over $1.0 billion in annual revenues, with growth. The period best was $1.21 billion in 2021, followed by $1.1 billion in 2022, prior to a slight decline in 2023.

| Fiscal Year | Revenues (Billions) | Growth |

| 2019 | $1.01 | -6.2% |

| 2020 | $1.01 | 0.2% |

| 2021 | $1.21 | 19.6% |

| 2022 | $1.10 | -9.1% |

| 2023 | $1.10 | -0.2% |

(Source: “Atlantica Sustainable Infrastructure plc,” MarketWatch, last accessed August 6, 2024.)

Analysts estimate that Atlantica will to continue to grow its revenues to $1.18 billion in 2024 and $1.23 billion in 2025. (Source: “Atlantica Sustainable Infrastructure plc (AY),” Yahoo! Finance, last accessed August 6, 2024.)

Revenues in the second quarter jumped 35.1% to $328.3 million. (Source: MarketWatch, op. cit.)

On the bottom line, the company reported three straight years of generally accepted accounting principles (GAAP) profits prior to losses in 2021 and 2022. Its profits rebounded with an impressive jump in 2023.

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2019 | $0.61 | 47.0% |

| 2020 | $0.12 | -81.2% |

| 2021 | -$0.27 | -334.0% |

| 2022 | -$0.05 | 82.5% |

| 2023 | $0.37 | 886.3% |

(Source: MarketWatch, op. cit.)

Analysts expect Atlantica Sustainable Infrastructure to deliver higher earnings of $0.55 per diluted share in 2024, followed by $0.64 per diluted hare in 2025.

There are also high estimates of $1.03 and $1.24 per diluted share in 2024 and 2025, respectively. (Source: Yahoo! Finance, op. cit.)

The second quarter saw the company deliver a 497.4% surge in earnings to $0.18 per diluted share. (Source: MarketWatch, op. cit.)

Looking at the funds statement, Atlantica has consistently generated positive free cash flow (FCF) to the five-year high of $654.0 million in 2022. FCF fell in 2023.

| Fiscal Year | FCF (Millions) | Growth |

| 2019 | $363.6 | -9.3% |

| 2020 | $460.5 | 26.7% |

| 2021 | $540.5 | 17.4% |

| 2022 | $654.0 | 21.0% |

| 2023 | $422.4 | -35.4% |

(Source: MarketWatch, op. cit.)

The major risk for Atlantica is the debt of $5.46 billion at the end of June. However, the company also holds $355.5 million in cash. (Source: Yahoo! Finance, op. cit.)

For now, the financial situation is okay. The company used its FCF to reduce debt by $647.7 million in 2023 while issuing $374.8 million in new debt. (Source: MarketWatch, op. cit.)

The table shows that Atlantica covered its interest expense via a higher earnings before interest and taxes (EBIT) in three of the last four years.

The interest coverage ratio improved to 1.11 times in 2023 versus 2021 and 2022.

| Fiscal Year | EBIT (Millions) | Interest Expense (Millions) | Interest Coverage Ratio |

| 2020 | $358.0 | $316.2 | 1.13X |

| 2021 | $327.9 | $302.6 | 1.08X |

| 2022 | $280.3 | $292.0 | 0.96X |

| 2023 | $387.6 | $350.3 | 1.11X |

(Source: Yahoo! Finance, op. cit.)

A look at the Piotroski score, an indicator of a company’s balance sheet, profitability, and operational efficiency, shows a strong reading of 8.0 for the company, just a notch below the top of 1.0–9.0 range. Atlantica’s Piotroski score averaged 7.0 from 2019 to 2023.

Atlantica Stock: Impressive Dividend Growth

Atlantica stock’s annual dividend of $1.78 per share represents a forward yield of 8.09%. The higher yield versus the five-year average of 6.27% is due to the price declining from the January 2021 high. (Source: Yahoo! Finance, op. cit.)

The dividend coverage ratio of 1.9 times suggests that the dividend streak should be intact.

| Metric | Value |

| Dividend Growth Streak | 7 years |

| Dividend Streak | 11 years |

| Dividend 7-Year CAGR | 9.5% |

| 10-Year Average Dividend Yield | 7.9% |

| Dividend Coverage Ratio | 1.9 |

The Lowdown on Atlantica Stock

AY stock has extremely high insider ownership at 42.3% of the outstanding shares. This is significant, incentivizing insiders to improve operations and generate shareholder value. (Source: Yahoo! Finance, op. cit.)

Institutional ownership of Atlantica stock is moderate at 48.6% of the outstanding shares. Among the 266 institutions holding AY stock, Lazard Asset Management LLC is the top holder, with an 8.74% stake. (Source: Yahoo! Finance, op. cit.)

Atlantica stock provides income investing with a nice, high dividend yield and the potential for above-average price appreciation.