ASC Stock Yields 10.2%…with 48.9% Upside?

Opportunity for Contrarian Income Investors

The maritime shipping business has many barriers to entry due to the high cost of capital investment required to buy cargo ships. But once these companies are established, they can deliver steady revenues while generating profits and free cash flow (FCF). As income investors know, this helps support dividend payments.

A small-cap maritime shipper with sound fundamentals to consider is Ardmore Shipping Corp (NYSE:ASC).

The company began its operations in 2010, operating product and chemical tankers that move goods around the world. (Source: “About,” Ardmore Shipping Corp, last accessed October 24, 2024.)

But while Ardmore Shipping is producing some decent results, ASC stock has fallen 28.4% over the last three months as of the time of writing on October 24.

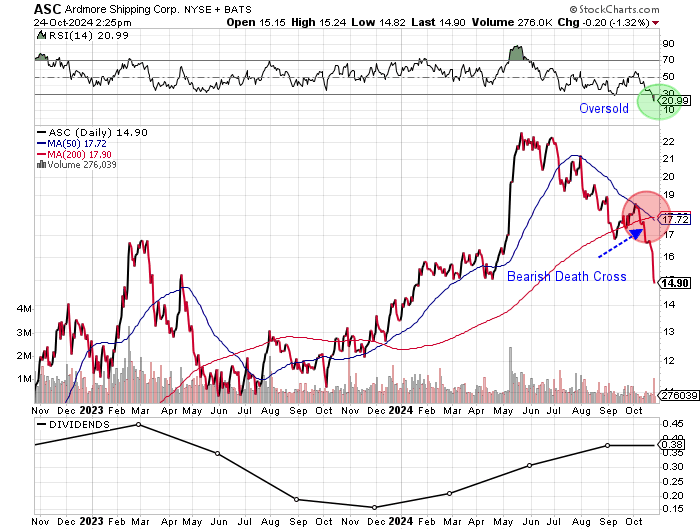

The chart below shows that ASC stock is in a technically oversold position following the emergence of a death cross. Watch for some support. ASC stock’s record high was $23.44 in May 2024.

Chart courtesy of StockCharts.com

Strong Second Half Results

Ardmore Shipping’s revenue picture shows mixed results with growth in only two of the last five years, including an 11.2% decline in 2023. The record high point for revenues was $445.7 million in 2022.

Despite the soft result in 2023, it was still the company’s second highest on record. The compound annual growth rate (CAGR) was a sound 14.5% during this period.

| Fiscal Year | Revenues (Millions) | Growth |

| 2019 | $230.0 | 9.5% |

| 2020 | $220.1 | -4.3% |

| 2021 | $192.5 | -12.5% |

| 2022 | $445.7 | 131.6% |

| 2023 | $396.0 | -11.2% |

(Source: “Ardmore Shipping Corporation,” MarketWatch, last accessed October 24, 2024.)

But there appears to be some reason for caution ahead, mainly due to the condition of the global economy.

Analysts expect Ardmore Shipping Corp to report revenue contraction of 4.6% to $378.2 million in 2024, albeit there’s a high estimate of $478.0 million. For 2025, the consensus revenue estimate is expected to fall another 21.9% to $295.4 million, with a high estimate of $445.0 million. (Source: “Ardmore Shipping Corporation (ASC),” Yahoo! Finance, last accessed October 24, 2024.)

So far, the company reported revenues of $227.6 million in the first half to June, up 8.3% versus the same period in 2023. This is on target to beat the consensus for 2024.

A big improvement for Ardmore Shipping were the significant gross margin exonerations in 2022 and 2023. These represent record highs, which is positive for the company’s profitability and FCF.

| Fiscal Year | Gross Margins |

| 2019 | 29.0% |

| 2020 | 31.2% |

| 2021 | 16.1% |

| 2022 | 47.7% |

| 2023 | 45.8% |

On the bottom line, after generally accepted accounting principles (GAAP) losses from 2019 to 2021, the company came back with two strong years of high profitability, including the record in 2022.

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2019 | -$0.69 | 47.3% |

| 2020 | -$0.18 | 73.7% |

| 2021 | -$1.12 | -518.0% |

| 2022 | $3.52 | 413.2% |

| 2023 | $2.71 | -23.0% |

(Source: MarketWatch, op. cit.)

A bright spot is that, despite the declining revenues, analysts expect Ardmore Shipping to deliver higher earnings of $3.57 per diluted share in 2024 prior to dropping to $2.71 per diluted share in 2025. Note that there’s a high estimate of $3.94 per diluted share for 2025. (Source: Yahoo! Finance, op. cit.)

Ardmore’s second quarter, which saw profits of $1.13 per diluted share, or 10.8% above the consensus, was the fourth straight quarter in which it beat estimates. Its first-half earnings of $2.39 per diluted share were 115% higher than in the comparative first half in 2023.

Moving to the funds statement, Ardmore Shipping delivered positive FCF in four of the five years, including a record $134.2 million in 2023. This is positive for ASC stock’s dividends.

| Fiscal Year | FCF (Millions) | Growth |

| 2019 | $15.4 | N/A |

| 2020 | $24.9 | 61.6% |

| 2021 | -$6.6 | -126.5% |

| 2022 | $116.9 | 1,873.1% |

| 2023 | $134.2 | 14.8% |

(Source: MarketWatch, op. cit.)

As I mentioned earlier, the maritime shipping industry entails high capital expenditures, but the company’s balance sheet is strong.

Working capital is strong, and Ardmore Shipping held $47.4 million in cash and total debt of $53.5 million at the end of June. The total debt to equity of 8.2% is strong. (Source: Yahoo! Finance, op. cit.)

Ardmore Shipping covered its interest payments via higher earnings before interest and taxes (EBIT) in three of the last four years. The interest coverage ratio of 11 times in 2023 supports a sound financial position.

| Fiscal Year | EBIT (Millions) | Interest Expense (Millions) | Interest Coverage Ratio |

| 2020 | $10.6 | $16.4 | 0.7X |

| 2021 | -$21.8 | $14.8 | N/A |

| 2022 | $156.3 | $17.5 | 8.9X |

| 2023 | $130.0 | $11.8 | 11.0X |

(Source: Yahoo! Finance, op. cit.)

ASC Stock’s Dividends Look Safe; Could Edge Higher

Ardmore Shipping raised its quarterly dividend for the third straight time to $0.38 per share for the August payment versus $0.31 per share in May, $0.21 per share in February, and $0.16 per share in November 2023. Its forward dividend yield is 10.2% compared to the prior 7.1% for the trailing four quarters.

ASC stock’s payout ratio is 56.1% of 2023 earnings; if it holds, it will fall to a more reasonable 42.6% its estimated 2024 earnings per share (EPS). The dividend could rise, especially given the strong dividend coverage ratio of four times.

| Metric | Value |

| Dividend Streak | 2 years |

| Dividend Growth Streak | 1 year |

| Dividend 7-Year CAGR | 5.5% |

| 10-Year Average Dividend Yield | 3.4% |

| Dividend Coverage Ratio | 4.0X |

The Lowdown on ASC Stock

Institutions love ASC stock, with 272 institutions holding a 75% stake in the outstanding shares. (Source: Yahoo! Finance, op. cit.)

While there’s some uncertainty ahead given a potential global slowdown, Ardmore Shipping is fundamentally strong. The price deterioration provides contrarian income investors with the opportunity to receive a high-dividend yield and the potential for gains. The consensus price target of $22.20 implies a potential share move of 48.9%.