Ares Capital Stock: 9.1%-Yielder Reports “Another Strong Quarter”

ARCC Stock: A Stable Dividend for the Last 15 Years

There’ve been some positive developments for Ares Capital stock lately.

It’s almost a lock that the Federal Reserve will begin cutting its key lending rate starting in September. And while interest rates are expected to decline over the next two years, they are still expected to remain above pre-2020 health crisis levels. In fact, the days of near-zero interest rates may be a thing of the past.

And that’s great news for business development companies (BDCs) like Ares Capital Corporation (NYSE:ARCC).

The largest publicly traded BDC in the U.S., Ares Capital is focused on providing direct loans and other corporate investments to private middle market companies. Its diversified portfolio consists of senior secured loans (73%) focused on defensively positioned companies in less cyclical industries. It also invests, to a lesser extent, in equity investments. (Source: “Second Quarter 2024 Earnings Presentation” Ares Capital Corporation, July 30, 2024.)

Ares Capital doesn’t invest in just any company. It originates investments in market-leading companies with a history of stable cash flows, proven competitive advantages and experienced management teams.

Its portfolio has a fair value of roughly $25.0 billion and consists of 525 portfolio companies. The top industries served include software & services (24%), health care services (13%), and commercial & professional services (8%).

The diversified portfolio has significant downside protection; the average position size is just 0.2% with the largest investment of approximately two percent. And, since its inception in 2004, cumulative net realized losses are less than 0%.

Another Strong Quarter

Ares Capital continues to report strong financial results, with second-quarter net income of $322.0 million, or $0.52 per share, and core earnings per share of $0.61. (Source: “Ares Capital Corporation Announces June 20, 2024 Financial Results and Declares Third Quarter 2023 Dividend of $0.48 Per Share,” Ares Capital Corporation, July 30, 2024.)

The BDC’s net investment income increased 14% year over year to $358.0 million, or $0.58 per share, from $314.0 million, or $0.57 per share, in the same period last year. Ares Capital reported net realized gains of $12.0 million, or $0.02 per share, up from a loss of $81.0 million, or a loss of $0.15 per share, in the same prior-year period.

Commenting on the results, Kipp deVeer, the company’s chief executive officer, said, “We reported another strong quarter with solid year-over-year growth in both our Core EPS and net asset value per share. We believe our deep origination capabilities and longstanding relationships continue to support our ability to deliver attractive investment returns for our shareholders.”

Scott Lem, chief financial officer, added, “With over $5 billion of available liquidity and a net debt to equity ratio of approximately 1.0x, our balance sheet continues to support our ability to invest in the compelling opportunities we are seeing.”

Maintains Quarterly Distribution of $0.48 Per Share

Commenting on Ares Capital stock’s dividend, Lem added, “With the declaration of the upcoming third quarter dividend, we have now had stable or increasing dividends for 15 consecutive years, which we believe is a testament to our industry-leading track record.”

To that end, Ares Capital declared a third quarter dividend of $0.48 per share, or $1.92 on an annual basis, for a current forward yield of 9.19%. That high-yield dividend is safe, too; the payout ratio is just 65.53%.

Ares Capital Stock Hits Record High

More often than not, an ultra-high-yield, inflation-crushing dividend comes from a low share price. That isn’t the case with Ares Capital stock. The company’s high-yield dividend is pretty consistent, with a five-year average of 9.24%.

It also is attached to a stock that continues to trade at record levels. After Ares Capital stock hit a new record intraday high of $21.35 on June 6, it continues to trade near those levels.

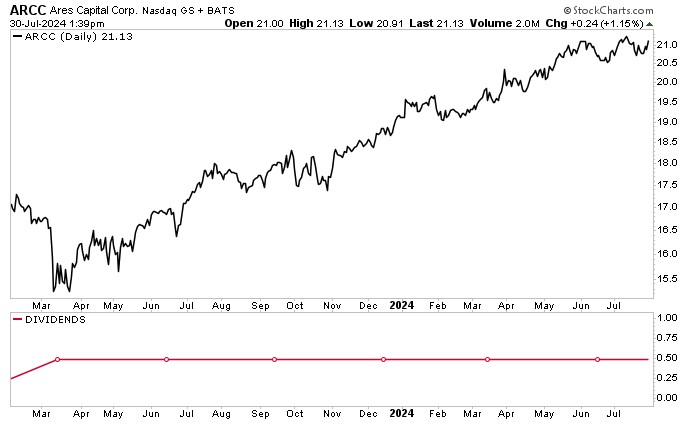

As you can see in the chart below, ARCC stock has been on a fantastic, market-thumping run, up 10% year to date and 18% year over year.

There’s every reason to believe that Ares Capital stock will notch up fresh highs over the coming quarters, with Wall Street analysts providing a 12-month high share price target of $23.00. This points to potential upside of approximately nine percent.

Chart courtesy of StockCharts.com

The Lowdown on Ares Capital Stock

Ares Capital Corporation is a great BDC with a diversified portfolio that provides shareholders with both an inflation-crushing dividend and strong underlying share price gains.

For investors with a long-term horizon, it’s tough to beat Ares Capital stock, which has provided annual shareholder returns of 13% since its 2004 initial public offering (IPO).

Had you invested $10,000 in Areas Capital when it IPO’d, and reinvested its dividends, today that investment would be worth almost $20,000.

As always, past performance is no guarantee of future gains, but Ares Capital stock has seemed like a no-brainer for income investors for the last 20 years.