ARCC Stock Currently Offering a High Dividend Yield of 9.29%

ARCC Stock is a Top High-Dividend Stock

Investing in high-dividend stocks is one way to earn market-beating returns through a steady income source. They are also a great way to receive a return on your invested capital at a high rate. And that’s not all; there are additional gains based on the stock price gain, which would only impact your bottom line positively.

Today’s stock, with a high dividend yield of 9.29%, is Ares Capital Corporation (NASDAQ:ARCC) stock. Ares Capital is a specialty finance company that operates as a closed-end, non-diversified investment management company. The business generates both a current income and a gain through capital appreciation by investing in debt and equity investments. There are many different investment industries that capital is deployed into, including automotive services, business services, consumer products, and packaging companies.

Management ensures that before an investment is made, whether it be debt or equity, the necessary research is done in order to ensure that the company is able to pay out a high dividend to its investors.

Why Is ARCC a High-Dividend-Yielding Stock?

Investments get compared on a relative basis; more specifically, the stock’s dividend yield is compared to other investment opportunities. In addition, any dividend-paying stock gets compared to the average dividend yield of the S&P 500 Index, which consists of the 500 largest companies that trade on a major U.S. trading exchange. The S&P 500 Index is used as the benchmark because these investments tend to be very fairly valued. That’s because investors from around the world focus on the stocks that are part of the index, due to the businesses being well known, powerful brands.

The current dividend yield of the index is 2.2%, which is less than a quarter of the yield on ARCC stock. On a relative basis, a $100,000 investment in the index would return $2,200 annually. Based solely on the income, this would produce a shortfall of $7,090 compared to ARCC stock.

Powerful Returns from the Dividend

The longer a stock is held, the more benefits and the higher probability of seeing positive returns. And ARCC stock is a great example of this. The company has been paying a dividend since its initial public offering (IPO) in 2004 of $15.00 per share. Now, the total dividend since 2004 on a per-share basis is $19.07. This is a 127% return, based only on the dividend income and not factoring in the capital gain of the shares. (Source: “Investor Presentation June 2017,” Ares Capital Corporation, last accessed June 27, 2017.)

As more time is spent holding the stock, the $19.07 in total dividends is only going to increase; in other words, the total return will go up. This is why high-dividend investing is a great method of generating a return on your invested capital. The advantage of this investing strategy is that there is no need to time your decisions to the market, removing the risk of purchasing a stock at a high price and banking on it trading higher in order to make a profit. This method also reduces the amount of commission that must be paid to your broker.

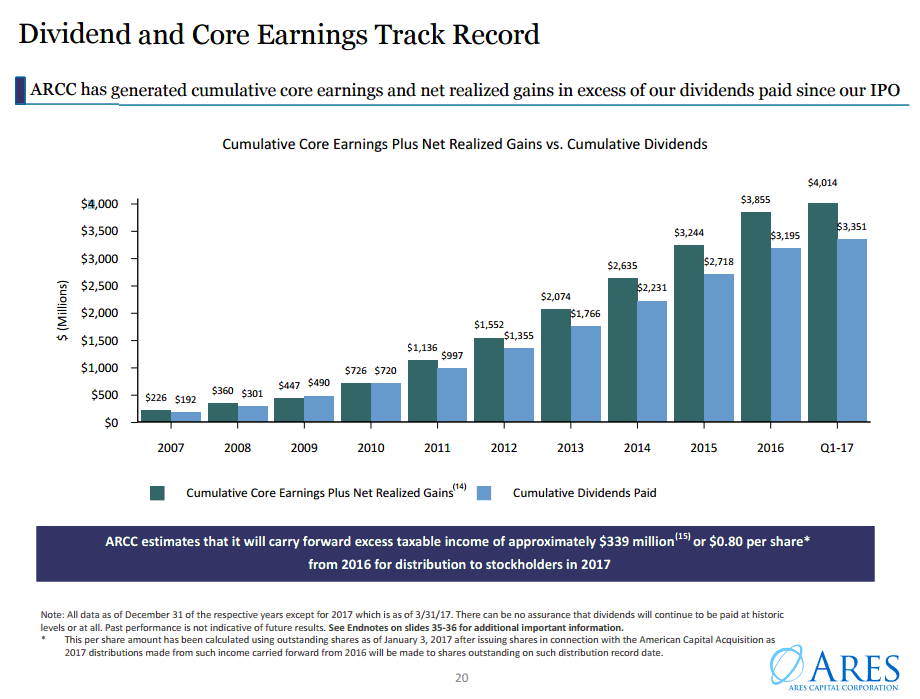

Another reason for the dividend remaining in place is the company’s wise use of finances. Since the IPO, Ares has ensured it pays out less than what it has earned. This is shown in the graph below:

(Source: Ibid.)

The dark blue column (on the left) is the total earnings that are generated for the entire company as a whole. The lighter blue column (to the right) represents the total dividends that are paid to all shareholders. Having earnings greater than the dividend payment also implies a greater possibility of the dividend remaining in place and not taking a hit.

Attractive Valuation

ARCC stock is a not one that you hear about often, which is usually an advantage. Companies that receive a lot of attention could see a higher valuation, which would lead to investors paying a premium. ARCC stock would be on the opposite end, trading at more than a 50% discount, based on its price-to-earnings (P/E) ratio of 11.9 times. This is compared to the industry ratio of 28.8 times.

Normally, a company would trade at a cheap valuation because there is a growth problem within a company. Ares, however, is a growing company, as evidenced by past revenue growth. Revenue has grown by more than 14% over the past five years, and has seen a yearly increase. In addition, the return on investment and equity are both higher than the industry average. In other words, investors have seen returns from ARCC stock that are higher than its industry peer average. (Source: “Ares Capital Corp.,” MarketWatch, last accessed June 27, 2017.)

Also Read:

5 Best Dividend Stocks to Watch in May 2017

Final Thoughts About ARCC Stock

ARCC stock is a great example of a high-quality, high-dividend-paying stock. Since the markets are unaware of the name, it comes with a cheaper valuation compared to its peer group. Before the market realizes this disconnect in valuation, now could be the time to pick up shares for your investment portfolio.

This is why income investors should focus on companies that have a solid business that can support a high dividend yield. Also, the Ares Capital management team is very shareholder-friendly, based on their own actions, which is rare to find from a high-dividend-paying stock.