Arbor Realty Trust Stock: 12.69%-Yielder for Wannabe Landlords

ABR Stock Trading at Book Value

Today, I want to discuss Arbor Realty Trust stock.

Real estate investment trust (REIT) structures are not for everyone, but for the income investor who loves companies with the main objective of paying dividends, they make sense. This is especially true as interest rates begin to fall for these high-capital-expenditure structures.

Arbor Realty Trust Inc (NYSE:ABR), founded in 2003, has developed into a nationwide REIT that invests in multi-family/single-family rental portfolios and commercial real estate assets. (Source: “Profile,” Arbor Realty Trust Inc, last accessed August 28, 2024.)

With the upward trend in rent across the nation, Arbor Realty Trust is in a sweet spot, allowing its investors to become landlords, raking in the higher rental rates.

Arbor Realty Trust stock has paid dividends in 13 straight years and raised dividends in 12 straight years. And investors currently get a juicy forward dividend yield of 12.69%.

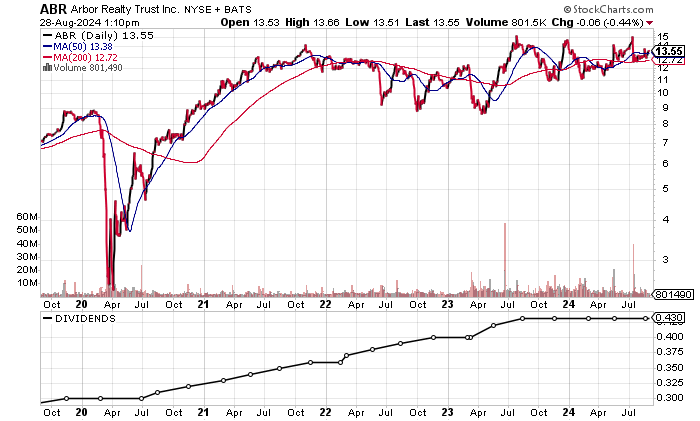

Since the pandemic in March 2020, when Arbor Realty Trust stock fell to $3.54, the shares have rallied 284%. However, the past year has seen a negative return of 15.1% to August 28.

At this juncture, ABR stock is sitting at around its 200-day moving average (MA) of $13.53 and just below its 50-day MA of $13.73. The stock could be on the verge of moving into a bullish golden cross formation should the 50-day MA move above the 200-day MA. This crossover suggests additional gains with Arbor Realty Trust stock.

Chart courtesy of StockCharts.com

Strong FCF & Profits Set to Rise

Arbor Realty Trust grew its revenues to a record $721.0 million in 2023. The compound annual growth rate (CAGR) was a healthy 19.9% from 2019 to 2023.

| Fiscal Year | Revenues (Millions) | Growth |

| 2019 | $349.4 | N/A |

| 2020 | $434.1 | 24.2% |

| 2021 | $590.9 | 36.1% |

| 2022 | $619.1 | 4.8% |

| 2023 | $721.0 | 16.5% |

(Source: “Arbor Realty Trust, Inc. (ABR),” Yahoo! Finance, last accessed August 28, 2024.)

On the bottom line, Arbor Realty Trust has produced consistent profits on a generally accepted accounting principles (GAAP) basis. Earnings grew in three of the last four years, including a rebound in 2023.

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2019 | $1.27 | N/A |

| 2020 | $1.41 | 10.8% |

| 2021 | $2.28 | 62.0% |

| 2022 | $1.67 | -26.6% |

| 2023 | $1.75 | 4.8% |

(Source: Yahoo! Finance, op. cit.)

On an adjusted basis, Arbor Realty Trust reported $2.25 per diluted share in 2023. Analysts estimate that this will fall to $1.73 per diluted share in 2024 and $1.68 per diluted share in 2025. There is a high estimate of $1.81 per diluted share in 2025. (Source: Yahoo! Finance, op. cit.)

Based on the current price of $13.56, Arbor Realty Trust stock trades at a reasonable forward price-earnings multiple of 8.1 times the consensus 2024 earnings-per-share (EPS) estimate.

As far as the last four quarters go, Arbor Realty Trust beat the consensus EPS estimate in all four quarters. In the second quarter ended June 30, 2024, the company reported $0.45 per diluted share, beating the consensus $0.41 per diluted share.

Arbor Realty Trust delivered positive free cash flow (FCF) in four straight years, including a massive 2022 when FCF broke above the $1.0-billion threshold. This was followed by a decline in 2023 due to a jump in stock buybacks, less new stock issued, and net debt reduction.

| Fiscal Year | FCF | Growth |

| 2020 | $55.2 million | N/A |

| 2021 | $216.8 million | 292.8% |

| 2022 | $1.1 billion | 407.2% |

| 2023 | $235.9 million | -78.5% |

(Source: Yahoo! Finance, op. cit.)

On the balance sheet, Arbor Realty Trust held $10.7 billion in total debt and $739.3 million in cash at the end of June. I don’t envision any issues at this time given the strong working capital, profitability, and positive FCF. (Source: Yahoo! Finance, op. cit.)

The Piotroski score, an indicator of a company’s balance sheet, profitability, and operational efficiency, shows a decent reading of 6.0 for Arbor Realty, which is above the midpoint of the 1.0 to 9.0 range.

Arbor Realty Trust Stock: 12 Straight Years of Growing Dividends

Arbor Realty Trust stock’s current annual dividend is $1.72 per share, representing a forward yield of 12.69%. This is above the five-year-average dividend yield of 10.36%. (Source: Yahoo! Finance, op. cit.)

Given the profitability and FCF, I expect the dividends to be safe. Moreover, they may rise a bit.

| Metric | Value |

| Dividend Growth Streak | 12 years |

| Dividend Streak | 13 years |

| Dividend 10-Year CAGR | 15.2% |

| 10-Year Average Dividend Yield | 15.1% |

| Dividend Coverage Ratio | 1.3X |

The Lowdown on Arbor Realty Trust Stock

Arbor Realty Trust stock’s institutional ownership is decent, with 410 institutions holding a 50.3% stake in the outstanding shares. (Source: Yahoo! Finance, op. cit.)

There is a large short position on ABR stock of 67.99 million shares as of August 15, representing 49.74% of the float. If Arbor Realty Trust stock rallies, I would expect to see short-covering and support for ABR. (Source: Arbor Realty Trust (NYSE:ABR) Stock, Short Interest Report, last accessed September 4, 2024.)